| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904695000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3926904510 | Doc | 58.5% | CN | US | 2025-05-12 |

| 3904691000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4008294000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 4008294000 | Doc | 57.9% | CN | US | 2025-05-12 |

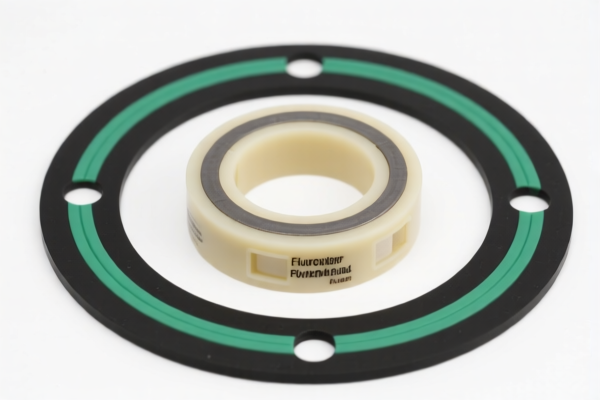

Here is the structured and professional analysis of the HS codes and tariff rates for High Temperature Fluororubber Gasket Raw Material, based on the provided data:

✅ HS CODE: 3904695000

Product Description: Fluororubber gaskets (fluoropolymer)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for fluoropolymer (halogenated olefins polymer), which aligns with the product description.

- Proactive Advice: Confirm the exact chemical composition and whether it is in its primary form or processed into a finished product.

✅ HS CODE: 3926904510

Product Description: Fluororubber gaskets (seals, O-rings, etc.)

Tariff Summary:

- Base Tariff Rate: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.5%

Key Notes:

- This code is for rubber seals, gaskets, and O-rings made of fluororubber.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 3926.90.45.90) and verify the finished product status.

✅ HS CODE: 3904691000

Product Description: Fluororubber gaskets (fluoropolymer)

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is for primary forms of fluoropolymer (e.g., raw materials), which may be more suitable for raw material imports.

- Proactive Advice: Confirm whether the product is in primary form or processed, and check if certifications (e.g., material safety, chemical composition) are required.

✅ HS CODE: 4008294000

Product Description: Fluororubber gaskets (sulfurized rubber)

Tariff Summary:

- Base Tariff Rate: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.9%

Key Notes:

- This code is for sulfurized rubber products, including non-cellular rubber (e.g., gaskets, sheets, strips).

- Proactive Advice: Confirm the processing stage (raw material vs. finished product) and ensure compliance with customs documentation (e.g., product specifications, material certificates).

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed HS codes will be subject to an additional 30% tariff after this date.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if anti-dumping or countervailing duties apply based on the country of origin.

- Certifications: Ensure the product has the necessary technical documentation, material safety data sheets (MSDS), and customs compliance certificates.

- Unit Price Verification: Confirm the unit price and product description to avoid misclassification and potential penalties.

If you need further assistance with customs declarations, tariff calculations, or product classification, feel free to provide more details. Here is the structured and professional analysis of the HS codes and tariff rates for High Temperature Fluororubber Gasket Raw Material, based on the provided data:

✅ HS CODE: 3904695000

Product Description: Fluororubber gaskets (fluoropolymer)

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for fluoropolymer (halogenated olefins polymer), which aligns with the product description.

- Proactive Advice: Confirm the exact chemical composition and whether it is in its primary form or processed into a finished product.

✅ HS CODE: 3926904510

Product Description: Fluororubber gaskets (seals, O-rings, etc.)

Tariff Summary:

- Base Tariff Rate: 3.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.5%

Key Notes:

- This code is for rubber seals, gaskets, and O-rings made of fluororubber.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 3926.90.45.90) and verify the finished product status.

✅ HS CODE: 3904691000

Product Description: Fluororubber gaskets (fluoropolymer)

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is for primary forms of fluoropolymer (e.g., raw materials), which may be more suitable for raw material imports.

- Proactive Advice: Confirm whether the product is in primary form or processed, and check if certifications (e.g., material safety, chemical composition) are required.

✅ HS CODE: 4008294000

Product Description: Fluororubber gaskets (sulfurized rubber)

Tariff Summary:

- Base Tariff Rate: 2.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.9%

Key Notes:

- This code is for sulfurized rubber products, including non-cellular rubber (e.g., gaskets, sheets, strips).

- Proactive Advice: Confirm the processing stage (raw material vs. finished product) and ensure compliance with customs documentation (e.g., product specifications, material certificates).

📌 Important Reminders:

- April 11, 2025 Special Tariff: All listed HS codes will be subject to an additional 30% tariff after this date.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if anti-dumping or countervailing duties apply based on the country of origin.

- Certifications: Ensure the product has the necessary technical documentation, material safety data sheets (MSDS), and customs compliance certificates.

- Unit Price Verification: Confirm the unit price and product description to avoid misclassification and potential penalties.

If you need further assistance with customs declarations, tariff calculations, or product classification, feel free to provide more details.

Customer Reviews

No reviews yet.