| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

| 4412525100 | Doc | 55.0% | CN | US | 2025-05-12 |

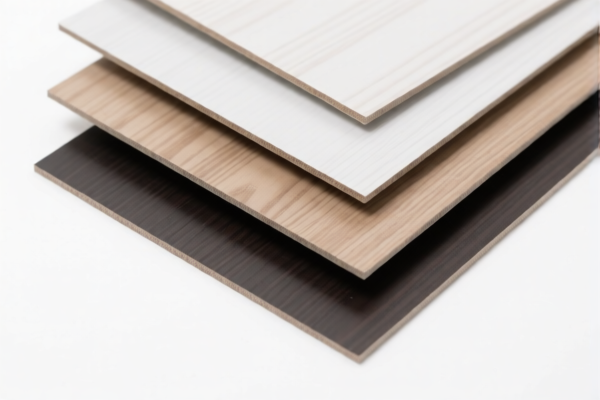

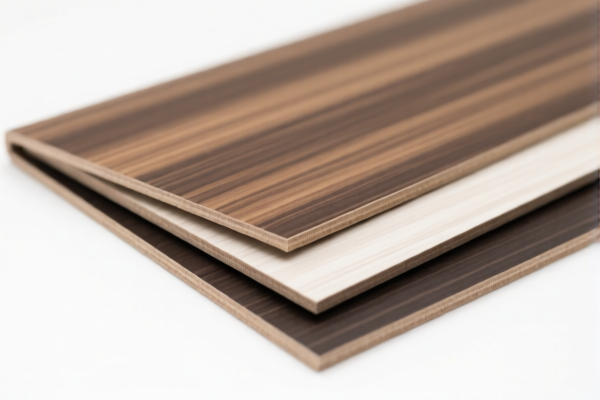

Product Classification: High Pressure Decorative Laminates with Stone Grain Finish

Based on the provided HS codes and tax details, here is the structured analysis for customs compliance and tariff considerations:

✅ HS CODE: 3921905010

Product Description: High Pressure Decorative Laminates (HPDL) – classified under "Other plastic sheets, plates, films, foils and strips" with a specific summary indicating it includes "high-pressure paper reinforced decorative laminates."

- Base Tariff Rate: 4.8%

- Additional Tariffs (as of now): 0.0%

- Tariff Imposed After April 11, 2025: 30.0%

- Total Tax Rate: 34.8% (4.8% + 30.0%)

- Notes:

- This classification is more specific and likely more accurate for HPDL products, especially if they are made of plastic or composite materials.

- The 30% additional tariff applies only after April 11, 2025.

✅ HS CODE: 4412525100

Product Description: Plywood, veneered panels, and similar laminated wood products, with at least one outer layer made of non-coniferous wood.

- Base Tariff Rate: 0.0%

- Additional Tariffs (as of now): 25.0%

- Tariff Imposed After April 11, 2025: 30.0%

- Total Tax Rate: 55.0% (0.0% + 25.0% + 30.0%)

- Notes:

- This classification is for wood-based laminates, not plastic-based HPDL.

- If your product is not made of wood or wood-based materials, this code is not applicable.

- The 30% additional tariff applies only after April 11, 2025.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm whether your product is made of plastic/composite (use HS 3921905010) or wood-based (use HS 4412525100).

- Unit Price and Certification: Ensure the product description and unit price align with the HS code. Some customs authorities may require certifications or technical specifications for accurate classification.

- Tariff Changes After April 11, 2025: Be aware that the 30% additional tariff will apply to both codes after this date. This could significantly increase import costs.

- Anti-Dumping Duties: Not applicable for these products unless specifically mentioned in the customs database.

- Documentation: Maintain clear documentation (e.g., product specifications, material composition, and origin) to support the correct HS code classification.

🛑 Proactive Advice

- Double-check the product composition to ensure the correct HS code is used.

- Monitor the April 11, 2025 deadline for tariff changes and plan accordingly.

- Consult a customs broker or expert if the product is borderline between classifications or if you're unsure about the material composition.

Let me know if you need help with a specific product description or customs documentation. Product Classification: High Pressure Decorative Laminates with Stone Grain Finish

Based on the provided HS codes and tax details, here is the structured analysis for customs compliance and tariff considerations:

✅ HS CODE: 3921905010

Product Description: High Pressure Decorative Laminates (HPDL) – classified under "Other plastic sheets, plates, films, foils and strips" with a specific summary indicating it includes "high-pressure paper reinforced decorative laminates."

- Base Tariff Rate: 4.8%

- Additional Tariffs (as of now): 0.0%

- Tariff Imposed After April 11, 2025: 30.0%

- Total Tax Rate: 34.8% (4.8% + 30.0%)

- Notes:

- This classification is more specific and likely more accurate for HPDL products, especially if they are made of plastic or composite materials.

- The 30% additional tariff applies only after April 11, 2025.

✅ HS CODE: 4412525100

Product Description: Plywood, veneered panels, and similar laminated wood products, with at least one outer layer made of non-coniferous wood.

- Base Tariff Rate: 0.0%

- Additional Tariffs (as of now): 25.0%

- Tariff Imposed After April 11, 2025: 30.0%

- Total Tax Rate: 55.0% (0.0% + 25.0% + 30.0%)

- Notes:

- This classification is for wood-based laminates, not plastic-based HPDL.

- If your product is not made of wood or wood-based materials, this code is not applicable.

- The 30% additional tariff applies only after April 11, 2025.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm whether your product is made of plastic/composite (use HS 3921905010) or wood-based (use HS 4412525100).

- Unit Price and Certification: Ensure the product description and unit price align with the HS code. Some customs authorities may require certifications or technical specifications for accurate classification.

- Tariff Changes After April 11, 2025: Be aware that the 30% additional tariff will apply to both codes after this date. This could significantly increase import costs.

- Anti-Dumping Duties: Not applicable for these products unless specifically mentioned in the customs database.

- Documentation: Maintain clear documentation (e.g., product specifications, material composition, and origin) to support the correct HS code classification.

🛑 Proactive Advice

- Double-check the product composition to ensure the correct HS code is used.

- Monitor the April 11, 2025 deadline for tariff changes and plan accordingly.

- Consult a customs broker or expert if the product is borderline between classifications or if you're unsure about the material composition.

Let me know if you need help with a specific product description or customs documentation.

Customer Reviews

No reviews yet.