| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920620090 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

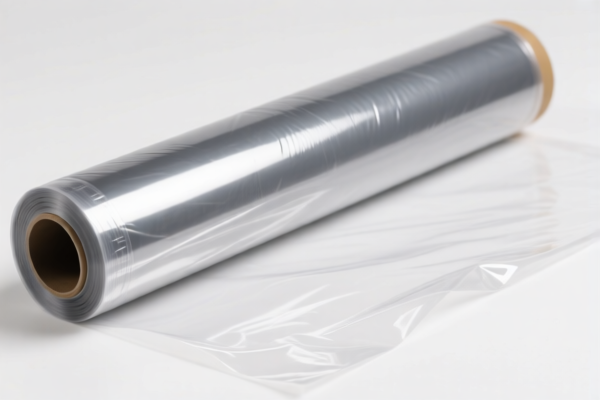

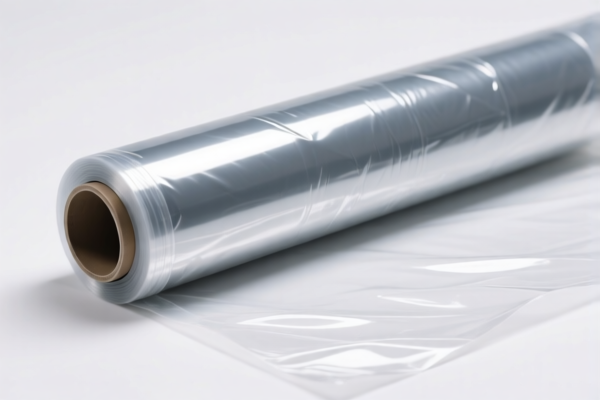

Here is the structured analysis and customs compliance guidance for the Industrial Grade Plastic Film product based on the provided HS codes and tax details:

📦 Product Classification Overview: Industrial Grade Plastic Film

Below are the HS codes and associated tariff details for different types of industrial-grade plastic films:

🔢 HS Code: 3921904090 - Plastic Industrial Grade Film

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 34.2%

- Notes: No additional tariffs beyond the April 11, 2025 special tariff.

🔢 HS Code: 3920991000 - Industrial Grade Polyethylene Film

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.0%

- Notes: High total tax due to both additional and special tariffs.

🔢 HS Code: 3920992000 - Industrial Grade PE Plastic Film

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 59.2%

- Notes: Similar to 3920991000, but with a slightly lower base rate.

🔢 HS Code: 3920620090 - PET Plastic Industrial Grade Film

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 59.2%

- Notes: PET films are subject to the same additional and special tariffs as other industrial-grade films.

🔢 HS Code: 3921905050 - Industrial Processing Plastic Film

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 34.8%

- Notes: No additional tariffs, but subject to the April 11, 2025 special tariff.

⚠️ Important Notes and Proactive Advice:

- April 11, 2025 Special Tariff: Applies to all listed HS codes. This is a time-sensitive policy and will significantly increase the total tax burden.

- Material Verification: Confirm the exact material (e.g., PE, PET, etc.) and technical specifications to ensure correct HS code classification.

- Unit Price and Certification: Check if any certifications (e.g., RoHS, REACH, or industry-specific standards) are required for import compliance.

- Tariff Impact: The total tax rate can vary from 34.2% to 61.0%, depending on the HS code and applicable tariffs.

- Anti-Dumping Duties: Not specified in the data, but be aware that anti-dumping duties may apply depending on the origin of the product and current trade policies.

✅ Action Steps for Importers:

- Confirm Product Specifications: Ensure the plastic film is correctly classified under the appropriate HS code.

- Review Tariff Changes: Be aware of the April 11, 2025 special tariff and its impact on total costs.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is close to the boundary of multiple HS codes.

- Check for Additional Duties: Verify if anti-dumping or countervailing duties apply based on the product’s origin.

Let me know if you need help with HS code selection or tariff calculation for a specific product. Here is the structured analysis and customs compliance guidance for the Industrial Grade Plastic Film product based on the provided HS codes and tax details:

📦 Product Classification Overview: Industrial Grade Plastic Film

Below are the HS codes and associated tariff details for different types of industrial-grade plastic films:

🔢 HS Code: 3921904090 - Plastic Industrial Grade Film

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 34.2%

- Notes: No additional tariffs beyond the April 11, 2025 special tariff.

🔢 HS Code: 3920991000 - Industrial Grade Polyethylene Film

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 61.0%

- Notes: High total tax due to both additional and special tariffs.

🔢 HS Code: 3920992000 - Industrial Grade PE Plastic Film

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 59.2%

- Notes: Similar to 3920991000, but with a slightly lower base rate.

🔢 HS Code: 3920620090 - PET Plastic Industrial Grade Film

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 59.2%

- Notes: PET films are subject to the same additional and special tariffs as other industrial-grade films.

🔢 HS Code: 3921905050 - Industrial Processing Plastic Film

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

- Total Tax Rate: 34.8%

- Notes: No additional tariffs, but subject to the April 11, 2025 special tariff.

⚠️ Important Notes and Proactive Advice:

- April 11, 2025 Special Tariff: Applies to all listed HS codes. This is a time-sensitive policy and will significantly increase the total tax burden.

- Material Verification: Confirm the exact material (e.g., PE, PET, etc.) and technical specifications to ensure correct HS code classification.

- Unit Price and Certification: Check if any certifications (e.g., RoHS, REACH, or industry-specific standards) are required for import compliance.

- Tariff Impact: The total tax rate can vary from 34.2% to 61.0%, depending on the HS code and applicable tariffs.

- Anti-Dumping Duties: Not specified in the data, but be aware that anti-dumping duties may apply depending on the origin of the product and current trade policies.

✅ Action Steps for Importers:

- Confirm Product Specifications: Ensure the plastic film is correctly classified under the appropriate HS code.

- Review Tariff Changes: Be aware of the April 11, 2025 special tariff and its impact on total costs.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is close to the boundary of multiple HS codes.

- Check for Additional Duties: Verify if anti-dumping or countervailing duties apply based on the product’s origin.

Let me know if you need help with HS code selection or tariff calculation for a specific product.

Customer Reviews

No reviews yet.