| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901101000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901201000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901201000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

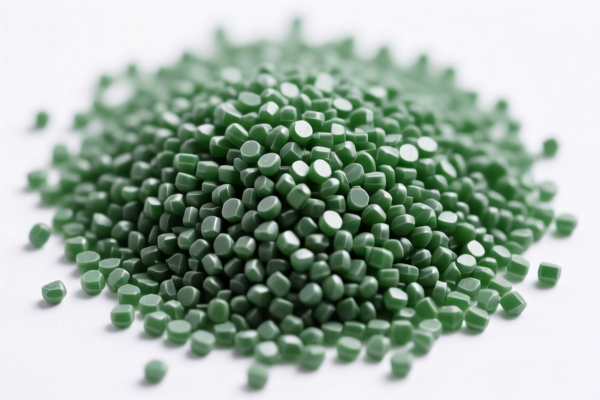

Product Classification: High Density Polyethylene (HDPE) Granules

HS CODE: 3901101000 / 3901201000

Classification Summary

HDPE (High Density Polyethylene) granules are classified under HS Chapter 3901, which covers ethylene polymers in primary forms. As a polymer derived from ethylene, HDPE in granular form is considered a primary form and thus falls under this classification.

Tariff Overview

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on imports after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost calculations and customs declarations. -

No Anti-Dumping Duties:

As of now, no specific anti-dumping duties are listed for HDPE granules under this HS code.

Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is indeed in granular form and not processed into films or other forms, which may fall under different HS codes (e.g., 3921 or 3920). -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or customs documentation) are required for import compliance. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as this could significantly impact the total import cost.

Alternative HS Codes for Reference

- 3921904090 – For HDPE industrial films (flexible, non-reinforced plastic films)

- 3920992000 – For agricultural HDPE films (e.g., mulch films)

These codes are not applicable for HDPE granules, but are included for reference in case of product transformation.

Conclusion

HDPE granules are best classified under HS CODE 3901101000 or 3901201000, with a total tax rate of 61.5%. Importers should be aware of the April 11, 2025 tariff increase and ensure proper classification to avoid penalties or delays.

Product Classification: High Density Polyethylene (HDPE) Granules

HS CODE: 3901101000 / 3901201000

Classification Summary

HDPE (High Density Polyethylene) granules are classified under HS Chapter 3901, which covers ethylene polymers in primary forms. As a polymer derived from ethylene, HDPE in granular form is considered a primary form and thus falls under this classification.

Tariff Overview

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

Key Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on imports after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost calculations and customs declarations. -

No Anti-Dumping Duties:

As of now, no specific anti-dumping duties are listed for HDPE granules under this HS code.

Proactive Advice for Importers

-

Verify Material Specifications:

Ensure the product is indeed in granular form and not processed into films or other forms, which may fall under different HS codes (e.g., 3921 or 3920). -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or customs documentation) are required for import compliance. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as this could significantly impact the total import cost.

Alternative HS Codes for Reference

- 3921904090 – For HDPE industrial films (flexible, non-reinforced plastic films)

- 3920992000 – For agricultural HDPE films (e.g., mulch films)

These codes are not applicable for HDPE granules, but are included for reference in case of product transformation.

Conclusion

HDPE granules are best classified under HS CODE 3901101000 or 3901201000, with a total tax rate of 61.5%. Importers should be aware of the April 11, 2025 tariff increase and ensure proper classification to avoid penalties or delays.

Customer Reviews

No reviews yet.