| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3901101000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 4413000000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 4411924000 | Doc | 61.0% | CN | US | 2025-05-12 |

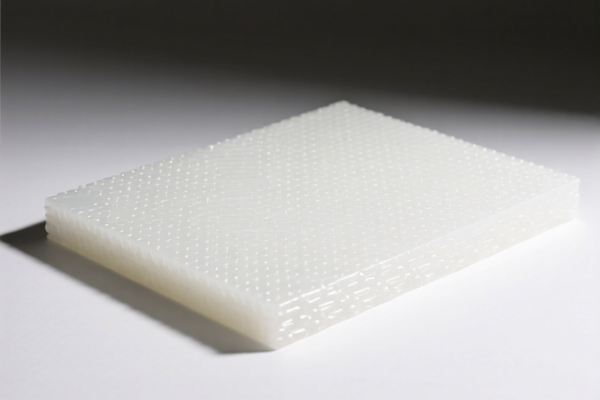

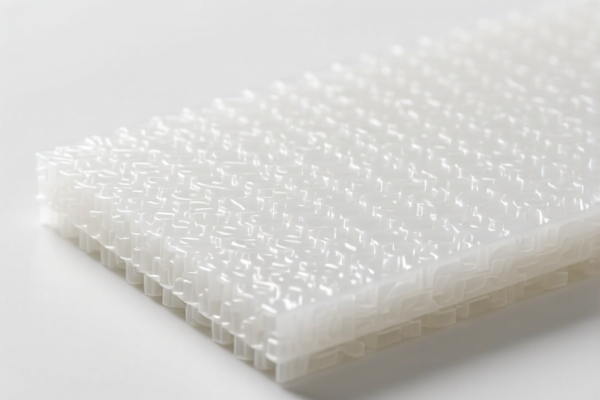

Product Name: High Density Polyethylene Board

Classification Notes: Based on the provided HS codes and summaries, the most accurate classification for High Density Polyethylene (HDPE) Board is 3921905050. This code falls under "Other plastic plates, sheets, films, foils and strips" and is the most appropriate for HDPE boards that are not in their original polymer form.

✅ HS CODE: 3921905050

Description: Other plastic plates, sheets, films, foils and strips (including those of plastics, whether or not reinforced, laminated, or otherwise combined with other materials)

Total Tax Rate: 34.8%

🔍 Tariff Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariffs (before April 11, 2025): 0.0%

- Additional Tariffs (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic, not metal)

⏱️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025.

- This is a critical date for customs clearance and cost estimation.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed High Density Polyethylene (HDPE) and not a composite or reinforced material, which may fall under a different HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Review Documentation: Ensure all customs documentation (e.g., commercial invoice, packing list, and product specifications) clearly describe the product to avoid misclassification.

- Consider Alternative Codes: If the product is flexible, consider 3921904090 (flexible plastic sheets, etc.), but only if the physical properties match.

📊 Comparison with Other Codes (for Reference):

| HS Code | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3901101000 | Ethylene polymers in primary form | 61.5% | For raw polymer, not finished product |

| 3921904090 | Flexible plastic sheets, etc. | 34.2% | If the HDPE board is flexible |

| 4413000000 | Compressed wood | 58.7% | Not applicable for plastic |

| 4411924000 | High-density wood fiberboard | 61.0% | Not applicable for plastic |

🛑 Important Reminder:

- Misclassification can lead to delays, penalties, or additional duties.

- Always confirm with a customs broker or a qualified customs compliance expert if the product is not clearly defined (e.g., if it contains additives or is a composite material).

Product Name: High Density Polyethylene Board

Classification Notes: Based on the provided HS codes and summaries, the most accurate classification for High Density Polyethylene (HDPE) Board is 3921905050. This code falls under "Other plastic plates, sheets, films, foils and strips" and is the most appropriate for HDPE boards that are not in their original polymer form.

✅ HS CODE: 3921905050

Description: Other plastic plates, sheets, films, foils and strips (including those of plastics, whether or not reinforced, laminated, or otherwise combined with other materials)

Total Tax Rate: 34.8%

🔍 Tariff Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariffs (before April 11, 2025): 0.0%

- Additional Tariffs (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic, not metal)

⏱️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025.

- This is a critical date for customs clearance and cost estimation.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed High Density Polyethylene (HDPE) and not a composite or reinforced material, which may fall under a different HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- Review Documentation: Ensure all customs documentation (e.g., commercial invoice, packing list, and product specifications) clearly describe the product to avoid misclassification.

- Consider Alternative Codes: If the product is flexible, consider 3921904090 (flexible plastic sheets, etc.), but only if the physical properties match.

📊 Comparison with Other Codes (for Reference):

| HS Code | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3901101000 | Ethylene polymers in primary form | 61.5% | For raw polymer, not finished product |

| 3921904090 | Flexible plastic sheets, etc. | 34.2% | If the HDPE board is flexible |

| 4413000000 | Compressed wood | 58.7% | Not applicable for plastic |

| 4411924000 | High-density wood fiberboard | 61.0% | Not applicable for plastic |

🛑 Important Reminder:

- Misclassification can lead to delays, penalties, or additional duties.

- Always confirm with a customs broker or a qualified customs compliance expert if the product is not clearly defined (e.g., if it contains additives or is a composite material).

Customer Reviews

No reviews yet.