| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

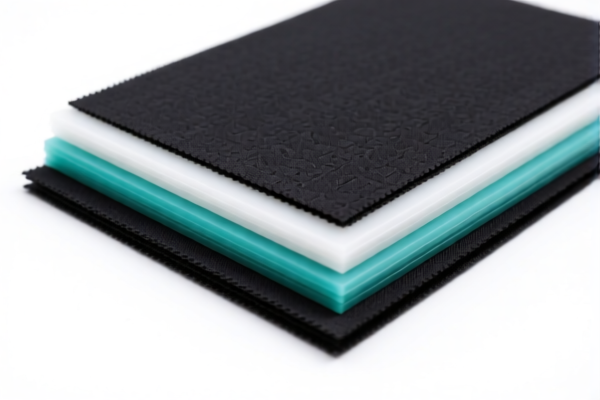

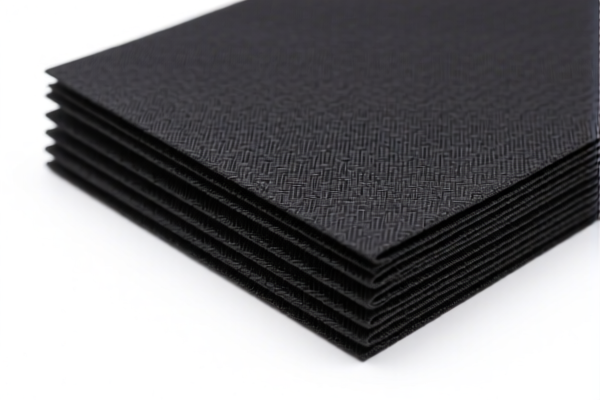

Here is the structured classification and tariff analysis for the "High Density Textile Plastic Sheets" product based on the provided HS codes and tariff details:

✅ HS CODE: 3921902900

Description: Other plastic sheets, plates, films, foils and strips, combined with other materials and with a weight exceeding 1.492 kg/m².

Total Tax Rate: 59.4%

Tariff Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code also applies to "high density textile plastic sheets" that meet the description of being combined with other materials and exceeding the weight threshold.

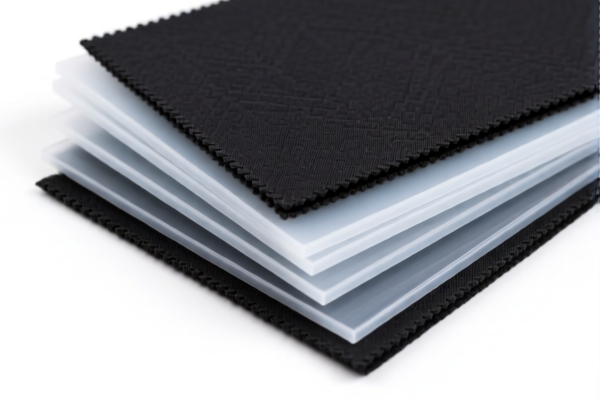

✅ HS CODE: 3921902550

Description: Other plastic sheets, plates, films, foils and strips, combined with textile materials and with a weight exceeding 1.492 kg/m².

Textile component: Synthetic fiber weight exceeds any other single textile fiber.

Plastic weight: Over 70% of total weight.

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

✅ HS CODE: 3920991000

Description: High-density polyethylene (HDPE) plastic sheets.

Total Tax Rate: 61.0%

Tariff Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

✅ HS CODE: 3921905050

Description: Plastic sheets, made of high-density polyethylene.

Total Tax Rate: 34.8%

Tariff Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code has no additional tariff (25.0%) applied, which may be due to specific product classification or preferential treatment.

✅ HS CODE: 3921902900 (Duplicate Entry)

Description: High-density textile plastic sheets, meeting the description of "other plastic products combined with other materials and with a weight exceeding 1.492 kg/m²."

Total Tax Rate: 59.4%

Tariff Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

📌 Key Notes and Recommendations:

- Time-sensitive policy: The special tariff of 30.0% applies after April 2, 2025. Ensure your import timeline is aligned with this date.

- Material verification: Confirm the exact composition of the product (e.g., plastic percentage, textile content, and whether it is combined with other materials).

- Certifications: Check if certifications (e.g., material safety, origin, or compliance with textile regulations) are required for customs clearance.

- Unit price: Verify the unit price and weight per square meter to ensure correct classification under the appropriate HS code.

- Anti-dumping duties: While not explicitly mentioned, be aware that anti-dumping duties may apply to certain plastic and textile products. Confirm with customs or a compliance expert if applicable.

🛑 Proactive Action Required:

- Double-check the product description to ensure it aligns with the HS code used.

- Consult a customs broker or compliance expert for final confirmation, especially if the product is close to the boundary of multiple classifications.

- Monitor updates on tariff changes, especially after April 2, 2025, to avoid unexpected costs. Here is the structured classification and tariff analysis for the "High Density Textile Plastic Sheets" product based on the provided HS codes and tariff details:

✅ HS CODE: 3921902900

Description: Other plastic sheets, plates, films, foils and strips, combined with other materials and with a weight exceeding 1.492 kg/m².

Total Tax Rate: 59.4%

Tariff Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code also applies to "high density textile plastic sheets" that meet the description of being combined with other materials and exceeding the weight threshold.

✅ HS CODE: 3921902550

Description: Other plastic sheets, plates, films, foils and strips, combined with textile materials and with a weight exceeding 1.492 kg/m².

Textile component: Synthetic fiber weight exceeds any other single textile fiber.

Plastic weight: Over 70% of total weight.

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

✅ HS CODE: 3920991000

Description: High-density polyethylene (HDPE) plastic sheets.

Total Tax Rate: 61.0%

Tariff Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

✅ HS CODE: 3921905050

Description: Plastic sheets, made of high-density polyethylene.

Total Tax Rate: 34.8%

Tariff Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 2, 2025: 30.0%

- Note: This code has no additional tariff (25.0%) applied, which may be due to specific product classification or preferential treatment.

✅ HS CODE: 3921902900 (Duplicate Entry)

Description: High-density textile plastic sheets, meeting the description of "other plastic products combined with other materials and with a weight exceeding 1.492 kg/m²."

Total Tax Rate: 59.4%

Tariff Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

📌 Key Notes and Recommendations:

- Time-sensitive policy: The special tariff of 30.0% applies after April 2, 2025. Ensure your import timeline is aligned with this date.

- Material verification: Confirm the exact composition of the product (e.g., plastic percentage, textile content, and whether it is combined with other materials).

- Certifications: Check if certifications (e.g., material safety, origin, or compliance with textile regulations) are required for customs clearance.

- Unit price: Verify the unit price and weight per square meter to ensure correct classification under the appropriate HS code.

- Anti-dumping duties: While not explicitly mentioned, be aware that anti-dumping duties may apply to certain plastic and textile products. Confirm with customs or a compliance expert if applicable.

🛑 Proactive Action Required:

- Double-check the product description to ensure it aligns with the HS code used.

- Consult a customs broker or compliance expert for final confirmation, especially if the product is close to the boundary of multiple classifications.

- Monitor updates on tariff changes, especially after April 2, 2025, to avoid unexpected costs.

Customer Reviews

No reviews yet.