| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907290000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

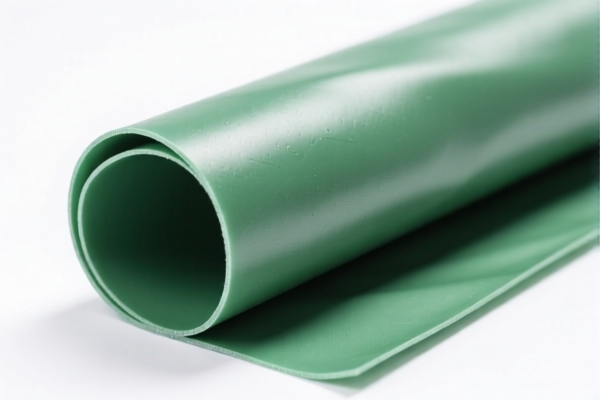

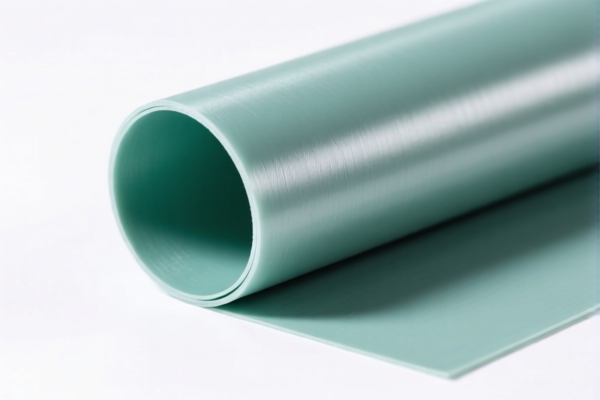

Product Name: High Weather Resistant Grade Polyamide Raw Material

Classification: Polyamide in primary form (HS Code: 3908.90.20.00)

✅ HS CODE: 3908902000

Description: Polyamide in primary form (including engineering grade and high-strength polyamide granules)

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be applied. This is a time-sensitive policy and may significantly increase the total import cost.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently listed for this product category.

- No Specific Tariffs on Iron/Aluminum: This product is a polymer, not a metal, so anti-dumping duties on iron and aluminum do not apply.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed in primary form (not compounded or processed) to qualify for this HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import.

- Monitor Tariff Updates: Keep an eye on April 11, 2025, as the additional tariff will increase the total tax rate by 5%.

- Consult Customs Broker: For complex cases, especially if the product is borderline between different HS codes, consult a customs broker or a classification expert.

📋 Other HS Codes for Reference:

- 3908907000 – Other polyamide in primary form (total tax: 61.5%)

- 3907290000 – Other polyether (total tax: 61.5%)

These codes may apply to similar but distinct materials, so double-check the exact product description before classification.

Product Name: High Weather Resistant Grade Polyamide Raw Material

Classification: Polyamide in primary form (HS Code: 3908.90.20.00)

✅ HS CODE: 3908902000

Description: Polyamide in primary form (including engineering grade and high-strength polyamide granules)

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

- April 11 Special Tariff: Starting from April 11, 2025, an additional 30.0% tariff will be applied. This is a time-sensitive policy and may significantly increase the total import cost.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently listed for this product category.

- No Specific Tariffs on Iron/Aluminum: This product is a polymer, not a metal, so anti-dumping duties on iron and aluminum do not apply.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed in primary form (not compounded or processed) to qualify for this HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import.

- Monitor Tariff Updates: Keep an eye on April 11, 2025, as the additional tariff will increase the total tax rate by 5%.

- Consult Customs Broker: For complex cases, especially if the product is borderline between different HS codes, consult a customs broker or a classification expert.

📋 Other HS Codes for Reference:

- 3908907000 – Other polyamide in primary form (total tax: 61.5%)

- 3907290000 – Other polyether (total tax: 61.5%)

These codes may apply to similar but distinct materials, so double-check the exact product description before classification.

Customer Reviews

No reviews yet.