| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112196050 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112196030 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111117030 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111117060 | Doc | 80.0% | CN | US | 2025-05-12 |

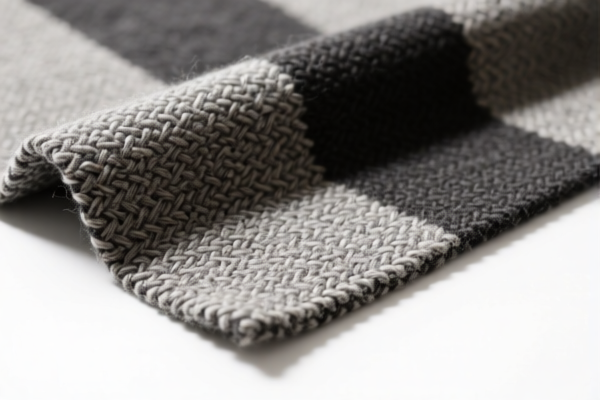

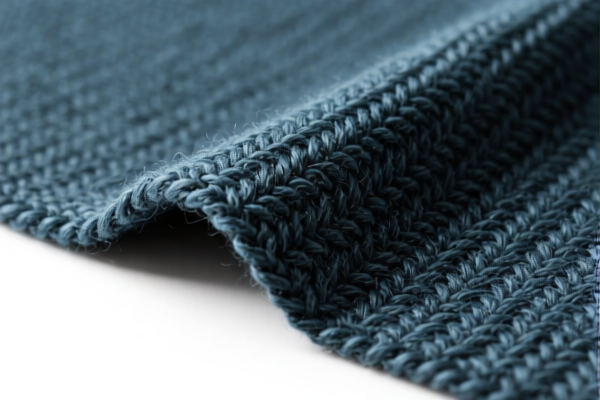

✅ Customs Classification and Tariff Analysis for High Count Wool Woven Fabric

Based on your provided product description and HS codes, here is a structured breakdown of the classification and applicable tariffs for high count wool woven fabric (containing 85% or more by weight, average fiber diameter ≤18.5 microns, weight 270–340 g/m²):

🔍 HS CODE: 5112196050

📌 Product Description:

- Woven fabrics of combed wool or combed fine animal hair

- Containing 85% or more by weight of wool or fine animal hair

- Other (not covered by more specific headings)

- Of wool yarns with an average fiber diameter of 18.5 microns or less

- Weighing more than 270 g/m² but not more than 340 g/m²

📊 Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently listed for this product category.

- No Special Tariffs on Iron/Aluminum: This product is not related to iron or aluminum, so no additional duties apply in that context.

📌 Proactive Advice:

- Verify Material Composition: Ensure the fabric contains 85% or more by weight of wool or fine animal hair, and that the average fiber diameter is ≤18.5 microns.

- Check Weight: Confirm the fabric weighs between 270 g/m² and 340 g/m² to qualify for this HS code.

- Documentation: Maintain certifications or test reports confirming the fiber content and weight, as customs may request this for verification.

- Plan for Tariff Changes: If importing after April 11, 2025, be prepared for a 30% increase in the additional tariff.

📌 Summary Table:

| Description | HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tariff |

|---|---|---|---|---|---|

| Woven fabric of combed wool, 85%+ wool, ≤18.5 microns, 270–340 g/m² | 5112196050 | 25.0% | 25.0% | 30.0% | 80.0% |

If you have further details about the origin of the fabric or specific country of import, I can provide more tailored guidance on preferential tariffs or free trade agreements.

✅ Customs Classification and Tariff Analysis for High Count Wool Woven Fabric

Based on your provided product description and HS codes, here is a structured breakdown of the classification and applicable tariffs for high count wool woven fabric (containing 85% or more by weight, average fiber diameter ≤18.5 microns, weight 270–340 g/m²):

🔍 HS CODE: 5112196050

📌 Product Description:

- Woven fabrics of combed wool or combed fine animal hair

- Containing 85% or more by weight of wool or fine animal hair

- Other (not covered by more specific headings)

- Of wool yarns with an average fiber diameter of 18.5 microns or less

- Weighing more than 270 g/m² but not more than 340 g/m²

📊 Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- No Anti-Dumping Duties: No specific anti-dumping duties are currently listed for this product category.

- No Special Tariffs on Iron/Aluminum: This product is not related to iron or aluminum, so no additional duties apply in that context.

📌 Proactive Advice:

- Verify Material Composition: Ensure the fabric contains 85% or more by weight of wool or fine animal hair, and that the average fiber diameter is ≤18.5 microns.

- Check Weight: Confirm the fabric weighs between 270 g/m² and 340 g/m² to qualify for this HS code.

- Documentation: Maintain certifications or test reports confirming the fiber content and weight, as customs may request this for verification.

- Plan for Tariff Changes: If importing after April 11, 2025, be prepared for a 30% increase in the additional tariff.

📌 Summary Table:

| Description | HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tariff |

|---|---|---|---|---|---|

| Woven fabric of combed wool, 85%+ wool, ≤18.5 microns, 270–340 g/m² | 5112196050 | 25.0% | 25.0% | 30.0% | 80.0% |

If you have further details about the origin of the fabric or specific country of import, I can provide more tailored guidance on preferential tariffs or free trade agreements.

Customer Reviews

No reviews yet.