| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926905900 | Doc | 57.4% | CN | US | 2025-05-12 |

| 4010355000 | Doc | 56.9% | CN | US | 2025-05-12 |

| 4010364500 | Doc | 61.4% | CN | US | 2025-05-12 |

| 5910009000 | Doc | 57.6% | CN | US | 2025-05-12 |

| 5910001030 | Doc | 59.0% | CN | US | 2025-05-12 |

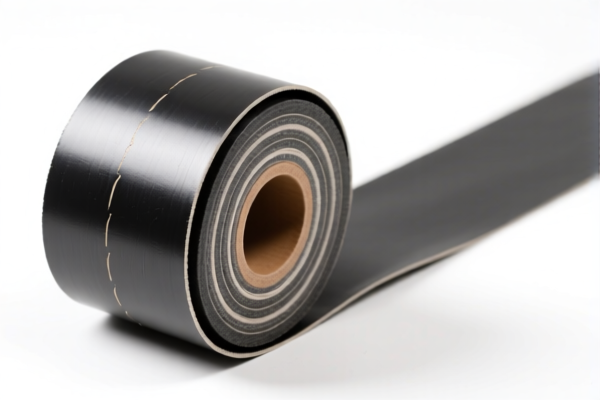

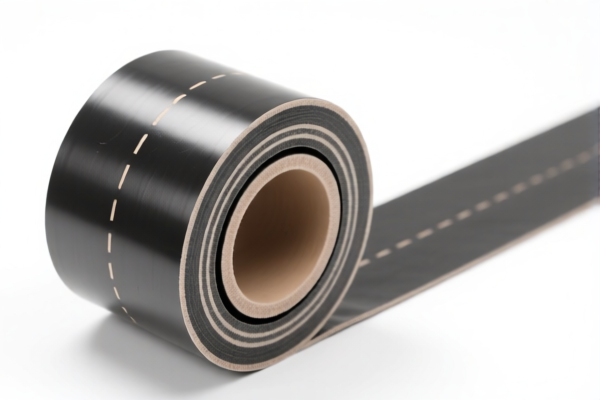

Here is the structured analysis and customs compliance guidance for Industrial Grade Conveyor Belting, based on the provided HS codes and tax details:

🔍 HS Code Classification Overview

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11, 2025 Special Tariff |

|---|---|---|---|---|---|

| 3926905900 | Conveyor belts and bands for machinery, containing textile fibers, other | 57.4% | 2.4% | 25.0% | 30.0% |

| 4010355000 | Vulcanized rubber conveyor belts or timing belts, with textile materials | 56.9% | 1.9% | 25.0% | 30.0% |

| 4010364500 | Vulcanized rubber conveyor belts or timing belts, other | 61.4% | 6.4% | 25.0% | 30.0% |

| 5910009000 | Conveyor belts or bands made of textile materials, possibly treated or reinforced | 57.6% | 2.6% | 25.0% | 30.0% |

| 5910001030 | Conveyor belts or bands made of man-made fibers, other | 59.0% | 4.0% | 25.0% | 30.0% |

📌 Key Tax Rate Observations

- Base Tariff Rates vary significantly:

- Lowest: 1.9% (4010355000)

-

Highest: 6.4% (4010364500)

-

Additional Tariff is uniform at 25.0% across all classifications.

-

April 11, 2025 Special Tariff is 30.0% for all, effective after April 11, 2025.

-

Total Tax Rates range from 56.9% to 61.4%, depending on the base rate and material composition.

⚠️ Time-Sensitive Policy Alert

- Additional tariffs of 30.0% will apply after April 11, 2025. Ensure your import timeline accounts for this to avoid unexpected costs.

📦 Proactive Compliance Advice

-

Verify Material Composition: Confirm whether the conveyor belt is made of rubber, textile, or synthetic fibers, as this determines the correct HS code.

-

Check Unit Price and Certification: Some classifications may require specific certifications (e.g., fire resistance, durability, or safety standards).

-

Review Tariff Preference Programs: If applicable, check if your product qualifies for preferential tariff rates under free trade agreements (e.g., RCEP, CPTPP).

-

Consult with Customs Broker: For complex or high-value shipments, seek professional assistance to ensure accurate classification and compliance.

📌 Summary of Actions Required

- Confirm the material type (rubber, textile, synthetic fiber) and construction (e.g., vulcanized, reinforced).

- Ensure product description aligns with the HS code summary.

- Plan for tariff increases after April 11, 2025.

- Maintain certifications and documentation for customs clearance.

Let me know if you need help selecting the most appropriate HS code for your specific conveyor belt product. Here is the structured analysis and customs compliance guidance for Industrial Grade Conveyor Belting, based on the provided HS codes and tax details:

🔍 HS Code Classification Overview

| HS Code | Description | Total Tax Rate | Base Tariff | Additional Tariff | April 11, 2025 Special Tariff |

|---|---|---|---|---|---|

| 3926905900 | Conveyor belts and bands for machinery, containing textile fibers, other | 57.4% | 2.4% | 25.0% | 30.0% |

| 4010355000 | Vulcanized rubber conveyor belts or timing belts, with textile materials | 56.9% | 1.9% | 25.0% | 30.0% |

| 4010364500 | Vulcanized rubber conveyor belts or timing belts, other | 61.4% | 6.4% | 25.0% | 30.0% |

| 5910009000 | Conveyor belts or bands made of textile materials, possibly treated or reinforced | 57.6% | 2.6% | 25.0% | 30.0% |

| 5910001030 | Conveyor belts or bands made of man-made fibers, other | 59.0% | 4.0% | 25.0% | 30.0% |

📌 Key Tax Rate Observations

- Base Tariff Rates vary significantly:

- Lowest: 1.9% (4010355000)

-

Highest: 6.4% (4010364500)

-

Additional Tariff is uniform at 25.0% across all classifications.

-

April 11, 2025 Special Tariff is 30.0% for all, effective after April 11, 2025.

-

Total Tax Rates range from 56.9% to 61.4%, depending on the base rate and material composition.

⚠️ Time-Sensitive Policy Alert

- Additional tariffs of 30.0% will apply after April 11, 2025. Ensure your import timeline accounts for this to avoid unexpected costs.

📦 Proactive Compliance Advice

-

Verify Material Composition: Confirm whether the conveyor belt is made of rubber, textile, or synthetic fibers, as this determines the correct HS code.

-

Check Unit Price and Certification: Some classifications may require specific certifications (e.g., fire resistance, durability, or safety standards).

-

Review Tariff Preference Programs: If applicable, check if your product qualifies for preferential tariff rates under free trade agreements (e.g., RCEP, CPTPP).

-

Consult with Customs Broker: For complex or high-value shipments, seek professional assistance to ensure accurate classification and compliance.

📌 Summary of Actions Required

- Confirm the material type (rubber, textile, synthetic fiber) and construction (e.g., vulcanized, reinforced).

- Ensure product description aligns with the HS code summary.

- Plan for tariff increases after April 11, 2025.

- Maintain certifications and documentation for customs clearance.

Let me know if you need help selecting the most appropriate HS code for your specific conveyor belt product.

Customer Reviews

No reviews yet.