| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

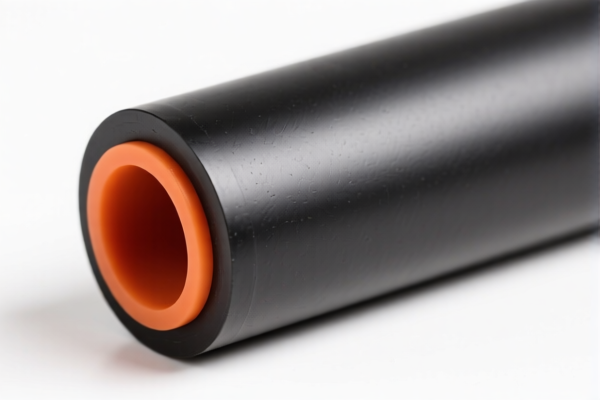

Product Classification: High Temperature Fluororubber Elastomer

HS CODE: 3904.69.10.00 and 4008.29.20.00 / 4008.29.40.00

🔍 Classification Overview

- Fluororubber (FKM) is a synthetic rubber with excellent heat resistance and chemical stability, commonly used in high-temperature environments.

- Based on the provided data, fluororubber products are classified under HS CODE 3904.69.10.00 (for general fluororubber products like sheets, high-strength, or high-elasticity variants).

- Fluororubber O-rings are classified under HS CODE 4008.29.20.00 or 4008.29.40.00, depending on specific product details.

📊 Tariff Summary (as of now)

- Base Tariff Rate:

- 3904.69.10.00: 0.0%

-

4008.29.20.00 / 4008.29.40.00: 2.9%

-

Additional Tariff (General):

-

25.0% applied to all products (not time-sensitive)

-

Special Tariff (April 11, 2025 onwards):

-

30.0% added to the base and general tariffs (applies to all listed HS codes)

-

Total Tax Rate:

- 3904.69.10.00: 55.0% (0.0% + 25.0% + 30.0%)

- 4008.29.20.00 / 4008.29.40.00: 57.9% (2.9% + 25.0% + 30.0%)

⚠️ Important Notes

- April 11, 2025 Special Tariff:

- This is a time-sensitive policy. If your product is imported after April 11, 2025, the 30.0% additional tariff will apply.

-

Ensure your import timeline is aligned with this policy to avoid unexpected costs.

-

Anti-dumping duties:

- No specific anti-dumping duties are mentioned for fluororubber in the provided data. However, always verify with customs or a compliance expert if your product is subject to any ongoing investigations.

📌 Proactive Advice for Importers

- Verify Material Specifications:

-

Confirm that the product is indeed fluororubber and not a different type of rubber (e.g., silicone or EPDM), as this can affect classification.

-

Check Unit Price and Packaging:

-

Tariff rates may vary based on the product’s form (e.g., sheets, O-rings, or molded parts), so ensure the HS code matches the actual product description.

-

Certifications and Documentation:

-

Some fluororubber products may require technical specifications, material safety data sheets (MSDS), or certifications for compliance with local regulations.

-

Consult a Customs Broker:

- For complex or high-value shipments, consider engaging a customs broker or compliance expert to ensure accurate classification and tariff calculation.

✅ Summary Table

| HS CODE | Product Description | Base Tariff | General Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3904.69.10.00 | Fluororubber (general) | 0.0% | 25.0% | 30.0% | 55.0% |

| 4008.29.20.00 | Fluororubber O-rings | 2.9% | 25.0% | 30.0% | 57.9% |

| 4008.29.40.00 | Fluororubber O-rings | 2.9% | 25.0% | 30.0% | 57.9% |

Let me know if you need help with customs documentation, tariff calculation tools, or HS code verification for specific product samples.

Product Classification: High Temperature Fluororubber Elastomer

HS CODE: 3904.69.10.00 and 4008.29.20.00 / 4008.29.40.00

🔍 Classification Overview

- Fluororubber (FKM) is a synthetic rubber with excellent heat resistance and chemical stability, commonly used in high-temperature environments.

- Based on the provided data, fluororubber products are classified under HS CODE 3904.69.10.00 (for general fluororubber products like sheets, high-strength, or high-elasticity variants).

- Fluororubber O-rings are classified under HS CODE 4008.29.20.00 or 4008.29.40.00, depending on specific product details.

📊 Tariff Summary (as of now)

- Base Tariff Rate:

- 3904.69.10.00: 0.0%

-

4008.29.20.00 / 4008.29.40.00: 2.9%

-

Additional Tariff (General):

-

25.0% applied to all products (not time-sensitive)

-

Special Tariff (April 11, 2025 onwards):

-

30.0% added to the base and general tariffs (applies to all listed HS codes)

-

Total Tax Rate:

- 3904.69.10.00: 55.0% (0.0% + 25.0% + 30.0%)

- 4008.29.20.00 / 4008.29.40.00: 57.9% (2.9% + 25.0% + 30.0%)

⚠️ Important Notes

- April 11, 2025 Special Tariff:

- This is a time-sensitive policy. If your product is imported after April 11, 2025, the 30.0% additional tariff will apply.

-

Ensure your import timeline is aligned with this policy to avoid unexpected costs.

-

Anti-dumping duties:

- No specific anti-dumping duties are mentioned for fluororubber in the provided data. However, always verify with customs or a compliance expert if your product is subject to any ongoing investigations.

📌 Proactive Advice for Importers

- Verify Material Specifications:

-

Confirm that the product is indeed fluororubber and not a different type of rubber (e.g., silicone or EPDM), as this can affect classification.

-

Check Unit Price and Packaging:

-

Tariff rates may vary based on the product’s form (e.g., sheets, O-rings, or molded parts), so ensure the HS code matches the actual product description.

-

Certifications and Documentation:

-

Some fluororubber products may require technical specifications, material safety data sheets (MSDS), or certifications for compliance with local regulations.

-

Consult a Customs Broker:

- For complex or high-value shipments, consider engaging a customs broker or compliance expert to ensure accurate classification and tariff calculation.

✅ Summary Table

| HS CODE | Product Description | Base Tariff | General Tariff | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|---|

| 3904.69.10.00 | Fluororubber (general) | 0.0% | 25.0% | 30.0% | 55.0% |

| 4008.29.20.00 | Fluororubber O-rings | 2.9% | 25.0% | 30.0% | 57.9% |

| 4008.29.40.00 | Fluororubber O-rings | 2.9% | 25.0% | 30.0% | 57.9% |

Let me know if you need help with customs documentation, tariff calculation tools, or HS code verification for specific product samples.

Customer Reviews

No reviews yet.