| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3915900090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4811512020 | Doc | 55.0% | CN | US | 2025-05-12 |

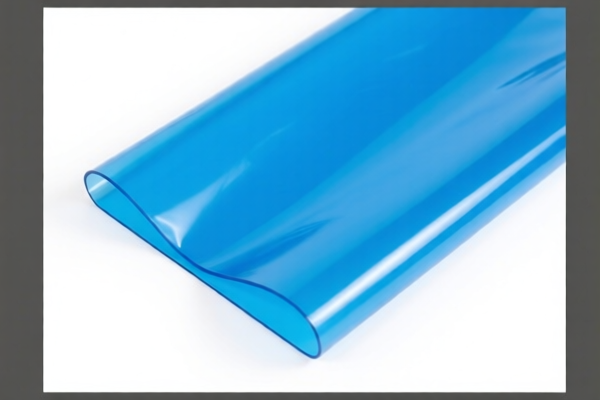

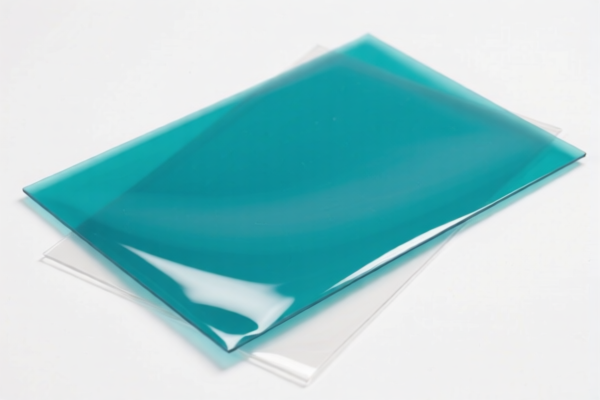

Product Name: Industrial Grade PET Plastic Sheet

Classification: Plastic sheets, films, foils, and strips, made of polyethylene terephthalate (PET), not elsewhere specified.

✅ HS CODE: 3921905050

Description: Other plastic sheets, films, foils, and strips (not combined with other materials or textile materials, or not meeting the weight criteria of 1.492 kg/m²).

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8% (before April 11, 2025)

- Total Tax Rate after April 11, 2025: 59.8% (4.8% + 25% + 30%)

⚠️ Important Notes:

- April 11 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- No Anti-dumping duties: No specific anti-dumping duties are currently listed for this product category.

- No specific restrictions on iron/aluminum: This product is not subject to anti-dumping duties on iron or aluminum.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is pure PET and not combined with other materials (e.g., textiles or paper), as this could change the HS code.

- Check Weight and Thickness: If the product is combined with textiles or paper, ensure it does not meet the 1.492 kg/m² threshold, which would move it to a different HS code (e.g., 3921902900 or 3921902550).

- Confirm Unit Price and Certification: Some countries may require specific certifications (e.g., RoHS, REACH) for imported plastics.

- Monitor Tariff Updates: Keep an eye on the April 11, 2025 deadline for the special tariff increase.

📊 Comparison with Other HS Codes:

| HS Code | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3921902900 | Combined with textiles, >1.492 kg/m² | 59.4% | Higher tax |

| 3921902550 | Combined with textiles, >1.492 kg/m², synthetic fiber > other fibers | 61.5% | Highest tax |

| 3921905050 | Other plastic sheets (not combined) | 34.8% (before 2025.4.2) | Recommended code |

| 3915900090 | PET plastic waste | 55.0% | Not applicable for industrial grade sheets |

| 4811512020 | Paper coated with plastic, >150 g/m² | 55.0% | Not applicable for pure PET sheets |

If you have more details about the product (e.g., thickness, combined materials, end use), I can help refine the classification further.

Product Name: Industrial Grade PET Plastic Sheet

Classification: Plastic sheets, films, foils, and strips, made of polyethylene terephthalate (PET), not elsewhere specified.

✅ HS CODE: 3921905050

Description: Other plastic sheets, films, foils, and strips (not combined with other materials or textile materials, or not meeting the weight criteria of 1.492 kg/m²).

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8% (before April 11, 2025)

- Total Tax Rate after April 11, 2025: 59.8% (4.8% + 25% + 30%)

⚠️ Important Notes:

- April 11 Special Tariff: A 30% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- No Anti-dumping duties: No specific anti-dumping duties are currently listed for this product category.

- No specific restrictions on iron/aluminum: This product is not subject to anti-dumping duties on iron or aluminum.

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is pure PET and not combined with other materials (e.g., textiles or paper), as this could change the HS code.

- Check Weight and Thickness: If the product is combined with textiles or paper, ensure it does not meet the 1.492 kg/m² threshold, which would move it to a different HS code (e.g., 3921902900 or 3921902550).

- Confirm Unit Price and Certification: Some countries may require specific certifications (e.g., RoHS, REACH) for imported plastics.

- Monitor Tariff Updates: Keep an eye on the April 11, 2025 deadline for the special tariff increase.

📊 Comparison with Other HS Codes:

| HS Code | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3921902900 | Combined with textiles, >1.492 kg/m² | 59.4% | Higher tax |

| 3921902550 | Combined with textiles, >1.492 kg/m², synthetic fiber > other fibers | 61.5% | Highest tax |

| 3921905050 | Other plastic sheets (not combined) | 34.8% (before 2025.4.2) | Recommended code |

| 3915900090 | PET plastic waste | 55.0% | Not applicable for industrial grade sheets |

| 4811512020 | Paper coated with plastic, >150 g/m² | 55.0% | Not applicable for pure PET sheets |

If you have more details about the product (e.g., thickness, combined materials, end use), I can help refine the classification further.

Customer Reviews

No reviews yet.