| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5402116000 | Doc | 63.0% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

Product Classification and Customs Tariff Analysis for "High Temperature Resistant Grade Polyamide Raw Material"

Below is a structured breakdown of the HS codes and associated tariffs for the declared product, based on the provided data:

1. HS Code: 3908902000

Product Description:

- Primary form of polyamide (other polyamides), suitable for high-performance polyamide raw materials, engineering-grade polyamide, and injection molding-grade polyamide.

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is for general-purpose polyamide raw materials, not specifically for high-temperature resistant grades.

- Proactive Advice: Confirm if the product is indeed a general polyamide or a specialized high-temperature variant, as this may affect classification.

2. HS Code: 3908907000

Product Description:

- Primary form of polyamide (other polyamides), suitable for high-temperature resistant polyamide pellets.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is explicitly for high-temperature resistant polyamide, making it the most likely match for your product.

- Proactive Advice: Verify the material specifications and confirm that the product is indeed classified under this code.

3. HS Code: 3920920000

Product Description:

- Plastic sheets made of polyamide, suitable for high-temperature resistant polyamide sheets.

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code applies to finished plastic sheets, not raw materials.

- Proactive Advice: If your product is in raw form (not processed into sheets), this code is not applicable.

4. HS Code: 5402116000

Product Description:

- Nylon or other polyamides, multi-strand or rope, suitable for high-temperature resistant polyamide multi-strand yarn.

Tariff Breakdown:

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 63.0%

Key Notes:

- This code is for polyamide-based ropes or multi-strand yarns, not raw materials.

- Proactive Advice: If your product is in the form of yarn or rope, this code may apply, but it is not suitable for raw material classification.

5. HS Code: 3907995050

Product Description:

- Other polyesters, primary form, suitable for heat-resistant polyester resin raw materials.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for polyester, not polyamide.

- Proactive Advice: Ensure the product is not misclassified as polyester. Confirm the chemical composition and structure.

Summary of Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an increase in total tax rate by 5% (from 25% to 30% additional tariff).

- This is a time-sensitive policy change and must be accounted for in customs declarations and cost calculations.

Proactive Customs Compliance Advice:

- Verify Material Specifications: Confirm the exact chemical structure and application of the polyamide (e.g., is it a high-temperature resistant variant?).

- Check Required Certifications: Some high-performance materials may require specific technical documentation or certifications.

- Review HS Code Classification: Ensure the product is not misclassified as polyester or finished goods (e.g., sheets or ropes).

- Monitor Tariff Updates: Stay informed about the April 11, 2025, tariff adjustment to avoid unexpected costs.

Let me know if you need help with HS code selection or customs documentation.

Product Classification and Customs Tariff Analysis for "High Temperature Resistant Grade Polyamide Raw Material"

Below is a structured breakdown of the HS codes and associated tariffs for the declared product, based on the provided data:

1. HS Code: 3908902000

Product Description:

- Primary form of polyamide (other polyamides), suitable for high-performance polyamide raw materials, engineering-grade polyamide, and injection molding-grade polyamide.

Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is for general-purpose polyamide raw materials, not specifically for high-temperature resistant grades.

- Proactive Advice: Confirm if the product is indeed a general polyamide or a specialized high-temperature variant, as this may affect classification.

2. HS Code: 3908907000

Product Description:

- Primary form of polyamide (other polyamides), suitable for high-temperature resistant polyamide pellets.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is explicitly for high-temperature resistant polyamide, making it the most likely match for your product.

- Proactive Advice: Verify the material specifications and confirm that the product is indeed classified under this code.

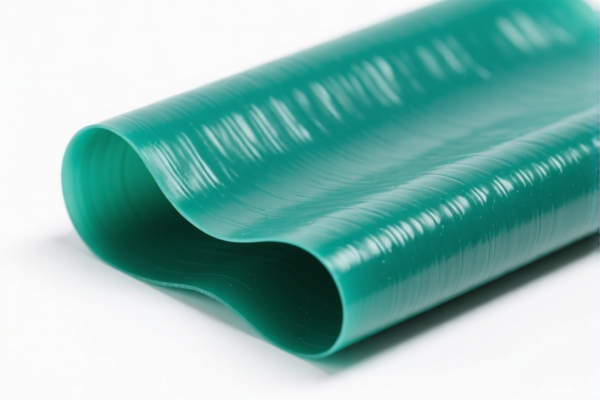

3. HS Code: 3920920000

Product Description:

- Plastic sheets made of polyamide, suitable for high-temperature resistant polyamide sheets.

Tariff Breakdown:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code applies to finished plastic sheets, not raw materials.

- Proactive Advice: If your product is in raw form (not processed into sheets), this code is not applicable.

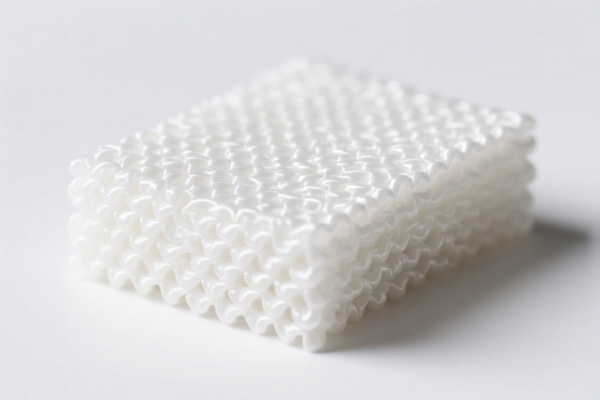

4. HS Code: 5402116000

Product Description:

- Nylon or other polyamides, multi-strand or rope, suitable for high-temperature resistant polyamide multi-strand yarn.

Tariff Breakdown:

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 63.0%

Key Notes:

- This code is for polyamide-based ropes or multi-strand yarns, not raw materials.

- Proactive Advice: If your product is in the form of yarn or rope, this code may apply, but it is not suitable for raw material classification.

5. HS Code: 3907995050

Product Description:

- Other polyesters, primary form, suitable for heat-resistant polyester resin raw materials.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for polyester, not polyamide.

- Proactive Advice: Ensure the product is not misclassified as polyester. Confirm the chemical composition and structure.

Summary of Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an increase in total tax rate by 5% (from 25% to 30% additional tariff).

- This is a time-sensitive policy change and must be accounted for in customs declarations and cost calculations.

Proactive Customs Compliance Advice:

- Verify Material Specifications: Confirm the exact chemical structure and application of the polyamide (e.g., is it a high-temperature resistant variant?).

- Check Required Certifications: Some high-performance materials may require specific technical documentation or certifications.

- Review HS Code Classification: Ensure the product is not misclassified as polyester or finished goods (e.g., sheets or ropes).

- Monitor Tariff Updates: Stay informed about the April 11, 2025, tariff adjustment to avoid unexpected costs.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.