| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5212226030 | Doc | 62.8% | CN | US | 2025-05-12 |

| 5212216090 | Doc | 62.8% | CN | US | 2025-05-12 |

| 5208521000 | Doc | 58.0% | CN | US | 2025-05-12 |

| 5208324020 | Doc | 64.7% | CN | US | 2025-05-12 |

| 5907006000 | Doc | 55.0% | CN | US | 2025-05-12 |

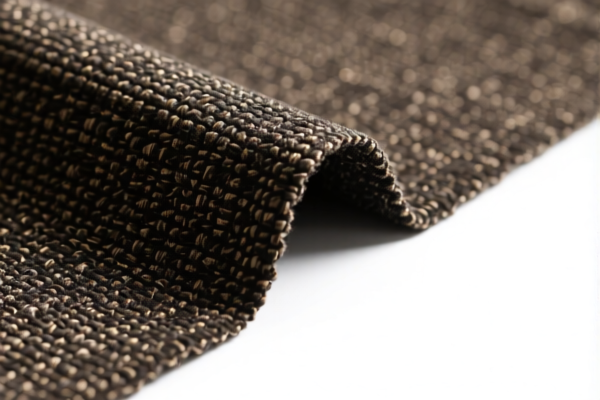

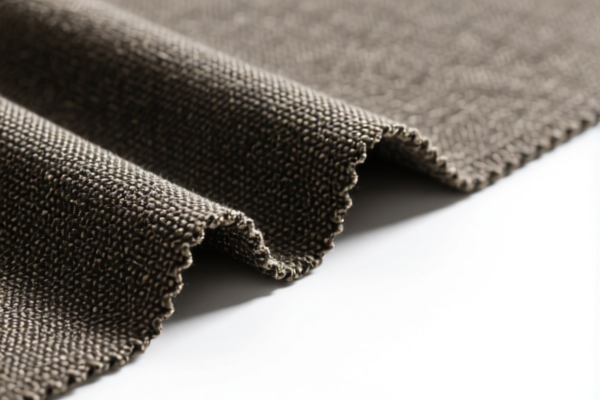

Here is the structured classification and tariff information for the High Density Upholstery Fabric based on the provided HS codes and tax details:

🔍 HS CODE: 5212226030

Product Description: High density cotton fabric, classified as bed sheets

Total Tax Rate: 62.8%

- Base Tariff Rate: 7.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is specific to bed sheets, so ensure the product is not intended for upholstery or other uses.

🔍 HS CODE: 5212216090

Product Description: High density cotton fabric, classified as other cotton woven fabrics

Total Tax Rate: 62.8%

- Base Tariff Rate: 7.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for cotton woven fabrics. Confirm the fabric is not specifically for bed sheets or other specialized uses.

🔍 HS CODE: 5208521000

Product Description: High density cotton fabric, classified as cotton fabric

Total Tax Rate: 58.0%

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category for cotton fabric. Ensure the fabric is not classified under more specific HS codes like 5212.

🔍 HS CODE: 5208324020

Product Description: High density cotton fabric for clothing, classified as cambric or gauze

Total Tax Rate: 64.7%

- Base Tariff Rate: 9.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for fabric intended for clothing, not upholstery. If the fabric is for furniture, this may not be the correct classification.

🔍 HS CODE: 5907006000

Product Description: High density coated fabric, classified as other impregnated, coated, or laminated textile fabrics

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for coated or laminated fabrics. If the upholstery fabric is treated with coatings, this may be the correct classification.

📌 Proactive Advice:

- Verify Material: Confirm the exact composition (e.g., 100% cotton, coated, or blended) to ensure correct HS code.

- Check Intended Use: Upholstery fabric may not fall under categories like "bed sheets" or "clothing fabric."

- Unit Price and Certification: If the fabric is imported from certain countries, check if anti-dumping duties apply (especially for iron or aluminum-based coatings).

- April 11, 2025 Deadline: Be aware of the additional 30.0% tariff that will apply after this date. Plan accordingly for cost estimation and compliance.

Let me know if you need help determining the most accurate HS code for your specific upholstery fabric. Here is the structured classification and tariff information for the High Density Upholstery Fabric based on the provided HS codes and tax details:

🔍 HS CODE: 5212226030

Product Description: High density cotton fabric, classified as bed sheets

Total Tax Rate: 62.8%

- Base Tariff Rate: 7.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This classification is specific to bed sheets, so ensure the product is not intended for upholstery or other uses.

🔍 HS CODE: 5212216090

Product Description: High density cotton fabric, classified as other cotton woven fabrics

Total Tax Rate: 62.8%

- Base Tariff Rate: 7.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for cotton woven fabrics. Confirm the fabric is not specifically for bed sheets or other specialized uses.

🔍 HS CODE: 5208521000

Product Description: High density cotton fabric, classified as cotton fabric

Total Tax Rate: 58.0%

- Base Tariff Rate: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category for cotton fabric. Ensure the fabric is not classified under more specific HS codes like 5212.

🔍 HS CODE: 5208324020

Product Description: High density cotton fabric for clothing, classified as cambric or gauze

Total Tax Rate: 64.7%

- Base Tariff Rate: 9.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for fabric intended for clothing, not upholstery. If the fabric is for furniture, this may not be the correct classification.

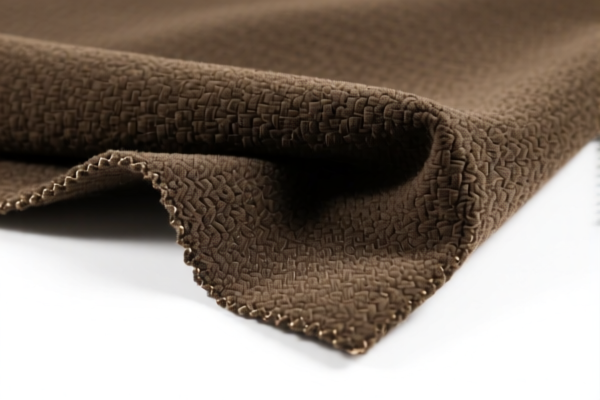

🔍 HS CODE: 5907006000

Product Description: High density coated fabric, classified as other impregnated, coated, or laminated textile fabrics

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for coated or laminated fabrics. If the upholstery fabric is treated with coatings, this may be the correct classification.

📌 Proactive Advice:

- Verify Material: Confirm the exact composition (e.g., 100% cotton, coated, or blended) to ensure correct HS code.

- Check Intended Use: Upholstery fabric may not fall under categories like "bed sheets" or "clothing fabric."

- Unit Price and Certification: If the fabric is imported from certain countries, check if anti-dumping duties apply (especially for iron or aluminum-based coatings).

- April 11, 2025 Deadline: Be aware of the additional 30.0% tariff that will apply after this date. Plan accordingly for cost estimation and compliance.

Let me know if you need help determining the most accurate HS code for your specific upholstery fabric.

Customer Reviews

No reviews yet.