| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

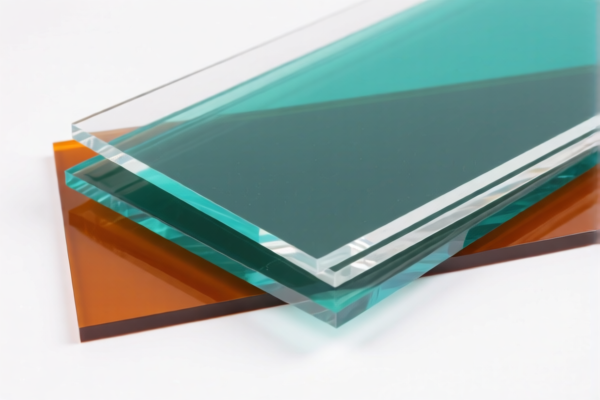

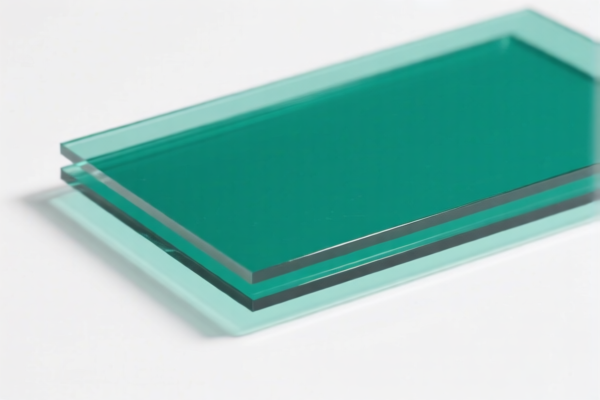

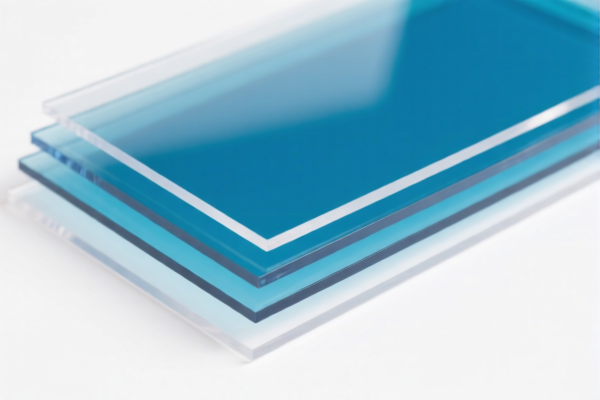

Product Name: High Lead Acrylic Transparent Sheet

Classification HS Code: 3920.59.40.00, 3920.59.80.00, 3920.51.50.50, 3920.51.50.90

🔍 HS Code Classification Summary

- 3920.59.40.00

- Description: Transparent sheets made of acrylic polymer (non-cellular, non-reinforced), containing 30% or more by weight of lead, and laminated or combined with other materials.

-

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

-

3920.59.80.00

- Description: Plastic sheets, films, etc., made of acrylic polymer (non-cellular, non-reinforced), not otherwise specified.

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

-

3920.51.50.50 / 3920.51.50.90

- Description: Sheets of polymethyl methacrylate (PMMA), i.e., acrylic, non-cellular, non-reinforced, not laminated or combined with other materials.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

⚠️ Key Tax Rate Changes and Alerts

- April 11, 2025 Special Tariff:

- Applies to all the above HS codes.

- Additional 30.0% will be imposed after April 11, 2025.

-

This is a time-sensitive policy—ensure your customs clearance is completed before this date to avoid higher costs.

-

Anti-dumping duties:

- Not explicitly mentioned for this product, but always verify if anti-dumping duties apply based on the material origin and country of import.

📌 Proactive Advice for Importers

- Verify Material Composition:

- Confirm the lead content (must be ≥30% by weight) if using HS Code 3920.59.40.00.

-

If lead content is less than 30%, the product may fall under a different HS code (e.g., 3920.51.50.50 or 3920.59.80.00).

-

Check Unit Price and Certification:

- Ensure the unit price is accurate for customs valuation.

-

Confirm if certifications (e.g., RoHS, REACH, or lead content certificates) are required for compliance.

-

Review Import Regulations:

- Some countries may have additional restrictions on lead-containing products.

- Be aware of environmental regulations or safety standards that may apply.

✅ Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3920.59.40.00 | High lead acrylic sheet (≥30% Pb) | 0.0% | 25.0% | 30.0% | 55.0% |

| 3920.59.80.00 | Acrylic sheet (non-cellular, non-reinforced) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920.51.50.50 | PMMA sheet (non-cellular, non-reinforced) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920.51.50.90 | PMMA sheet (non-cellular, non-reinforced) | 6.5% | 25.0% | 30.0% | 61.5% |

If you need further assistance with customs documentation, certification requirements, or tariff calculation, feel free to ask.

Product Name: High Lead Acrylic Transparent Sheet

Classification HS Code: 3920.59.40.00, 3920.59.80.00, 3920.51.50.50, 3920.51.50.90

🔍 HS Code Classification Summary

- 3920.59.40.00

- Description: Transparent sheets made of acrylic polymer (non-cellular, non-reinforced), containing 30% or more by weight of lead, and laminated or combined with other materials.

-

Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

-

3920.59.80.00

- Description: Plastic sheets, films, etc., made of acrylic polymer (non-cellular, non-reinforced), not otherwise specified.

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

-

3920.51.50.50 / 3920.51.50.90

- Description: Sheets of polymethyl methacrylate (PMMA), i.e., acrylic, non-cellular, non-reinforced, not laminated or combined with other materials.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

⚠️ Key Tax Rate Changes and Alerts

- April 11, 2025 Special Tariff:

- Applies to all the above HS codes.

- Additional 30.0% will be imposed after April 11, 2025.

-

This is a time-sensitive policy—ensure your customs clearance is completed before this date to avoid higher costs.

-

Anti-dumping duties:

- Not explicitly mentioned for this product, but always verify if anti-dumping duties apply based on the material origin and country of import.

📌 Proactive Advice for Importers

- Verify Material Composition:

- Confirm the lead content (must be ≥30% by weight) if using HS Code 3920.59.40.00.

-

If lead content is less than 30%, the product may fall under a different HS code (e.g., 3920.51.50.50 or 3920.59.80.00).

-

Check Unit Price and Certification:

- Ensure the unit price is accurate for customs valuation.

-

Confirm if certifications (e.g., RoHS, REACH, or lead content certificates) are required for compliance.

-

Review Import Regulations:

- Some countries may have additional restrictions on lead-containing products.

- Be aware of environmental regulations or safety standards that may apply.

✅ Summary Table

| HS Code | Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3920.59.40.00 | High lead acrylic sheet (≥30% Pb) | 0.0% | 25.0% | 30.0% | 55.0% |

| 3920.59.80.00 | Acrylic sheet (non-cellular, non-reinforced) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920.51.50.50 | PMMA sheet (non-cellular, non-reinforced) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3920.51.50.90 | PMMA sheet (non-cellular, non-reinforced) | 6.5% | 25.0% | 30.0% | 61.5% |

If you need further assistance with customs documentation, certification requirements, or tariff calculation, feel free to ask.

Customer Reviews

No reviews yet.