Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5702921000 | Doc | 57.7% | CN | US | 2025-05-12 |

| 5702505900 | Doc | 57.7% | CN | US | 2025-05-12 |

| 4601298000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5702109030 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5703392030 | Doc | 61.0% | CN | US | 2025-05-12 |

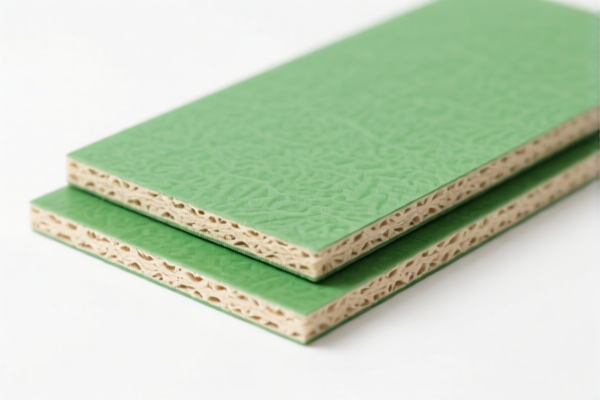

Here is the structured classification and tariff information for Indoor Vegetable Fiber Woven Rugs, based on the provided HS codes and tax details:

📦 Product Classification Overview: Indoor Vegetable Fiber Woven Rugs

✅ HS CODE: 5702921000

- Description: Woven carpets, not tufted or flocked, made of man-made textile materials.

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to synthetic fiber woven rugs, not vegetable fiber.

✅ HS CODE: 5702505900

- Description: Woven carpets, not tufted or flocked, made of other textile materials.

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to natural or other textile materials, but not vegetable fiber.

✅ HS CODE: 4601298000

- Description: Mats, mats, and screens made of vegetable materials, other.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for vegetable fiber products like mats or screens, not carpets.

- Important: This may not be the correct classification for woven rugs.

✅ HS CODE: 5702109030

- Description: Carpets made of man-made fibers.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to synthetic fiber carpets, not vegetable fiber.

✅ HS CODE: 5703392030

- Description: Tufted carpets made of other man-made textile materials, with area ≤ 5.25 m².

- Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to tufted carpets, not woven and not vegetable fiber.

📌 Proactive Advice for Importers

- Verify Material: Ensure the rug is made of vegetable fiber (e.g., jute, hemp, bamboo) and is woven, not tufted or flocked.

- Check Unit Price: Tariff rates may vary based on the value of the product, especially if it falls under preferential trade agreements.

- Certifications: Confirm if any certifications (e.g., organic, eco-friendly) are required for import or tax exemptions.

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date. Plan your import schedule accordingly.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is borderline between categories.

📌 Summary of Key Tax Rate Changes

| HS Code | Base Tariff | Additional Tariff | Special Tariff (after April 11, 2025) | Total Tax |

|---|---|---|---|---|

| 5702921000 | 2.7% | 25.0% | 30.0% | 57.7% |

| 5702505900 | 2.7% | 25.0% | 30.0% | 57.7% |

| 4601298000 | 0.0% | 25.0% | 30.0% | 55.0% |

| 5702109030 | 0.0% | 25.0% | 30.0% | 55.0% |

| 5703392030 | 6.0% | 25.0% | 30.0% | 61.0% |

If you provide more details about the material composition and construction method of the rug, I can help you determine the most accurate HS code. Here is the structured classification and tariff information for Indoor Vegetable Fiber Woven Rugs, based on the provided HS codes and tax details:

📦 Product Classification Overview: Indoor Vegetable Fiber Woven Rugs

✅ HS CODE: 5702921000

- Description: Woven carpets, not tufted or flocked, made of man-made textile materials.

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to synthetic fiber woven rugs, not vegetable fiber.

✅ HS CODE: 5702505900

- Description: Woven carpets, not tufted or flocked, made of other textile materials.

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to natural or other textile materials, but not vegetable fiber.

✅ HS CODE: 4601298000

- Description: Mats, mats, and screens made of vegetable materials, other.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for vegetable fiber products like mats or screens, not carpets.

- Important: This may not be the correct classification for woven rugs.

✅ HS CODE: 5702109030

- Description: Carpets made of man-made fibers.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to synthetic fiber carpets, not vegetable fiber.

✅ HS CODE: 5703392030

- Description: Tufted carpets made of other man-made textile materials, with area ≤ 5.25 m².

- Total Tax Rate: 61.0%

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to tufted carpets, not woven and not vegetable fiber.

📌 Proactive Advice for Importers

- Verify Material: Ensure the rug is made of vegetable fiber (e.g., jute, hemp, bamboo) and is woven, not tufted or flocked.

- Check Unit Price: Tariff rates may vary based on the value of the product, especially if it falls under preferential trade agreements.

- Certifications: Confirm if any certifications (e.g., organic, eco-friendly) are required for import or tax exemptions.

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date. Plan your import schedule accordingly.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is borderline between categories.

📌 Summary of Key Tax Rate Changes

| HS Code | Base Tariff | Additional Tariff | Special Tariff (after April 11, 2025) | Total Tax |

|---|---|---|---|---|

| 5702921000 | 2.7% | 25.0% | 30.0% | 57.7% |

| 5702505900 | 2.7% | 25.0% | 30.0% | 57.7% |

| 4601298000 | 0.0% | 25.0% | 30.0% | 55.0% |

| 5702109030 | 0.0% | 25.0% | 30.0% | 55.0% |

| 5703392030 | 6.0% | 25.0% | 30.0% | 61.0% |

If you provide more details about the material composition and construction method of the rug, I can help you determine the most accurate HS code.

Customer Reviews

No reviews yet.