| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the High Proportion Polyurethane Textile Composite Boards based on the provided HS codes:

✅ HS CODE: 3921131100

Product Description:

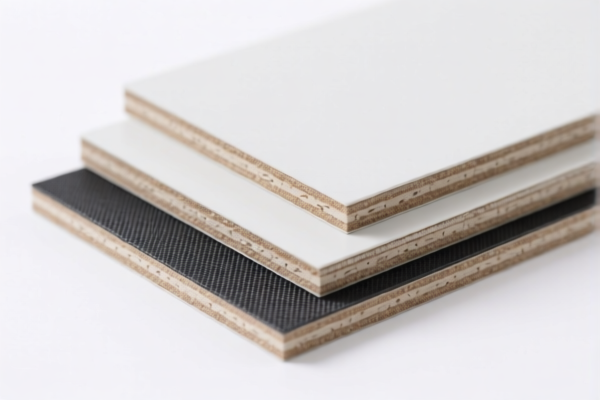

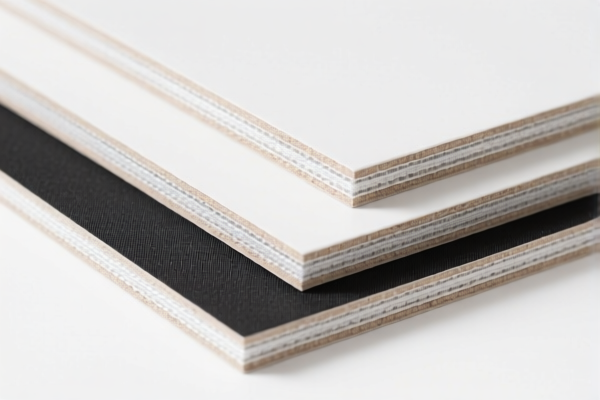

- High proportion polyurethane textile composite boards

- Meets the characteristics of "honeycomb plastic", "polyurethane plastic", and "plastic combined with textile materials"

- The term "high proportion" implies that the plastic content exceeds 70%

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3921131500

Product Description:

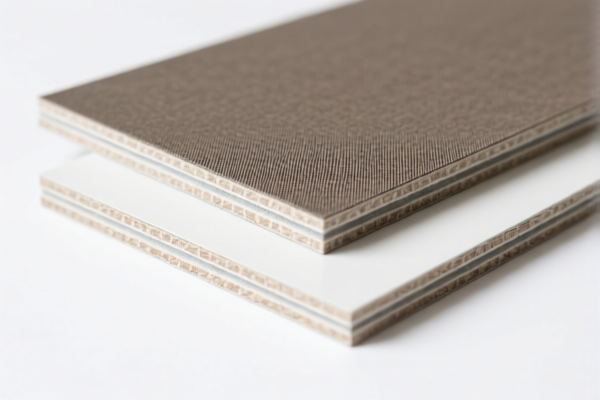

- Polyurethane textile composite high-density boards

- Polyurethane textile composite multi-layer boards

- Includes "polyurethane plastic" and "plastic combined with textile materials"

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921131950

Product Description:

- Polyurethane textile composite heavy-duty boards

- Polyurethane textile composite thick boards

- Meets the description: "honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials"

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes and Recommendations:

- Time-sensitive policy:

-

Additional tariffs of 30.0% will be applied after April 11, 2025. Ensure your import timeline is aligned with this.

-

Material Verification:

-

Confirm the exact composition of the product (e.g., percentage of polyurethane vs. textile content) to ensure correct HS code classification.

-

Certifications:

-

Check if any certifications (e.g., safety, environmental compliance) are required for import into the destination country.

-

Unit Price and Classification:

-

Verify the unit price and product description to avoid misclassification, which could lead to delays or penalties.

-

Anti-dumping duties:

- Currently, no specific anti-dumping duties are mentioned for this product category. However, always check the latest customs notices for updates.

If you need further assistance with customs documentation or classification confirmation, feel free to provide more details about the product specifications and intended market. Here is the structured classification and tariff information for the High Proportion Polyurethane Textile Composite Boards based on the provided HS codes:

✅ HS CODE: 3921131100

Product Description:

- High proportion polyurethane textile composite boards

- Meets the characteristics of "honeycomb plastic", "polyurethane plastic", and "plastic combined with textile materials"

- The term "high proportion" implies that the plastic content exceeds 70%

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

✅ HS CODE: 3921131500

Product Description:

- Polyurethane textile composite high-density boards

- Polyurethane textile composite multi-layer boards

- Includes "polyurethane plastic" and "plastic combined with textile materials"

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921131950

Product Description:

- Polyurethane textile composite heavy-duty boards

- Polyurethane textile composite thick boards

- Meets the description: "honeycomb polyurethane plastic sheets, films, foils, and strips combined with textile materials"

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

⚠️ Important Notes and Recommendations:

- Time-sensitive policy:

-

Additional tariffs of 30.0% will be applied after April 11, 2025. Ensure your import timeline is aligned with this.

-

Material Verification:

-

Confirm the exact composition of the product (e.g., percentage of polyurethane vs. textile content) to ensure correct HS code classification.

-

Certifications:

-

Check if any certifications (e.g., safety, environmental compliance) are required for import into the destination country.

-

Unit Price and Classification:

-

Verify the unit price and product description to avoid misclassification, which could lead to delays or penalties.

-

Anti-dumping duties:

- Currently, no specific anti-dumping duties are mentioned for this product category. However, always check the latest customs notices for updates.

If you need further assistance with customs documentation or classification confirmation, feel free to provide more details about the product specifications and intended market.

Customer Reviews

No reviews yet.