| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112196050 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112196020 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5801100000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5802300020 | Doc | 61.2% | CN | US | 2025-05-12 |

| 5802300090 | Doc | 61.2% | CN | US | 2025-05-12 |

| 5806103020 | Doc | 58.8% | CN | US | 2025-05-12 |

| 5806391000 | Doc | 61.6% | CN | US | 2025-05-12 |

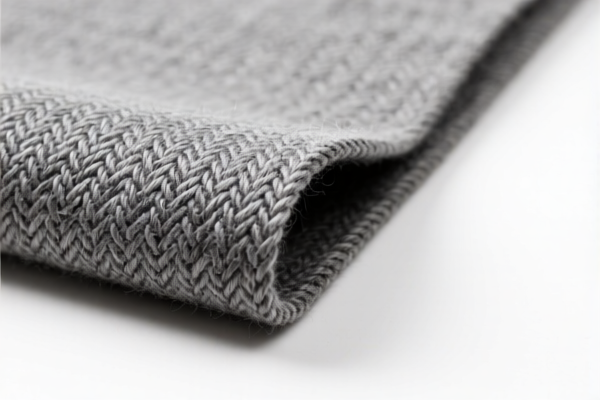

✅ Customs Classification and Tariff Analysis for High Count Combed Wool Woven Fabric

You have provided multiple HS codes and tariff details for various types of wool and fine animal hair woven fabrics. Based on your declared product — "High count combed wool woven fabric (more than 85% content, less than 18.5 microns, 270–340 g/m²)" — the most accurate HS code is:

✅ HS CODE: 5112196050

🔍 Product Description Match:

- Woven fabrics of combed wool or of combed fine animal hair

- Containing 85% or more by weight of wool or fine animal hair

- Other: Other

- Of wool yarns with an average fiber diameter of 18.5 microns or less

- Weighing more than 270 g/m² but not more than 340 g/m²

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes and Alerts:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost.

- No Anti-dumping duties are currently listed for this product category.

- No specific anti-dumping duties on iron/aluminum apply here, as this is a textile product.

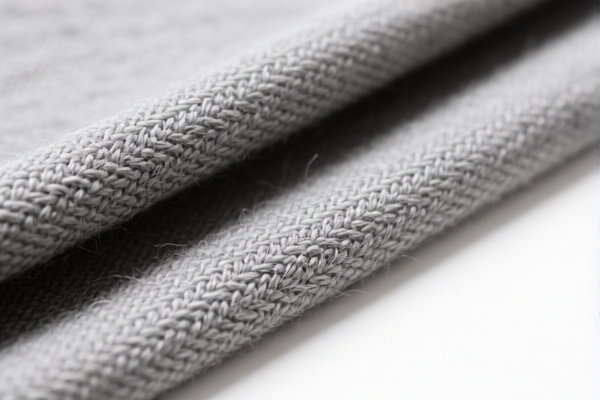

📌 Proactive Advice for Importers:

- Verify the exact composition of the fabric (e.g., wool percentage, fiber diameter, and whether it contains fine animal hair).

- Check the weight per square meter to ensure it falls within the 270–340 g/m² range.

- Confirm the HS code with customs or a classification expert, as small differences in description can lead to different classifications.

- Review required certifications (e.g., origin, fiber content, and compliance with textile regulations).

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

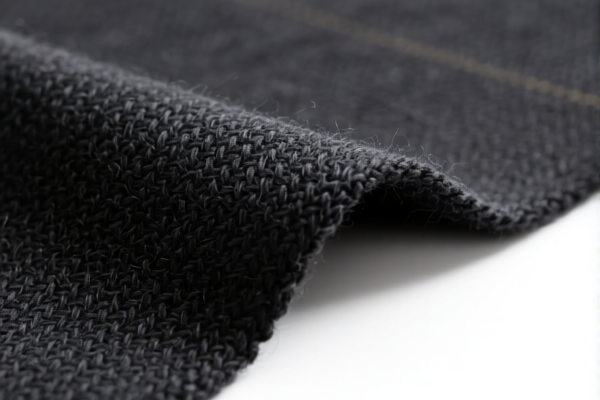

📌 Comparison with Other HS Codes (for reference):

