| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102055 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919102040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4811411000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

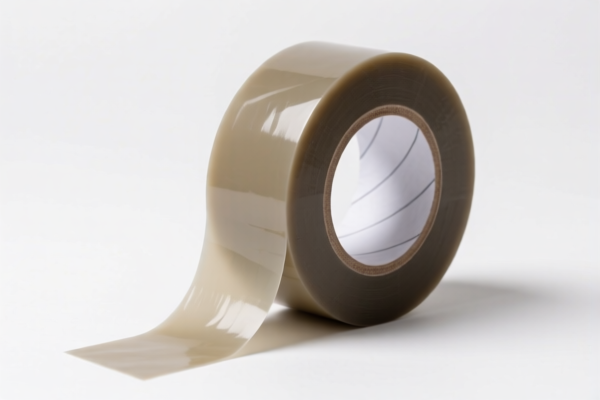

Product Classification: High Temperature Plastic Self Adhesive Tape

Based on the provided HS codes and descriptions, the most likely classifications for High Temperature Plastic Self Adhesive Tape are as follows:

✅ HS CODE: 3919905060

Description:

- Applicable to self-adhesive high-temperature plastic tape.

- Falls under HS Chapter 3919, which covers plastic self-adhesive products.

- Suitable for general-purpose self-adhesive plastic tapes, including high-temperature variants.

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3919102055

Description:

- Applicable to plastic self-adhesive tape with a width not exceeding 20 cm.

- This code is more specific than 3919905060 and may be more suitable if the tape width is under 20 cm.

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3919102040

Description:

- Also applicable to plastic self-adhesive tape, but with a more general description.

- May be used for standard self-adhesive plastic tapes, including high-temperature variants.

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ HS CODE: 4811411000

Description:

- Applicable to self-adhesive paper rolls with adhesive or bonding agents.

- Not ideal for plastic-based high-temperature tape, but may be used if the product is paper-based with adhesive.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

⚠️ HS CODE: 3919101050

Description:

- Applicable to self-adhesive reflective plastic tape.

- Specifically for reflective surfaces, which may not match the general high-temperature plastic tape unless it has reflective properties.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

📌 Recommendation & Proactive Advice:

- Verify Material Composition: Ensure the product is plastic-based and not paper-based (which would fall under 4811411000).

- Check Tape Width: If the tape width is under 20 cm, 3919102055 may be the most accurate classification.

- Confirm Reflective Features: If the tape has reflective properties, 3919101050 may apply.

- Check Unit Price & Certification: Some products may require certifications (e.g., fire resistance, safety standards) for customs clearance.

- Monitor Tariff Changes: The April 11, 2025 special tariff increase is time-sensitive and will affect all listed codes.

- Consider Anti-Dumping Duties: If the product contains iron or aluminum components, check for anti-dumping duties (not listed here, but may apply depending on origin).

📌 Final Note:

For customs compliance, it is highly recommended to consult a customs broker or use a HS code lookup tool with detailed product specifications (e.g., material, width, adhesive type, and intended use).

Product Classification: High Temperature Plastic Self Adhesive Tape

Based on the provided HS codes and descriptions, the most likely classifications for High Temperature Plastic Self Adhesive Tape are as follows:

✅ HS CODE: 3919905060

Description:

- Applicable to self-adhesive high-temperature plastic tape.

- Falls under HS Chapter 3919, which covers plastic self-adhesive products.

- Suitable for general-purpose self-adhesive plastic tapes, including high-temperature variants.

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3919102055

Description:

- Applicable to plastic self-adhesive tape with a width not exceeding 20 cm.

- This code is more specific than 3919905060 and may be more suitable if the tape width is under 20 cm.

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3919102040

Description:

- Also applicable to plastic self-adhesive tape, but with a more general description.

- May be used for standard self-adhesive plastic tapes, including high-temperature variants.

Tariff Summary:

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ HS CODE: 4811411000

Description:

- Applicable to self-adhesive paper rolls with adhesive or bonding agents.

- Not ideal for plastic-based high-temperature tape, but may be used if the product is paper-based with adhesive.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

⚠️ HS CODE: 3919101050

Description:

- Applicable to self-adhesive reflective plastic tape.

- Specifically for reflective surfaces, which may not match the general high-temperature plastic tape unless it has reflective properties.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

📌 Recommendation & Proactive Advice:

- Verify Material Composition: Ensure the product is plastic-based and not paper-based (which would fall under 4811411000).

- Check Tape Width: If the tape width is under 20 cm, 3919102055 may be the most accurate classification.

- Confirm Reflective Features: If the tape has reflective properties, 3919101050 may apply.

- Check Unit Price & Certification: Some products may require certifications (e.g., fire resistance, safety standards) for customs clearance.

- Monitor Tariff Changes: The April 11, 2025 special tariff increase is time-sensitive and will affect all listed codes.

- Consider Anti-Dumping Duties: If the product contains iron or aluminum components, check for anti-dumping duties (not listed here, but may apply depending on origin).

📌 Final Note:

For customs compliance, it is highly recommended to consult a customs broker or use a HS code lookup tool with detailed product specifications (e.g., material, width, adhesive type, and intended use).

Customer Reviews

No reviews yet.