| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3909400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3824821000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3824999330 | Doc | 60.0% | CN | US | 2025-05-12 |

Product Classification: Industrial Grade Phenolic Resin

HS CODEs and Tax Information Summary:

✅ HS CODE: 3909400000

Description: Industrial grade phenolic resin, building grade phenolic resin. This HS code includes amino resins, phenolic resins, and polyurethanes in primary form, including phenolic resins.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

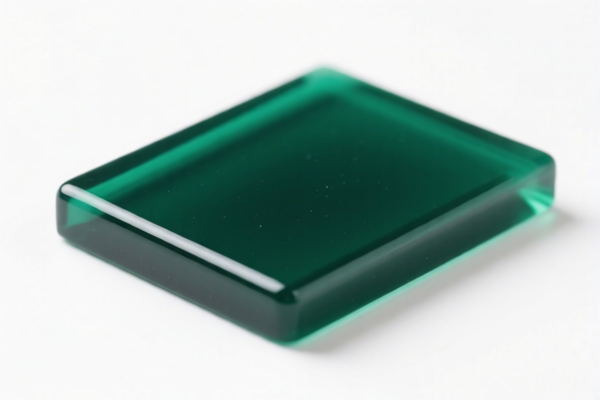

✅ HS CODE: 3920940000

Description: Industrial grade phenolic resin sheets, phenolic resin industrial thin sheets. This HS code refers to other plastics in the form of sheets, films, foils, strips, etc., not cellular or reinforced, and not laminated or combined with other materials.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3824821000

Description: Industrial grade chlorinated phenolic resin. This HS code refers to chemical preparations or formulations from the chemical industry or related industries, containing chlorine components.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3824999330

Description: Industrial grade phenolic resin plasticizer. This HS code refers to preparations or formulations for adhesives or chemical products, not otherwise specified, and thus fall under this category.

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.0%

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all four HS codes after this date. Ensure your import timeline accounts for this.

- Anti-dumping duties: Not currently applicable for these HS codes, but always verify with the latest customs updates.

- Material Verification: Confirm the exact chemical composition and form of the product (e.g., resin, sheet, chlorinated, or plasticizer) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Unit Price: Be aware that the total tax rate is based on the product's value, so unit price and product form can affect the final customs cost.

Proactive Advice:

Before shipping, double-check the product's chemical structure and physical form to ensure accurate HS code classification. If in doubt, consult a customs broker or classification expert.

Product Classification: Industrial Grade Phenolic Resin

HS CODEs and Tax Information Summary:

✅ HS CODE: 3909400000

Description: Industrial grade phenolic resin, building grade phenolic resin. This HS code includes amino resins, phenolic resins, and polyurethanes in primary form, including phenolic resins.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3920940000

Description: Industrial grade phenolic resin sheets, phenolic resin industrial thin sheets. This HS code refers to other plastics in the form of sheets, films, foils, strips, etc., not cellular or reinforced, and not laminated or combined with other materials.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3824821000

Description: Industrial grade chlorinated phenolic resin. This HS code refers to chemical preparations or formulations from the chemical industry or related industries, containing chlorine components.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3824999330

Description: Industrial grade phenolic resin plasticizer. This HS code refers to preparations or formulations for adhesives or chemical products, not otherwise specified, and thus fall under this category.

- Base Tariff Rate: 5.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.0%

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all four HS codes after this date. Ensure your import timeline accounts for this.

- Anti-dumping duties: Not currently applicable for these HS codes, but always verify with the latest customs updates.

- Material Verification: Confirm the exact chemical composition and form of the product (e.g., resin, sheet, chlorinated, or plasticizer) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Unit Price: Be aware that the total tax rate is based on the product's value, so unit price and product form can affect the final customs cost.

Proactive Advice:

Before shipping, double-check the product's chemical structure and physical form to ensure accurate HS code classification. If in doubt, consult a customs broker or classification expert.

Customer Reviews

No reviews yet.