Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

| 4412525100 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

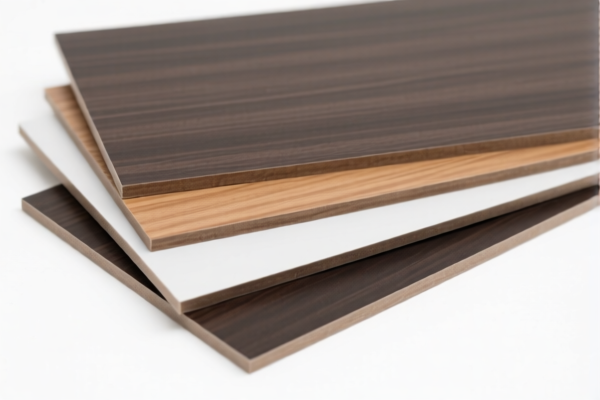

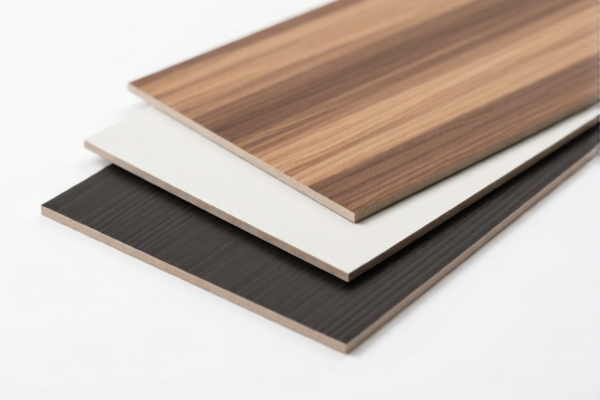

Product Classification: High Pressure Decorative Laminates for Office Furniture

HS CODE: 3921.90.50.10 (10-digit code)

🔍 Classification Summary

- Product Name: High Pressure Decorative Laminates (HPL) used in office furniture

- HS Code: 3921.90.50.10

- Description: This code applies to high-pressure decorative laminates made of paper impregnated with thermosetting resins, typically used for decorative surfaces in furniture, countertops, and other interior applications.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 4.8%

- Additional Tariffs (currently): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on this product after April 11, 2025. This is a significant increase and will raise the total tax rate from 4.8% to 34.8%.

- No Anti-Dumping Duties: As of now, there are no specific anti-dumping duties reported for this product category.

- No Additional Tariffs (currently): There are no other additional tariffs in place at this time.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed a high-pressure decorative laminate (HPL) and not a different type of composite or wood product (e.g., particle board or MDF with a veneer).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., fire resistance, environmental standards) are required for import.

- Plan for Tariff Increase: If importing after April 11, 2025, budget for the 30% additional tariff to avoid unexpected costs.

- Consider Alternative HS Codes: If the product is misclassified (e.g., classified under 4412.52.51.00 for wood-based laminates), the tariff rate could be 55.0%, which is significantly higher. Double-check classification with customs or a classification expert.

📚 Example for Clarity

- If you import 100 units of HPL at $100 per unit, the total value is $10,000.

- Base Tariff (4.8%) = $480

- After April 11, 2025, Additional Tariff (30%) = $3,000

- Total Tariff Cost = $3,480

✅ Conclusion

- HS Code: 3921.90.50.10

- Total Tax Rate: 34.8%

- Key Date: April 11, 2025 – 30% additional tariff will apply

- Action Required: Verify product classification, plan for higher tariffs, and ensure compliance with all import documentation and certifications.

Product Classification: High Pressure Decorative Laminates for Office Furniture

HS CODE: 3921.90.50.10 (10-digit code)

🔍 Classification Summary

- Product Name: High Pressure Decorative Laminates (HPL) used in office furniture

- HS Code: 3921.90.50.10

- Description: This code applies to high-pressure decorative laminates made of paper impregnated with thermosetting resins, typically used for decorative surfaces in furniture, countertops, and other interior applications.

📊 Tariff Breakdown (as of now)

- Base Tariff Rate: 4.8%

- Additional Tariffs (currently): 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

⚠️ Important Notes on Tariff Changes

- April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on this product after April 11, 2025. This is a significant increase and will raise the total tax rate from 4.8% to 34.8%.

- No Anti-Dumping Duties: As of now, there are no specific anti-dumping duties reported for this product category.

- No Additional Tariffs (currently): There are no other additional tariffs in place at this time.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed a high-pressure decorative laminate (HPL) and not a different type of composite or wood product (e.g., particle board or MDF with a veneer).

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., fire resistance, environmental standards) are required for import.

- Plan for Tariff Increase: If importing after April 11, 2025, budget for the 30% additional tariff to avoid unexpected costs.

- Consider Alternative HS Codes: If the product is misclassified (e.g., classified under 4412.52.51.00 for wood-based laminates), the tariff rate could be 55.0%, which is significantly higher. Double-check classification with customs or a classification expert.

📚 Example for Clarity

- If you import 100 units of HPL at $100 per unit, the total value is $10,000.

- Base Tariff (4.8%) = $480

- After April 11, 2025, Additional Tariff (30%) = $3,000

- Total Tariff Cost = $3,480

✅ Conclusion

- HS Code: 3921.90.50.10

- Total Tax Rate: 34.8%

- Key Date: April 11, 2025 – 30% additional tariff will apply

- Action Required: Verify product classification, plan for higher tariffs, and ensure compliance with all import documentation and certifications.

Customer Reviews

No reviews yet.