| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905010 | Doc | 34.8% | CN | US | 2025-05-12 |

| 4412525100 | Doc | 55.0% | CN | US | 2025-05-12 |

Product Name: High Pressure Decorative Laminates for Retail Displays

Classification: Based on the provided HS codes, the product may fall under one of the following classifications:

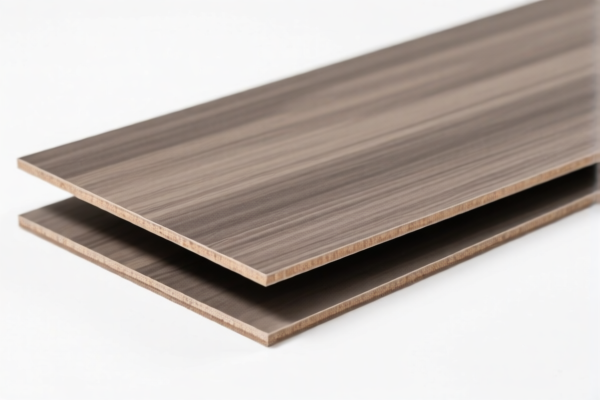

HS CODE: 3921905010

Description: High-pressure decorative laminates (e.g., for retail displays)

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariffs: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic-based, not metal)

Key Notes: - This code is for plastic-based laminates, which are commonly used in retail displays. - The 30% additional tariff applies after April 11, 2025, so be mindful of the timing of your import. - This classification is not subject to anti-dumping duties on metals.

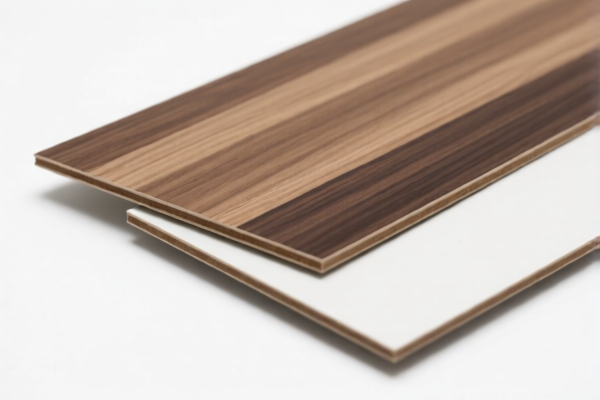

HS CODE: 4412525100

Description: Plywood, veneered panels, and similar laminated wood products, with at least one outer layer of non-coniferous wood

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariffs: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is wood-based, not metal)

Key Notes: - This code is for wood-based laminates, which may be used in some display applications. - The 25% additional tariff is already included in the total tax rate. - An additional 30% will be applied after April 11, 2025. - This classification is not subject to anti-dumping duties on metals.

✅ Proactive Advice:

- Verify the material composition of your product (plastic vs. wood) to ensure correct classification.

- Check the unit price and total value to determine if any preferential tariff rates apply.

- Confirm required certifications (e.g., fire safety, environmental compliance) for retail display use.

- Monitor the April 11, 2025 deadline for additional tariffs and plan accordingly.

- If your product is imported from a country subject to anti-dumping duties, ensure you have the necessary documentation to avoid penalties.

Let me know if you need help determining which HS code applies to your specific product.

Product Name: High Pressure Decorative Laminates for Retail Displays

Classification: Based on the provided HS codes, the product may fall under one of the following classifications:

HS CODE: 3921905010

Description: High-pressure decorative laminates (e.g., for retail displays)

Total Tax Rate: 34.8%

- Base Tariff Rate: 4.8%

- Additional Tariffs: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is plastic-based, not metal)

Key Notes: - This code is for plastic-based laminates, which are commonly used in retail displays. - The 30% additional tariff applies after April 11, 2025, so be mindful of the timing of your import. - This classification is not subject to anti-dumping duties on metals.

HS CODE: 4412525100

Description: Plywood, veneered panels, and similar laminated wood products, with at least one outer layer of non-coniferous wood

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariffs: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is wood-based, not metal)

Key Notes: - This code is for wood-based laminates, which may be used in some display applications. - The 25% additional tariff is already included in the total tax rate. - An additional 30% will be applied after April 11, 2025. - This classification is not subject to anti-dumping duties on metals.

✅ Proactive Advice:

- Verify the material composition of your product (plastic vs. wood) to ensure correct classification.

- Check the unit price and total value to determine if any preferential tariff rates apply.

- Confirm required certifications (e.g., fire safety, environmental compliance) for retail display use.

- Monitor the April 11, 2025 deadline for additional tariffs and plan accordingly.

- If your product is imported from a country subject to anti-dumping duties, ensure you have the necessary documentation to avoid penalties.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.