| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919101010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905020 | Doc | 60.8% | CN | US | 2025-05-12 |

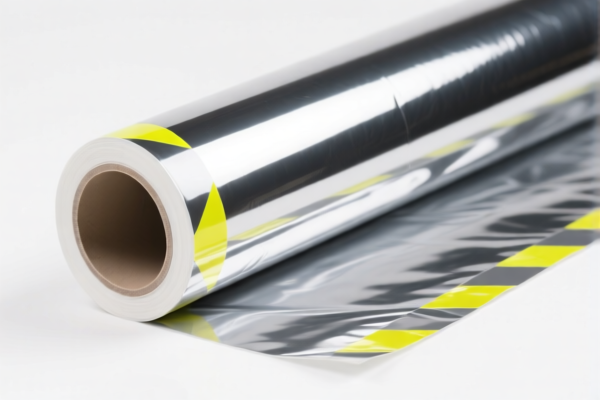

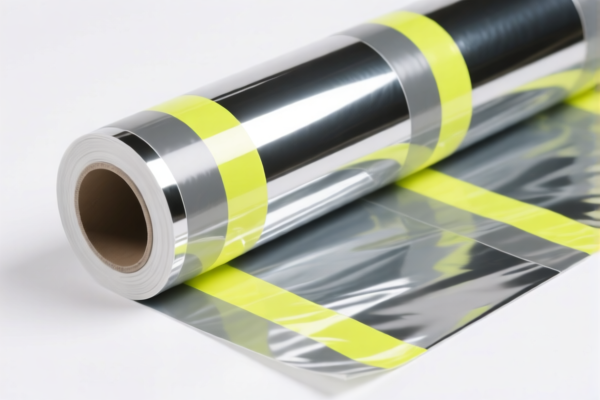

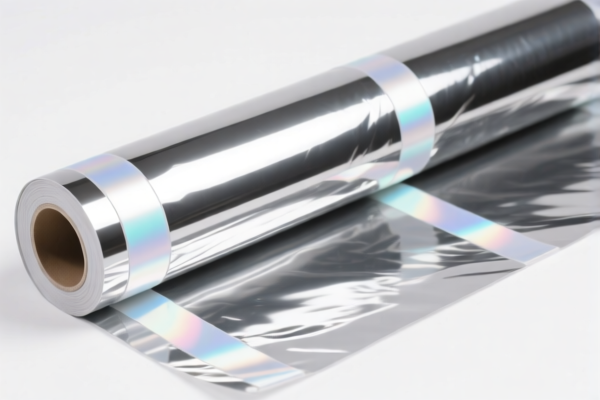

Here is the structured classification and tariff information for High Strength Reflective Self Adhesive Film, based on the provided HS codes and tax details:

✅ HS CODE: 3919101010

Product Description:

- Applicable to self-adhesive reflective materials, such as road marking tapes or other self-adhesive plastic products with a width not exceeding 20 cm.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3919101050

Product Description:

- Applicable to self-adhesive reflective plastic films with a width not exceeding 20 cm and a reflective surface.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3919905010

Product Description:

- Applicable to self-adhesive reflective tapes or bands classified as reflective sheets.

Tariff Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3919905060

Product Description:

- Applicable to self-adhesive reflective tapes classified as other self-adhesive plastic products.

Tariff Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3919905020

Product Description:

- Applicable to self-adhesive reflective tapes classified as other self-adhesive plastic products.

Tariff Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, check for any applicable anti-dumping duties. These are not included in the base or additional tariffs listed above and may vary depending on the country of origin and specific product composition. -

Certifications Required:

Ensure your product meets any import certifications (e.g., CE, RoHS, or specific customs documentation) required by the importing country.

📌 Proactive Advice:

-

Verify Material and Unit Price:

Confirm the exact composition and dimensions of your product to ensure correct HS code classification. -

Check for Certifications:

Review the required certifications for your product in the target market to avoid delays in customs clearance. -

Monitor Tariff Updates:

Stay informed about any changes in tariff policies, especially the April 11, 2025 deadline, to avoid unexpected costs.

Let me know if you need help with HS code selection or customs documentation! Here is the structured classification and tariff information for High Strength Reflective Self Adhesive Film, based on the provided HS codes and tax details:

✅ HS CODE: 3919101010

Product Description:

- Applicable to self-adhesive reflective materials, such as road marking tapes or other self-adhesive plastic products with a width not exceeding 20 cm.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3919101050

Product Description:

- Applicable to self-adhesive reflective plastic films with a width not exceeding 20 cm and a reflective surface.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3919905010

Product Description:

- Applicable to self-adhesive reflective tapes or bands classified as reflective sheets.

Tariff Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3919905060

Product Description:

- Applicable to self-adhesive reflective tapes classified as other self-adhesive plastic products.

Tariff Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3919905020

Product Description:

- Applicable to self-adhesive reflective tapes classified as other self-adhesive plastic products.

Tariff Breakdown:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in your customs planning. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, check for any applicable anti-dumping duties. These are not included in the base or additional tariffs listed above and may vary depending on the country of origin and specific product composition. -

Certifications Required:

Ensure your product meets any import certifications (e.g., CE, RoHS, or specific customs documentation) required by the importing country.

📌 Proactive Advice:

-

Verify Material and Unit Price:

Confirm the exact composition and dimensions of your product to ensure correct HS code classification. -

Check for Certifications:

Review the required certifications for your product in the target market to avoid delays in customs clearance. -

Monitor Tariff Updates:

Stay informed about any changes in tariff policies, especially the April 11, 2025 deadline, to avoid unexpected costs.

Let me know if you need help with HS code selection or customs documentation!

Customer Reviews

No reviews yet.