| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

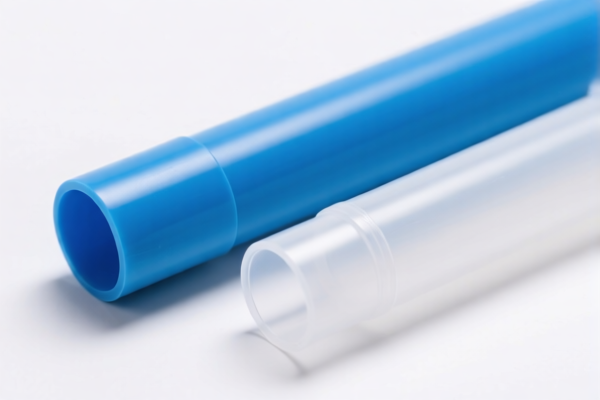

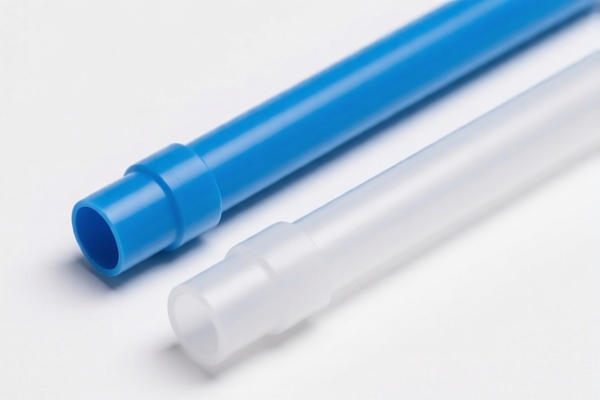

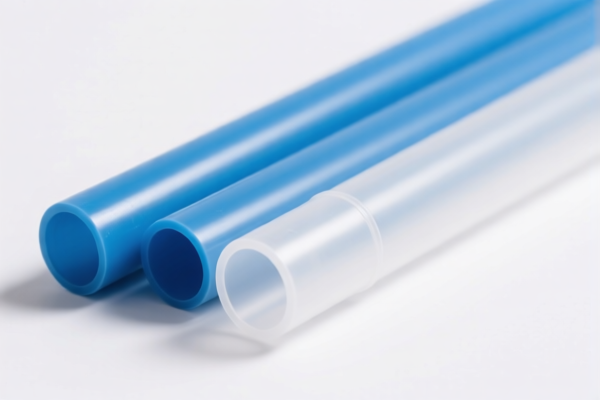

Product Classification: High Pressure Plastic Tubes

HS CODE: 3917.31.00.00 and 3917.32.00.50 (both fall under the same classification for "Other plastic tubes and pipe fittings, not reinforced, not combined with other materials, without fittings")

Tariff Overview (as of current data):

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 2, 2025): 30.0%

- Total Tax Rate: 58.1% (3.1% + 25.0% + 30.0%)

Key Notes on Tariff Changes:

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on imports after April 2, 2025. This is a time-sensitive policy and must be accounted for in cost calculations and customs declarations. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for this product category (plastic tubes) in the provided data.

Proactive Advice for Importers:

-

Verify Material Composition:

Ensure the plastic tubes are not reinforced or combined with other materials (e.g., metal, fiber), as this could change the HS code classification. -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or industry-specific standards) are required for import compliance. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 2, 2025, as this could significantly impact the total import cost. -

Consult Customs Broker or Trade Compliance Specialist:

For complex or high-value shipments, it is advisable to seek professional assistance to ensure accurate classification and compliance.

Summary Table:

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tax Rate |

|---|---|---|---|---|---|

| 3917.31.00.00 | Other plastic tubes, not reinforced, no fittings | 3.1% | 25.0% | 30.0% | 58.1% |

| 3917.32.00.50 | Other plastic tubes, not reinforced, no fittings | 3.1% | 25.0% | 30.0% | 58.1% |

Let me know if you need help with customs documentation or further classification details.

Product Classification: High Pressure Plastic Tubes

HS CODE: 3917.31.00.00 and 3917.32.00.50 (both fall under the same classification for "Other plastic tubes and pipe fittings, not reinforced, not combined with other materials, without fittings")

Tariff Overview (as of current data):

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 2, 2025): 30.0%

- Total Tax Rate: 58.1% (3.1% + 25.0% + 30.0%)

Key Notes on Tariff Changes:

-

April 2, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on imports after April 2, 2025. This is a time-sensitive policy and must be accounted for in cost calculations and customs declarations. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for this product category (plastic tubes) in the provided data.

Proactive Advice for Importers:

-

Verify Material Composition:

Ensure the plastic tubes are not reinforced or combined with other materials (e.g., metal, fiber), as this could change the HS code classification. -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or industry-specific standards) are required for import compliance. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 2, 2025, as this could significantly impact the total import cost. -

Consult Customs Broker or Trade Compliance Specialist:

For complex or high-value shipments, it is advisable to seek professional assistance to ensure accurate classification and compliance.

Summary Table:

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tax Rate |

|---|---|---|---|---|---|

| 3917.31.00.00 | Other plastic tubes, not reinforced, no fittings | 3.1% | 25.0% | 30.0% | 58.1% |

| 3917.32.00.50 | Other plastic tubes, not reinforced, no fittings | 3.1% | 25.0% | 30.0% | 58.1% |

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.