Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901101000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 4411924000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 4413000000 | Doc | 58.7% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for High Density Polyethylene (HDPE) Sheet, based on the provided HS codes and tax details:

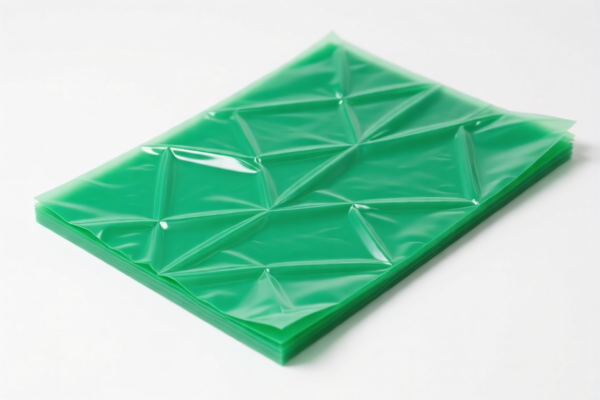

✅ Product Classification: High Density Polyethylene Sheet

🔍 HS CODE: 3901101000

- Description: High-density polyethylene sheets (ethylene polymers).

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Notes: This is the most accurate classification for HDPE sheets made from ethylene polymers.

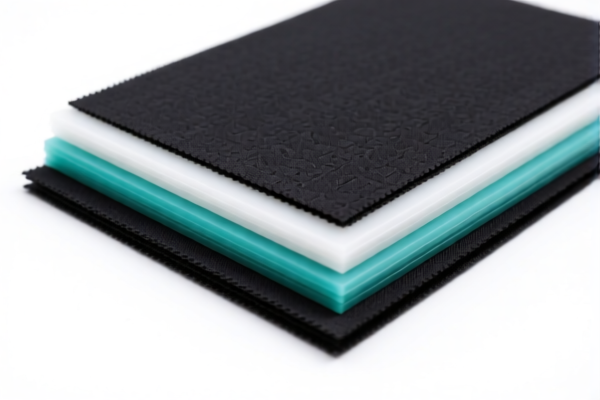

🔍 HS CODE: 3921905050

- Description: HDPE plastic sheets classified under "Other plastic sheets, plates, films, foils and strips."

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

- Notes: Applicable for rigid HDPE sheets that do not fall under 3901.

🔍 HS CODE: 3921904090

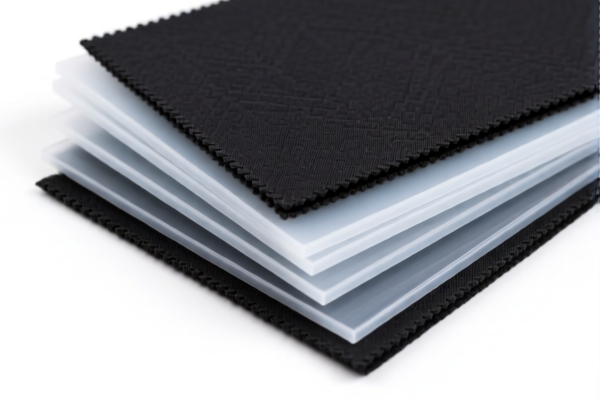

- Description: HDPE plastic soft sheets (flexible plastic sheets, films, etc.).

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Notes: For flexible HDPE sheets or films.

⚠️ HS CODE: 4411924000

- Description: High-density engineered boards (wood-based).

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.0%

- Notes: This is not for HDPE but for wood-based high-density boards. Not applicable for HDPE.

⚠️ HS CODE: 4413000000

- Description: High-density compressed wood products (blocks, boards, strips, etc.).

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.7%

- Notes: Again, this is for wood-based products, not HDPE. Not applicable for HDPE.

📌 Proactive Advice for Users:

- Verify Material: Ensure the product is pure HDPE and not a composite or wood-based product (which would fall under different HS codes).

- Check Unit Price: Tariff rates can vary based on the declared value and may affect the total import cost.

- Certifications: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- April 11, 2025 Deadline: Be aware of the special tariff that will apply after this date. Plan your import schedule accordingly.

- Consult Customs Broker: For complex cases, it's advisable to consult a customs broker or a compliance expert to ensure correct classification and avoid penalties.

Let me know if you need help determining the correct HS code based on specific product details. Here is the structured classification and tariff information for High Density Polyethylene (HDPE) Sheet, based on the provided HS codes and tax details:

✅ Product Classification: High Density Polyethylene Sheet

🔍 HS CODE: 3901101000

- Description: High-density polyethylene sheets (ethylene polymers).

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Notes: This is the most accurate classification for HDPE sheets made from ethylene polymers.

🔍 HS CODE: 3921905050

- Description: HDPE plastic sheets classified under "Other plastic sheets, plates, films, foils and strips."

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

- Notes: Applicable for rigid HDPE sheets that do not fall under 3901.

🔍 HS CODE: 3921904090

- Description: HDPE plastic soft sheets (flexible plastic sheets, films, etc.).

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Notes: For flexible HDPE sheets or films.

⚠️ HS CODE: 4411924000

- Description: High-density engineered boards (wood-based).

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.0%

- Notes: This is not for HDPE but for wood-based high-density boards. Not applicable for HDPE.

⚠️ HS CODE: 4413000000

- Description: High-density compressed wood products (blocks, boards, strips, etc.).

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.7%

- Notes: Again, this is for wood-based products, not HDPE. Not applicable for HDPE.

📌 Proactive Advice for Users:

- Verify Material: Ensure the product is pure HDPE and not a composite or wood-based product (which would fall under different HS codes).

- Check Unit Price: Tariff rates can vary based on the declared value and may affect the total import cost.

- Certifications: Confirm if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product.

- April 11, 2025 Deadline: Be aware of the special tariff that will apply after this date. Plan your import schedule accordingly.

- Consult Customs Broker: For complex cases, it's advisable to consult a customs broker or a compliance expert to ensure correct classification and avoid penalties.

Let me know if you need help determining the correct HS code based on specific product details.

Customer Reviews

No reviews yet.