| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907915000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907400000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907995010 | Doc | 61.5% | CN | US | 2025-05-12 |

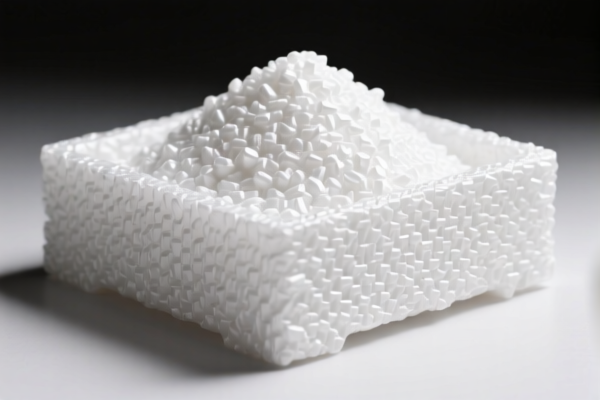

Customs Classification and Tariff Analysis for "High Heat Resistant Polystyrene Resin"

Based on the product name "High Heat Resistant Polystyrene Resin", the following HS codes and tariff details are relevant. Please note that the classification and tax rates are based on the provided data and current regulations as of April 2025.

1. HS Code: 3903190000

Product Description: High heat resistant polystyrene (a type of styrene polymer)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

Key Notes:

- This code is specifically for polystyrene resins and is the most accurate match for the product name.

- Ensure the product is not modified (e.g., compounded with other materials), as this may change the classification.

- Proactive Advice: Confirm the material composition and technical specifications to ensure it falls under this category.

2. HS Code: 3907915000

Product Description: High heat resistant unsaturated polyester resin

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

Key Notes:

- This code applies to unsaturated polyester resins.

- If the product is not unsaturated polyester, this may not be the correct classification.

- Proactive Advice: Verify the chemical structure and type of polyester to ensure proper classification.

3. HS Code: 3907995050

Product Description: Heat-resistant polyester resin (other types)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

Key Notes:

- This code is for other polyester resins, including polyester resins not classified elsewhere.

- If the product is not unsaturated polyester, this may be the correct code.

- Proactive Advice: Confirm the polyester type and application (e.g., industrial, coating, etc.).

4. HS Code: 3907400000

Product Description: High heat resistant polycarbonate resin

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.8%

Key Notes:

- This code is for polycarbonate resins.

- If the product is polycarbonate, this is the correct classification.

- Proactive Advice: Ensure the product is not modified or compounded with other materials.

5. HS Code: 3907995010

Product Description: PBT high heat resistant resin (Polybutylene Terephthalate)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

Key Notes:

- This code is for PBT resins, a type of polyester.

- If the product is PBT, this is the correct classification.

- Proactive Advice: Confirm the chemical name and molecular structure to ensure accuracy.

Important Reminders:

- April 11, 2025 Special Tariff: A 30% additional tariff is imposed on all the above HS codes after April 11, 2025.

- Anti-dumping duties: Not applicable for these HS codes (no mention of anti-dumping duties on plastics).

- Certifications: Ensure the product has technical specifications, material safety data sheets (MSDS), and customs documentation for compliance.

- Unit Price: Verify the unit price and weight for accurate customs valuation.

Conclusion:

The most likely HS code for "High Heat Resistant Polystyrene Resin" is 3903190000, but the other codes may apply depending on the exact chemical composition and type of resin. Always confirm the material details and technical specifications before finalizing the classification.

Customs Classification and Tariff Analysis for "High Heat Resistant Polystyrene Resin"

Based on the product name "High Heat Resistant Polystyrene Resin", the following HS codes and tariff details are relevant. Please note that the classification and tax rates are based on the provided data and current regulations as of April 2025.

1. HS Code: 3903190000

Product Description: High heat resistant polystyrene (a type of styrene polymer)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

Key Notes:

- This code is specifically for polystyrene resins and is the most accurate match for the product name.

- Ensure the product is not modified (e.g., compounded with other materials), as this may change the classification.

- Proactive Advice: Confirm the material composition and technical specifications to ensure it falls under this category.

2. HS Code: 3907915000

Product Description: High heat resistant unsaturated polyester resin

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

Key Notes:

- This code applies to unsaturated polyester resins.

- If the product is not unsaturated polyester, this may not be the correct classification.

- Proactive Advice: Verify the chemical structure and type of polyester to ensure proper classification.

3. HS Code: 3907995050

Product Description: Heat-resistant polyester resin (other types)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

Key Notes:

- This code is for other polyester resins, including polyester resins not classified elsewhere.

- If the product is not unsaturated polyester, this may be the correct code.

- Proactive Advice: Confirm the polyester type and application (e.g., industrial, coating, etc.).

4. HS Code: 3907400000

Product Description: High heat resistant polycarbonate resin

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 60.8%

Key Notes:

- This code is for polycarbonate resins.

- If the product is polycarbonate, this is the correct classification.

- Proactive Advice: Ensure the product is not modified or compounded with other materials.

5. HS Code: 3907995010

Product Description: PBT high heat resistant resin (Polybutylene Terephthalate)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 61.5%

Key Notes:

- This code is for PBT resins, a type of polyester.

- If the product is PBT, this is the correct classification.

- Proactive Advice: Confirm the chemical name and molecular structure to ensure accuracy.

Important Reminders:

- April 11, 2025 Special Tariff: A 30% additional tariff is imposed on all the above HS codes after April 11, 2025.

- Anti-dumping duties: Not applicable for these HS codes (no mention of anti-dumping duties on plastics).

- Certifications: Ensure the product has technical specifications, material safety data sheets (MSDS), and customs documentation for compliance.

- Unit Price: Verify the unit price and weight for accurate customs valuation.

Conclusion:

The most likely HS code for "High Heat Resistant Polystyrene Resin" is 3903190000, but the other codes may apply depending on the exact chemical composition and type of resin. Always confirm the material details and technical specifications before finalizing the classification.

Customer Reviews

No reviews yet.