| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5503110000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 5402459010 | Doc | 63.0% | CN | US | 2025-05-12 |

| 5402510000 | Doc | 63.8% | CN | US | 2025-05-12 |

Product Name: High Toughness Grade Polyamide Raw Material

Classification: Polyamide (Nylon) in primary form

✅ HS CODE: 3908902000

Description: Polyamide in primary form

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Changes:

- The additional tariff of 25.0% is currently in effect.

- Starting April 11, 2025, an extra 30.0% will be applied, increasing the total tax to 55.0%.

-

This is a time-sensitive policy, so ensure your customs clearance is completed before this date if possible.

-

Material Verification:

- Confirm that the product is in primary form (not processed or compounded) to ensure correct classification under HS 3908902000.

-

If the material is compounded or mixed with other substances, it may fall under a different HS code (e.g., 3908907000).

-

Certifications:

-

Check if any technical specifications or certifications (e.g., RoHS, REACH) are required for import into the destination country.

-

Alternative HS Codes:

- If the product is not in primary form, consider HS 3908907000 (other polyamide in primary form) or 5503110000 (synthetic short fibers made of polyamide) depending on the final product form.

📌 Proactive Advice:

- Verify the exact material composition and processing stage to ensure correct HS code classification.

- Check the unit price and total value of the goods, as this may affect the application of additional tariffs or duties.

- Consult with a customs broker or import/export specialist to ensure compliance with local regulations and avoid delays or penalties.

Let me know if you need help with HS code selection for a specific product description or packaging.

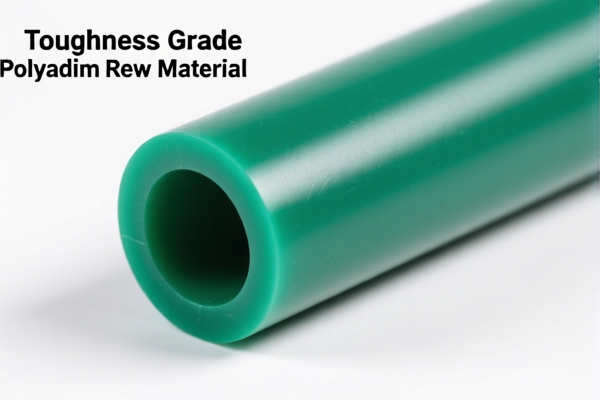

Product Name: High Toughness Grade Polyamide Raw Material

Classification: Polyamide (Nylon) in primary form

✅ HS CODE: 3908902000

Description: Polyamide in primary form

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Key Notes and Recommendations:

- Tariff Changes:

- The additional tariff of 25.0% is currently in effect.

- Starting April 11, 2025, an extra 30.0% will be applied, increasing the total tax to 55.0%.

-

This is a time-sensitive policy, so ensure your customs clearance is completed before this date if possible.

-

Material Verification:

- Confirm that the product is in primary form (not processed or compounded) to ensure correct classification under HS 3908902000.

-

If the material is compounded or mixed with other substances, it may fall under a different HS code (e.g., 3908907000).

-

Certifications:

-

Check if any technical specifications or certifications (e.g., RoHS, REACH) are required for import into the destination country.

-

Alternative HS Codes:

- If the product is not in primary form, consider HS 3908907000 (other polyamide in primary form) or 5503110000 (synthetic short fibers made of polyamide) depending on the final product form.

📌 Proactive Advice:

- Verify the exact material composition and processing stage to ensure correct HS code classification.

- Check the unit price and total value of the goods, as this may affect the application of additional tariffs or duties.

- Consult with a customs broker or import/export specialist to ensure compliance with local regulations and avoid delays or penalties.

Let me know if you need help with HS code selection for a specific product description or packaging.

Customer Reviews

No reviews yet.