Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

| 4412525100 | Doc | 55.0% | CN | US | 2025-05-12 |

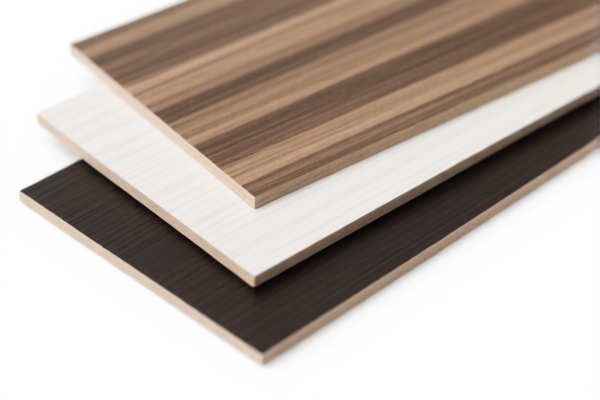

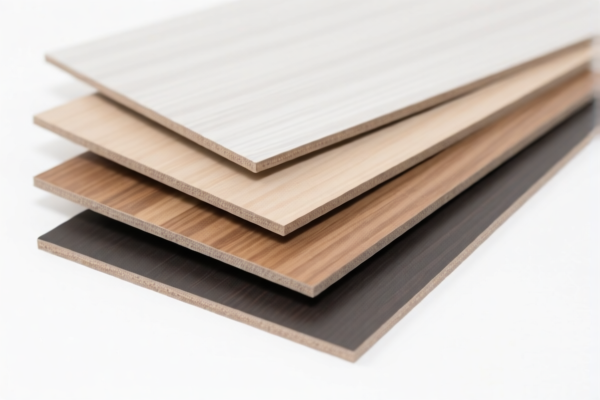

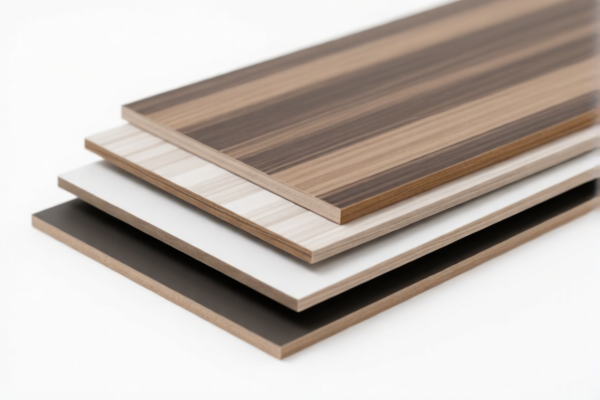

Product Classification: High Pressure Decorative Laminates - Matte Surface

HS CODE: 3921905010

🔍 Classification Summary

- Product Name: High Pressure Decorative Laminates (Matte Surface)

- HS Code: 3921905010

- Description: This code applies to high-pressure decorative laminates with a matte surface, typically used for furniture, interior design, and decorative panels.

📊 Tariff Breakdown

- Base Tariff Rate: 4.8%

- Additional Tariffs (Currently): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

⚠️ Important Notes

- April 11 Special Tariff: A 30% additional tariff will be imposed on imports after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently applicable for this product category.

- No Additional Tariffs (Currently): As of now, no extra tariffs are applied beyond the base rate.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed a high-pressure decorative laminate with a matte surface and not misclassified as a different type of panel (e.g., OSB or particle board with a plastic overlay, which falls under HS code 4410190030).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., fire resistance, environmental standards) are required for import.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially after April 11, 2025, to avoid unexpected costs.

- Consult Customs Broker: For complex classifications or large shipments, consider consulting a customs broker or compliance expert.

📚 Alternative HS Code for Reference

- HS Code 4410190030: Applies to wood-based panels (e.g., OSB, particle board) with a decorative plastic laminate surface.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

⚠️ Important: If your product is a wood-based panel with a decorative plastic layer, it may fall under 4410190030, not 3921905010. Ensure correct classification to avoid penalties or delays. Product Classification: High Pressure Decorative Laminates - Matte Surface

HS CODE: 3921905010

🔍 Classification Summary

- Product Name: High Pressure Decorative Laminates (Matte Surface)

- HS Code: 3921905010

- Description: This code applies to high-pressure decorative laminates with a matte surface, typically used for furniture, interior design, and decorative panels.

📊 Tariff Breakdown

- Base Tariff Rate: 4.8%

- Additional Tariffs (Currently): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

⚠️ Important Notes

- April 11 Special Tariff: A 30% additional tariff will be imposed on imports after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently applicable for this product category.

- No Additional Tariffs (Currently): As of now, no extra tariffs are applied beyond the base rate.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed a high-pressure decorative laminate with a matte surface and not misclassified as a different type of panel (e.g., OSB or particle board with a plastic overlay, which falls under HS code 4410190030).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., fire resistance, environmental standards) are required for import.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially after April 11, 2025, to avoid unexpected costs.

- Consult Customs Broker: For complex classifications or large shipments, consider consulting a customs broker or compliance expert.

📚 Alternative HS Code for Reference

- HS Code 4410190030: Applies to wood-based panels (e.g., OSB, particle board) with a decorative plastic laminate surface.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

⚠️ Important: If your product is a wood-based panel with a decorative plastic layer, it may fall under 4410190030, not 3921905010. Ensure correct classification to avoid penalties or delays.

Customer Reviews

No reviews yet.