Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907914000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907915000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907914000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907915000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907915000 | Doc | 61.5% | CN | US | 2025-05-12 |

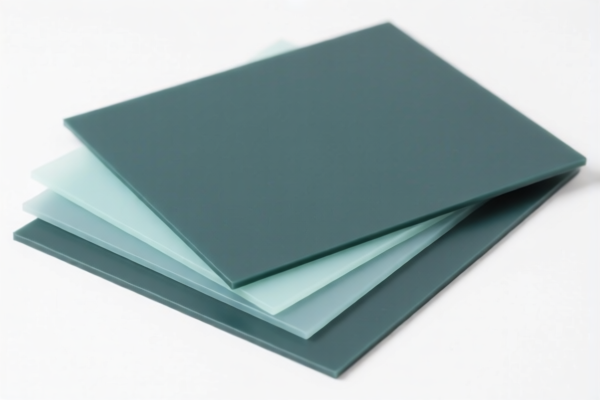

Product Classification: Industrial Grade Other Unsaturated Polyester Resins

HS CODEs and Tax Details:

- HS CODE: 3907914000

- Product Description: Unsaturated polyester resin products

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to general unsaturated polyester resin products, including those with specific properties like weather resistance.

-

HS CODE: 3907915000

- Product Description: Unsaturated polyester resin semi-finished products, hand-laid grade resins, or unsaturated polyester resin composite boards

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code includes semi-finished products and composite boards, which may be subject to stricter customs scrutiny due to their potential for further processing.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All products under these HS codes will face an additional 30.0% tariff, increasing the total tax rate by 5.0% compared to the current 25.0% additional tariff.

- This change is time-sensitive and will affect import costs significantly after April 11, 2025.

📌 Additional Considerations:

- Anti-dumping duties: Not currently applicable for unsaturated polyester resins, but always verify with the latest customs updates.

- Material Verification: Confirm the exact chemical composition and intended use of the resin (e.g., whether it is for hand-laid applications or composite boards) to ensure correct HS code classification.

- Certifications: Some products may require technical documentation or certifications (e.g., safety, environmental compliance) for customs clearance.

- Unit Price: Be aware that higher tax rates may impact the final cost, especially for bulk imports.

✅ Proactive Advice:

- Double-check the product description to ensure it aligns with the correct HS code (e.g., whether it's a finished product or semi-finished).

- Review the import date to determine if the April 11, 2025, tariff applies.

-

Consult with customs brokers or legal advisors for complex or high-value shipments to avoid delays or penalties. Product Classification: Industrial Grade Other Unsaturated Polyester Resins

HS CODEs and Tax Details: -

HS CODE: 3907914000

- Product Description: Unsaturated polyester resin products

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to general unsaturated polyester resin products, including those with specific properties like weather resistance.

-

HS CODE: 3907915000

- Product Description: Unsaturated polyester resin semi-finished products, hand-laid grade resins, or unsaturated polyester resin composite boards

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code includes semi-finished products and composite boards, which may be subject to stricter customs scrutiny due to their potential for further processing.

📌 Key Tax Rate Changes (April 11, 2025 onwards):

- All products under these HS codes will face an additional 30.0% tariff, increasing the total tax rate by 5.0% compared to the current 25.0% additional tariff.

- This change is time-sensitive and will affect import costs significantly after April 11, 2025.

📌 Additional Considerations:

- Anti-dumping duties: Not currently applicable for unsaturated polyester resins, but always verify with the latest customs updates.

- Material Verification: Confirm the exact chemical composition and intended use of the resin (e.g., whether it is for hand-laid applications or composite boards) to ensure correct HS code classification.

- Certifications: Some products may require technical documentation or certifications (e.g., safety, environmental compliance) for customs clearance.

- Unit Price: Be aware that higher tax rates may impact the final cost, especially for bulk imports.

✅ Proactive Advice:

- Double-check the product description to ensure it aligns with the correct HS code (e.g., whether it's a finished product or semi-finished).

- Review the import date to determine if the April 11, 2025, tariff applies.

- Consult with customs brokers or legal advisors for complex or high-value shipments to avoid delays or penalties.

Customer Reviews

No reviews yet.