| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320020 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917330000 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3901101000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917390050 | Doc | 33.1% | CN | US | 2025-05-12 |

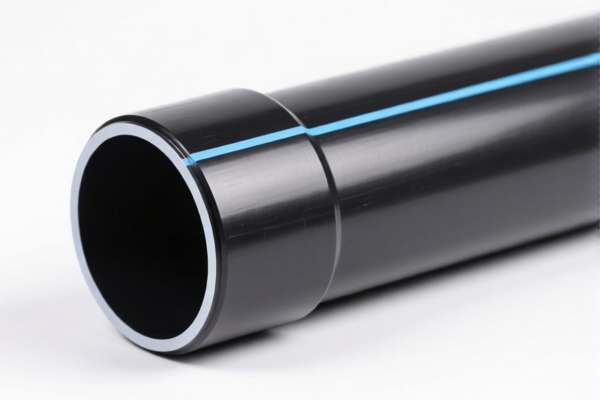

Product Name: High Density Polyethylene Pipe

Classification: Plastic Pipe (HDPE)

HS Code: 3917320020 (Primary Code for HDPE Plastic Pipe)

🔍 HS Code Breakdown and Tax Details

- HS CODE: 3917320020

- Description: Polyethylene plastic pipes and pipe fittings

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

📌 Key Tax Rate Changes and Notes

- April 11, 2025 Special Tariff:

- Applies to all listed HS codes (e.g., 3917320020, 3917330000, etc.)

-

Additional 30.0% will be imposed on top of the base and general tariffs after this date.

-

Other HS Codes for Reference:

- 3917330000 – Plastic pipes, plastic hoses, and fittings (33.1% total tax)

- No general additional tariff, but still subject to the 30.0% special tariff after April 11, 2025.

- 3917210000 – Plastic pipes (58.1% total tax)

- Same tax structure as 3917320020.

- 3901101000 – Polyethylene, primary form (61.5% total tax)

- Higher tax rate due to raw material classification.

- 3917390050 – Plastic pipes not metal-reinforced or PVC (33.1% total tax)

- Lower base tax, but still subject to the 30.0% special tariff after April 11, 2025.

⚠️ Important Compliance Actions

- Verify Material Specifications:

-

Ensure the product is indeed made of high-density polyethylene (HDPE) and not PVC or other materials that may fall under different HS codes.

-

Check Unit Price and Certification:

-

Confirm the unit price and whether certifications (e.g., ISO, CE, or specific import permits) are required for customs clearance.

-

Monitor Tariff Updates:

-

Stay informed about April 11, 2025 policy changes. This will significantly increase the import cost for all listed HS codes.

-

Consult with Customs Broker:

- For accurate classification and to avoid penalties, it is recommended to work with a qualified customs broker or compliance expert.

📌 Summary Table for Reference

| HS Code | Description | Total Tax Rate | Base Tariff | General Additional | April 11, 2025 Special |

|---|---|---|---|---|---|

| 3917320020 | HDPE Plastic Pipe & Fittings | 58.1% | 3.1% | 25.0% | 30.0% |

| 3917330000 | Plastic Pipes & Fittings | 33.1% | 3.1% | 0.0% | 30.0% |

| 3917210000 | Plastic Pipes | 58.1% | 3.1% | 25.0% | 30.0% |

| 3901101000 | Polyethylene, Primary Form | 61.5% | 6.5% | 25.0% | 30.0% |

| 3917390050 | Plastic Pipes (Non-Metal, Non-PVC) | 33.1% | 3.1% | 0.0% | 30.0% |

If you need help determining the most accurate HS code for your specific product, feel free to provide more details (e.g., material, dimensions, use case).

Product Name: High Density Polyethylene Pipe

Classification: Plastic Pipe (HDPE)

HS Code: 3917320020 (Primary Code for HDPE Plastic Pipe)

🔍 HS Code Breakdown and Tax Details

- HS CODE: 3917320020

- Description: Polyethylene plastic pipes and pipe fittings

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a time-sensitive policy. Ensure compliance with updated regulations after this date.

📌 Key Tax Rate Changes and Notes

- April 11, 2025 Special Tariff:

- Applies to all listed HS codes (e.g., 3917320020, 3917330000, etc.)

-

Additional 30.0% will be imposed on top of the base and general tariffs after this date.

-

Other HS Codes for Reference:

- 3917330000 – Plastic pipes, plastic hoses, and fittings (33.1% total tax)

- No general additional tariff, but still subject to the 30.0% special tariff after April 11, 2025.

- 3917210000 – Plastic pipes (58.1% total tax)

- Same tax structure as 3917320020.

- 3901101000 – Polyethylene, primary form (61.5% total tax)

- Higher tax rate due to raw material classification.

- 3917390050 – Plastic pipes not metal-reinforced or PVC (33.1% total tax)

- Lower base tax, but still subject to the 30.0% special tariff after April 11, 2025.

⚠️ Important Compliance Actions

- Verify Material Specifications:

-

Ensure the product is indeed made of high-density polyethylene (HDPE) and not PVC or other materials that may fall under different HS codes.

-

Check Unit Price and Certification:

-

Confirm the unit price and whether certifications (e.g., ISO, CE, or specific import permits) are required for customs clearance.

-

Monitor Tariff Updates:

-

Stay informed about April 11, 2025 policy changes. This will significantly increase the import cost for all listed HS codes.

-

Consult with Customs Broker:

- For accurate classification and to avoid penalties, it is recommended to work with a qualified customs broker or compliance expert.

📌 Summary Table for Reference

| HS Code | Description | Total Tax Rate | Base Tariff | General Additional | April 11, 2025 Special |

|---|---|---|---|---|---|

| 3917320020 | HDPE Plastic Pipe & Fittings | 58.1% | 3.1% | 25.0% | 30.0% |

| 3917330000 | Plastic Pipes & Fittings | 33.1% | 3.1% | 0.0% | 30.0% |

| 3917210000 | Plastic Pipes | 58.1% | 3.1% | 25.0% | 30.0% |

| 3901101000 | Polyethylene, Primary Form | 61.5% | 6.5% | 25.0% | 30.0% |

| 3917390050 | Plastic Pipes (Non-Metal, Non-PVC) | 33.1% | 3.1% | 0.0% | 30.0% |

If you need help determining the most accurate HS code for your specific product, feel free to provide more details (e.g., material, dimensions, use case).

Customer Reviews

No reviews yet.