Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920940000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3909400000 | Doc | 61.5% | CN | US | 2025-05-12 |

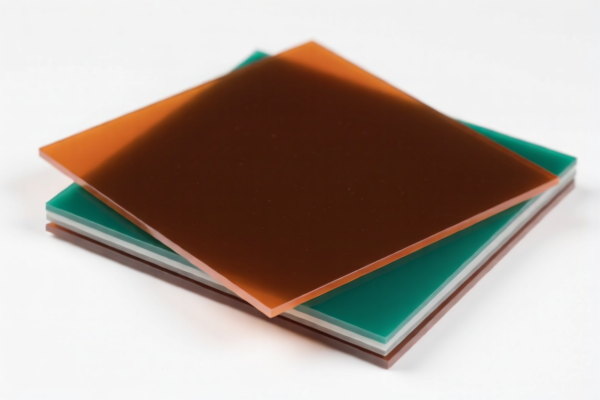

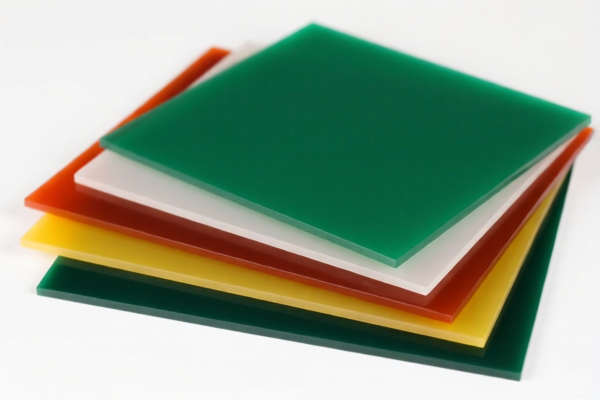

Product Classification: Industrial Grade Phenolic Resin Sheets

HS CODE: 3920940000

🔍 Classification Summary

- Product: Industrial Grade Phenolic Resin Sheets

- HS Code: 3920940000

- Description: Non-cellular, non-reinforced plastic sheets, films, foils, and strips, laminated, backed, or similarly combined with other materials — other plastics — phenolic resin

📊 Tariff Breakdown

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on imports after this date.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties for iron or aluminum are applicable for this product.

- Material Verification Required: Confirm the exact composition and whether the product is laminated or combined with other materials, as this may affect classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination country.

📌 Proactive Advice

- Verify Material Composition: Ensure the product is indeed phenolic resin and not a composite or modified version.

- Check Unit Price: Confirm the unit price and quantity for accurate customs valuation.

- Consult Local Customs Authority: For the most up-to-date tariff information and compliance requirements.

- Consider Alternative HS Codes: If the product is in a different form (e.g., powder or liquid), the HS code may change.

Let me know if you need help with customs documentation or further classification details.

Product Classification: Industrial Grade Phenolic Resin Sheets

HS CODE: 3920940000

🔍 Classification Summary

- Product: Industrial Grade Phenolic Resin Sheets

- HS Code: 3920940000

- Description: Non-cellular, non-reinforced plastic sheets, films, foils, and strips, laminated, backed, or similarly combined with other materials — other plastics — phenolic resin

📊 Tariff Breakdown

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on imports after this date.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties for iron or aluminum are applicable for this product.

- Material Verification Required: Confirm the exact composition and whether the product is laminated or combined with other materials, as this may affect classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination country.

📌 Proactive Advice

- Verify Material Composition: Ensure the product is indeed phenolic resin and not a composite or modified version.

- Check Unit Price: Confirm the unit price and quantity for accurate customs valuation.

- Consult Local Customs Authority: For the most up-to-date tariff information and compliance requirements.

- Consider Alternative HS Codes: If the product is in a different form (e.g., powder or liquid), the HS code may change.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.