| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4807009400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4807009200 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 4805922000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7211140045 | Doc | 30.0% | CN | US | 2025-05-12 |

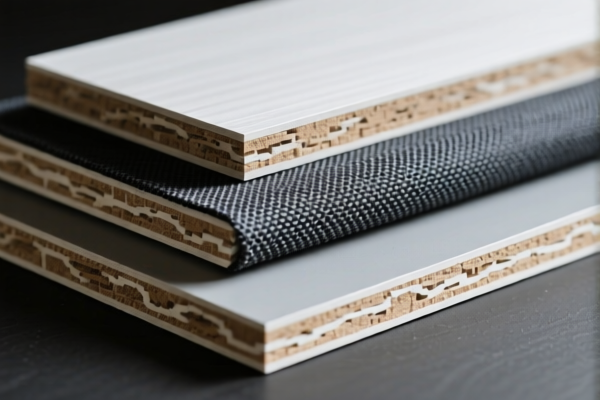

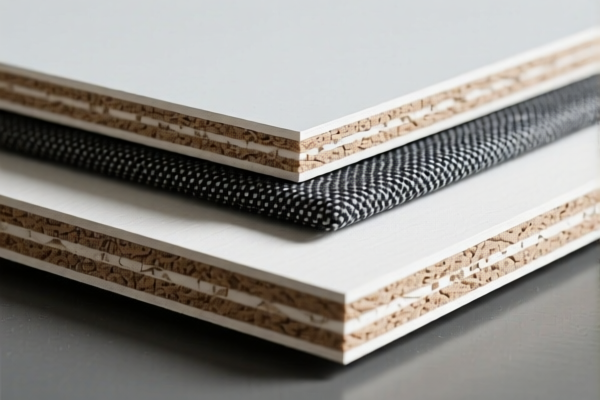

Product Classification and Customs Tariff Analysis for "Industrial Composite Boards"

Below is a detailed breakdown of the HS codes and associated tariffs for the declared product "Industrial Composite Boards," based on the provided data:

✅ HS CODE: 4807009400

Description: Industrial composite paperboard, made by bonding flat paper or paperboard together with adhesives, not surface-coated or impregnated, may be internally reinforced, in rolls or sheets.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code applies to composite paperboard with internal reinforcement.

- Ensure the product is not surface-coated or impregnated.

- Verify if the product is in rolls or sheets.

✅ HS CODE: 4807009200

Description: Industrial composite paperboard, composite paper and paperboard not surface-coated or impregnated, in rolls or sheets.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code is for composite paperboard without internal reinforcement.

- Confirm the product is not surface-coated or impregnated.

- Ensure it is in rolls or sheets.

✅ HS CODE: 3921904010

Description: Industrial paper-plastic composite boards, flexible plastic sheets, films, foils, and strips reinforced with paper.

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code applies to paper-reinforced flexible plastic boards.

- Confirm the product is not rigid or in a different form.

- Be aware of the 30% additional tariff after April 11, 2025.

✅ HS CODE: 4805922000

Description: Industrial paperboard, paperboard products, weight may be between 150–225g/m², not specially treated.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code is for standard industrial paperboard without special treatment.

- Confirm the weight range and that it is not coated or laminated.

✅ HS CODE: 7211140045

Description: Industrial steel plates, width less than 600 mm, not coated, plated, or coated, not further processed, hot-rolled flat-rolled iron or non-alloy steel products, thickness of 4.75 mm or more, non-rolled products.

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 30.0%

- Notes:

- This code applies to steel plates, not related to composite boards.

- Ensure the product is not a composite or laminated steel product.

- Be aware of the 30% additional tariff after April 11, 2025.

📌 Proactive Advice for Users:

- Verify Material Composition: Confirm whether the product is paper-based, plastic-reinforced, or steel-based, as this will determine the correct HS code.

- Check Surface Treatment: Ensure the product is not coated, impregnated, or laminated, as this may change the classification.

- Confirm Physical Form: Check if the product is in rolls, sheets, or other forms, as this can affect the HS code.

- Review Tariff Changes: Be aware of the 30% additional tariff after April 11, 2025, which applies to several of the listed codes.

- Certifications Required: Some products may require specific certifications (e.g., environmental, safety, or quality standards) for customs clearance.

If you have more details about the product (e.g., exact composition, weight, form, and intended use), I can help you further narrow down the correct HS code and tax implications. Product Classification and Customs Tariff Analysis for "Industrial Composite Boards"

Below is a detailed breakdown of the HS codes and associated tariffs for the declared product "Industrial Composite Boards," based on the provided data:

✅ HS CODE: 4807009400

Description: Industrial composite paperboard, made by bonding flat paper or paperboard together with adhesives, not surface-coated or impregnated, may be internally reinforced, in rolls or sheets.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code applies to composite paperboard with internal reinforcement.

- Ensure the product is not surface-coated or impregnated.

- Verify if the product is in rolls or sheets.

✅ HS CODE: 4807009200

Description: Industrial composite paperboard, composite paper and paperboard not surface-coated or impregnated, in rolls or sheets.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code is for composite paperboard without internal reinforcement.

- Confirm the product is not surface-coated or impregnated.

- Ensure it is in rolls or sheets.

✅ HS CODE: 3921904010

Description: Industrial paper-plastic composite boards, flexible plastic sheets, films, foils, and strips reinforced with paper.

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Notes:

- This code applies to paper-reinforced flexible plastic boards.

- Confirm the product is not rigid or in a different form.

- Be aware of the 30% additional tariff after April 11, 2025.

✅ HS CODE: 4805922000

Description: Industrial paperboard, paperboard products, weight may be between 150–225g/m², not specially treated.

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes:

- This code is for standard industrial paperboard without special treatment.

- Confirm the weight range and that it is not coated or laminated.

✅ HS CODE: 7211140045

Description: Industrial steel plates, width less than 600 mm, not coated, plated, or coated, not further processed, hot-rolled flat-rolled iron or non-alloy steel products, thickness of 4.75 mm or more, non-rolled products.

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 30.0%

- Notes:

- This code applies to steel plates, not related to composite boards.

- Ensure the product is not a composite or laminated steel product.

- Be aware of the 30% additional tariff after April 11, 2025.

📌 Proactive Advice for Users:

- Verify Material Composition: Confirm whether the product is paper-based, plastic-reinforced, or steel-based, as this will determine the correct HS code.

- Check Surface Treatment: Ensure the product is not coated, impregnated, or laminated, as this may change the classification.

- Confirm Physical Form: Check if the product is in rolls, sheets, or other forms, as this can affect the HS code.

- Review Tariff Changes: Be aware of the 30% additional tariff after April 11, 2025, which applies to several of the listed codes.

- Certifications Required: Some products may require specific certifications (e.g., environmental, safety, or quality standards) for customs clearance.

If you have more details about the product (e.g., exact composition, weight, form, and intended use), I can help you further narrow down the correct HS code and tax implications.

Customer Reviews

No reviews yet.