| HS Code | Description | Total Tariff | Notes |

|---|---|---|---|

| 5112196020 | Similar to 5112196050, but contains fine animal hair | 80.0% | Same base and additional tariffs |

| 5801100000 | Woven pile fabrics (e.g., chenille) | 55.0% | Lower base tariff, but still subject to 2025.4.2 increase |

| 5802300020 | Tufted textile fabrics (e.g., terry) | 61.2% | Lower base, but still high total |

| 5802300090 | Tufted textile fabrics (other) | 61.2% | Same as above |

| 5806103020 | Narrow woven pile fabrics | 58.8% | Lower base, but still subject to 2025.4.2 increase |

| 5806391000 | Narrow woven fabrics (other) | 61.6% | Slightly higher than 5802300020 |

✅ Conclusion:

For your high-count combed wool woven fabric (85%+ wool, <18.5 microns, 270–340 g/m²), the correct HS code is 5112196050, with a total tariff of 80.0%, including a 30.0% additional tariff after April 11, 2025.

Make sure to double-check the product description and classification to avoid misclassification and unnecessary delays or penalties at customs.

✅ Customs Classification and Tariff Analysis for High Count Combed Wool Woven Fabric

You have provided multiple HS codes and tariff details for various types of wool and fine animal hair woven fabrics. Based on your declared product — "High count combed wool woven fabric (more than 85% content, less than 18.5 microns, 270–340 g/m²)" — the most accurate HS code is:

✅ HS CODE: 5112196050

🔍 Product Description Match:

- Woven fabrics of combed wool or of combed fine animal hair

- Containing 85% or more by weight of wool or fine animal hair

- Other: Other

- Of wool yarns with an average fiber diameter of 18.5 microns or less

- Weighing more than 270 g/m² but not more than 340 g/m²

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes and Alerts:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost.

- No Anti-dumping duties are currently listed for this product category.

- No specific anti-dumping duties on iron/aluminum apply here, as this is a textile product.

📌 Proactive Advice for Importers:

- Verify the exact composition of the fabric (e.g., wool percentage, fiber diameter, and whether it contains fine animal hair).

- Check the weight per square meter to ensure it falls within the 270–340 g/m² range.

- Confirm the HS code with customs or a classification expert, as small differences in description can lead to different classifications.

- Review required certifications (e.g., origin, fiber content, and compliance with textile regulations).

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

📌 Comparison with Other HS Codes (for reference):

| HS Code | Description | Total Tariff | Notes |

|---|---|---|---|

| 5112196020 | Similar to 5112196050, but contains fine animal hair | 80.0% | Same base and additional tariffs |

| 5801100000 | Woven pile fabrics (e.g., chenille) | 55.0% | Lower base tariff, but still subject to 2025.4.2 increase |

| 5802300020 | Tufted textile fabrics (e.g., terry) | 61.2% | Lower base, but still high total |

| 5802300090 | Tufted textile fabrics (other) | 61.2% | Same as above |

| 5806103020 | Narrow woven pile fabrics | 58.8% | Lower base, but still subject to 2025.4.2 increase |

| 5806391000 | Narrow woven fabrics (other) | 61.6% | Slightly higher than 5802300020 |

✅ Conclusion:

For your high-count combed wool woven fabric (85%+ wool, <18.5 microns, 270–340 g/m²), the correct HS code is 5112196050, with a total tariff of 80.0%, including a 30.0% additional tariff after April 11, 2025.

Make sure to double-check the product description and classification to avoid misclassification and unnecessary delays or penalties at customs.

Customer Reviews

No reviews yet.