Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

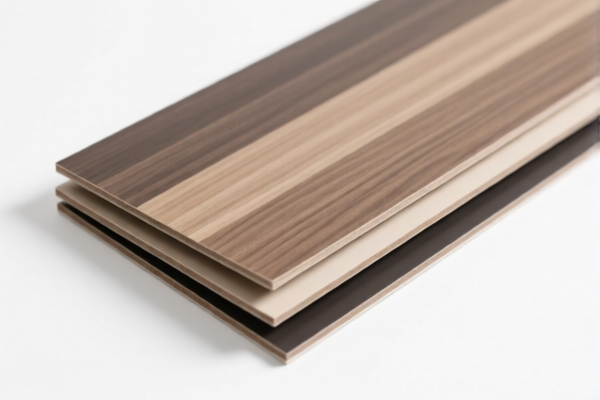

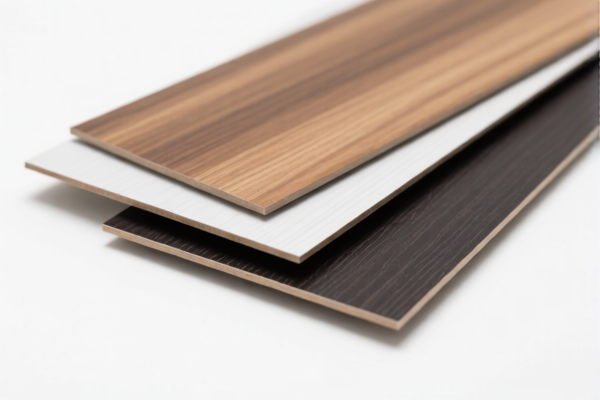

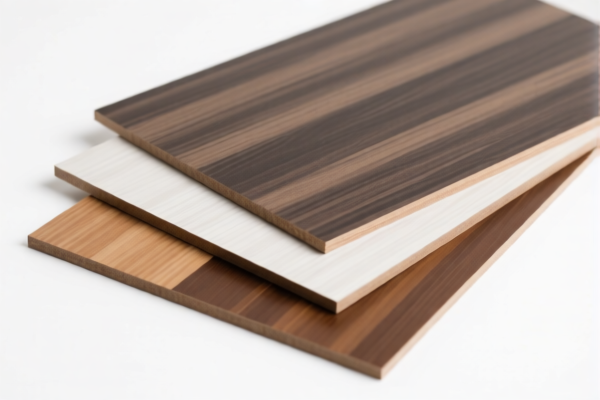

Product Name: High Pressure Decorative Laminates for Interior Decoration

HS CODE: 3921905010

🔍 Classification Summary:

- Product Description: High Pressure Decorative Laminates (HPDL) made from paper and resin, commonly used for interior decoration, such as countertops, cabinets, and wall panels.

- HS Code: 3921905010 (10-digit code)

- Tariff Classification: This code falls under Chapter 39 (Plastics and articles thereof), specifically for laminates made of plastic, not elsewhere specified.

📊 Tariff Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariff (Currently): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.8% (4.8% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff will be imposed after April 11, 2025. Ensure your customs clearance is completed before this date to avoid the extra cost.

📌 Key Considerations:

- Material Composition: Confirm the laminate is made of high-pressure paper and resin. If it contains other materials (e.g., metal, glass), the classification may change.

- Unit Price: The tax rate may be affected by the declared value and unit price. Ensure accurate valuation to avoid disputes.

- Certifications: Some countries may require specific certifications (e.g., fire resistance, environmental standards) for interior decoration materials. Verify if these are needed for your destination market.

- Anti-Dumping Duties: Not applicable for this product (no mention of anti-dumping duties on plastics or laminates in the provided data).

✅ Proactive Advice:

- Verify Product Composition: Ensure the product is classified correctly under HS 3921905010 and not under a different code (e.g., 3921905090 or 3921905020).

- Plan for Tariff Changes: If your shipment is scheduled after April 11, 2025, factor in the 30.0% additional tariff in your cost estimation.

- Consult Customs Broker: For complex or high-value shipments, seek assistance from a licensed customs broker to ensure compliance and avoid delays.

Let me know if you need help with customs documentation or tariff calculation tools!

Product Name: High Pressure Decorative Laminates for Interior Decoration

HS CODE: 3921905010

🔍 Classification Summary:

- Product Description: High Pressure Decorative Laminates (HPDL) made from paper and resin, commonly used for interior decoration, such as countertops, cabinets, and wall panels.

- HS Code: 3921905010 (10-digit code)

- Tariff Classification: This code falls under Chapter 39 (Plastics and articles thereof), specifically for laminates made of plastic, not elsewhere specified.

📊 Tariff Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariff (Currently): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.8% (4.8% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff will be imposed after April 11, 2025. Ensure your customs clearance is completed before this date to avoid the extra cost.

📌 Key Considerations:

- Material Composition: Confirm the laminate is made of high-pressure paper and resin. If it contains other materials (e.g., metal, glass), the classification may change.

- Unit Price: The tax rate may be affected by the declared value and unit price. Ensure accurate valuation to avoid disputes.

- Certifications: Some countries may require specific certifications (e.g., fire resistance, environmental standards) for interior decoration materials. Verify if these are needed for your destination market.

- Anti-Dumping Duties: Not applicable for this product (no mention of anti-dumping duties on plastics or laminates in the provided data).

✅ Proactive Advice:

- Verify Product Composition: Ensure the product is classified correctly under HS 3921905010 and not under a different code (e.g., 3921905090 or 3921905020).

- Plan for Tariff Changes: If your shipment is scheduled after April 11, 2025, factor in the 30.0% additional tariff in your cost estimation.

- Consult Customs Broker: For complex or high-value shipments, seek assistance from a licensed customs broker to ensure compliance and avoid delays.

Let me know if you need help with customs documentation or tariff calculation tools!

Customer Reviews

No reviews yet.