| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4412525100 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

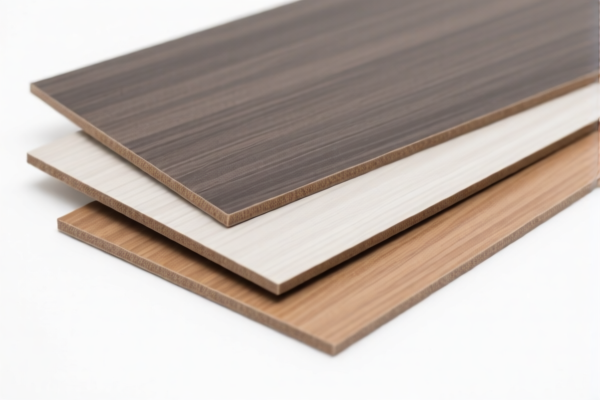

Product Classification and Customs Tariff Analysis for High Pressure Decorative Laminates for Hospital Walls

✅ HS CODE: 4412.52.51.00

Product Description: Decorative laminates, suitable for hospital walls

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Other duties: No specific anti-dumping duties on iron or aluminum apply here

Key Notes: - This classification applies to decorative laminates made from wood or other materials, intended for hospital wall decoration. - The high total tax rate is due to the additional tariffs applied after April 11, 2025. - Proactive Advice: Confirm the exact composition and intended use of the laminates to ensure correct classification. Check if any special certifications (e.g., fire resistance, hospital-grade materials) are required for import.

✅ HS CODE: 3921.90.50.10

Product Description: High-pressure paper-reinforced plastic decorative panels, suitable for hospital walls

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Other duties: No specific anti-dumping duties on iron or aluminum apply here

Key Notes: - This classification applies to decorative plastic panels made with high-pressure paper reinforcement, suitable for hospital walls. - The base tariff is relatively low, but the total tax rate increases significantly after April 11, 2025. - Proactive Advice: Verify the exact material composition (e.g., type of plastic, reinforcement) to ensure correct HS code classification. Confirm if any health or safety certifications are required for hospital use.

📌 Important Reminders:

- April 11, 2025, Special Tariff: Both products are subject to an additional 30.0% tariff after this date. Ensure your import timeline accounts for this.

- Material Verification: Confirm the exact composition and intended use of the product to avoid misclassification.

- Certifications: Check if any specific certifications (e.g., fire resistance, hospital-grade compliance) are required for import into the destination country.

- Tariff Calculation: Total tax = base tariff + additional tariff + special tariff (if applicable after April 11, 2025).

Let me know if you need help calculating the final cost or preparing customs documentation. Product Classification and Customs Tariff Analysis for High Pressure Decorative Laminates for Hospital Walls

✅ HS CODE: 4412.52.51.00

Product Description: Decorative laminates, suitable for hospital walls

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Other duties: No specific anti-dumping duties on iron or aluminum apply here

Key Notes: - This classification applies to decorative laminates made from wood or other materials, intended for hospital wall decoration. - The high total tax rate is due to the additional tariffs applied after April 11, 2025. - Proactive Advice: Confirm the exact composition and intended use of the laminates to ensure correct classification. Check if any special certifications (e.g., fire resistance, hospital-grade materials) are required for import.

✅ HS CODE: 3921.90.50.10

Product Description: High-pressure paper-reinforced plastic decorative panels, suitable for hospital walls

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this product category

- Other duties: No specific anti-dumping duties on iron or aluminum apply here

Key Notes: - This classification applies to decorative plastic panels made with high-pressure paper reinforcement, suitable for hospital walls. - The base tariff is relatively low, but the total tax rate increases significantly after April 11, 2025. - Proactive Advice: Verify the exact material composition (e.g., type of plastic, reinforcement) to ensure correct HS code classification. Confirm if any health or safety certifications are required for hospital use.

📌 Important Reminders:

- April 11, 2025, Special Tariff: Both products are subject to an additional 30.0% tariff after this date. Ensure your import timeline accounts for this.

- Material Verification: Confirm the exact composition and intended use of the product to avoid misclassification.

- Certifications: Check if any specific certifications (e.g., fire resistance, hospital-grade compliance) are required for import into the destination country.

- Tariff Calculation: Total tax = base tariff + additional tariff + special tariff (if applicable after April 11, 2025).

Let me know if you need help calculating the final cost or preparing customs documentation.

Customer Reviews

No reviews yet.