| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3926909400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

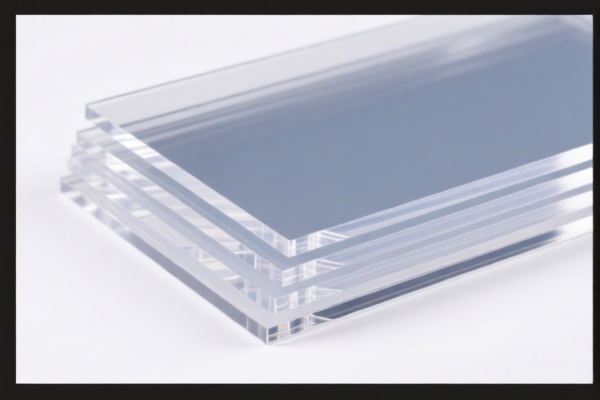

Product Classification: High Lead Content Acrylic Transparent Sheet

Based on the provided HS codes and descriptions, the product falls under HS Code 3920594000 and 3926909400, both of which are relevant to high lead content acrylic transparent sheets. Below is a structured breakdown of the classification and tariff implications:

HS CODE: 3920594000

Description:

- Acrylic polymer-made plastic sheets, films, foils, and strips, non-cellular and non-reinforced, laminated, supported, or otherwise combined with other materials, containing 30% or more by weight of lead, and transparent.

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

HS CODE: 3926909400

Description:

- High lead content transparent plastic sheets (not specifically limited to acrylic, but includes similar materials).

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Observations and Recommendations:

- Tariff Increase Alert:

-

A 30% additional tariff will be applied after April 11, 2025. This is a critical date to note for customs clearance planning and cost estimation.

-

Material Composition:

-

The product must contain 30% or more by weight of lead to qualify under HS Code 3920594000. Ensure that the material composition is verified and documented for customs compliance.

-

Certifications Required:

-

Lead content must be certified by a recognized authority or laboratory. This is essential for customs clearance and to avoid delays or penalties.

-

Unit Price and Classification:

-

Confirm the unit price and product specifications to ensure correct classification. If the product is not strictly acrylic-based, HS Code 3926909400 may be more appropriate.

-

Anti-Dumping Duties:

- While not explicitly mentioned in the data, anti-dumping duties may apply depending on the country of origin and market conditions. It is advisable to consult with a customs broker or trade compliance expert for specific cases.

Proactive Advice:

- Verify the lead content and material composition with your supplier.

- Check the exact product description to ensure it matches the HS code description.

- Plan for the April 11, 2025, tariff increase in your import cost calculations.

- Obtain necessary certifications (e.g., lead content, safety, etc.) to avoid customs delays.

Let me know if you need help with HS code selection based on specific product details or documentation.

Product Classification: High Lead Content Acrylic Transparent Sheet

Based on the provided HS codes and descriptions, the product falls under HS Code 3920594000 and 3926909400, both of which are relevant to high lead content acrylic transparent sheets. Below is a structured breakdown of the classification and tariff implications:

HS CODE: 3920594000

Description:

- Acrylic polymer-made plastic sheets, films, foils, and strips, non-cellular and non-reinforced, laminated, supported, or otherwise combined with other materials, containing 30% or more by weight of lead, and transparent.

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

HS CODE: 3926909400

Description:

- High lead content transparent plastic sheets (not specifically limited to acrylic, but includes similar materials).

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Observations and Recommendations:

- Tariff Increase Alert:

-

A 30% additional tariff will be applied after April 11, 2025. This is a critical date to note for customs clearance planning and cost estimation.

-

Material Composition:

-

The product must contain 30% or more by weight of lead to qualify under HS Code 3920594000. Ensure that the material composition is verified and documented for customs compliance.

-

Certifications Required:

-

Lead content must be certified by a recognized authority or laboratory. This is essential for customs clearance and to avoid delays or penalties.

-

Unit Price and Classification:

-

Confirm the unit price and product specifications to ensure correct classification. If the product is not strictly acrylic-based, HS Code 3926909400 may be more appropriate.

-

Anti-Dumping Duties:

- While not explicitly mentioned in the data, anti-dumping duties may apply depending on the country of origin and market conditions. It is advisable to consult with a customs broker or trade compliance expert for specific cases.

Proactive Advice:

- Verify the lead content and material composition with your supplier.

- Check the exact product description to ensure it matches the HS code description.

- Plan for the April 11, 2025, tariff increase in your import cost calculations.

- Obtain necessary certifications (e.g., lead content, safety, etc.) to avoid customs delays.

Let me know if you need help with HS code selection based on specific product details or documentation.

Customer Reviews

No reviews yet.