| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5402510000 | Doc | 63.8% | CN | US | 2025-05-12 |

| 5402116000 | Doc | 63.0% | CN | US | 2025-05-12 |

| 5503199000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 5402499140 | Doc | 63.0% | CN | US | 2025-05-12 |

| 5402620000 | Doc | 62.5% | CN | US | 2025-05-12 |

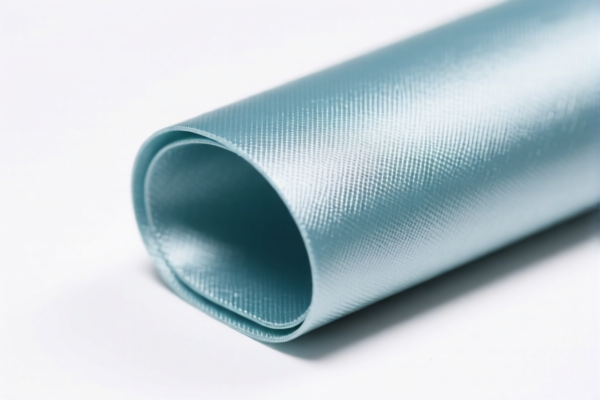

Product Name: Industrial Grade Polyamide Raw Material

Classification: Based on the provided HS codes and summaries, the product is likely classified under HS CODE 5402510000 or 5402116000, depending on the exact form and packaging of the material.

✅ HS CODE: 5402510000

Description: Polyamide fiber raw material (nylon or other polyamides)

Total Tax Rate: 63.8%

🔍 Tax Breakdown:

- Base Tariff Rate: 8.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is polyamide, not metal)

⚠️ Important Notes:

- April 11 Special Tariff: Applies after April 11, 2025. Ensure compliance with updated regulations if importing after this date.

- Material Verification: Confirm that the product is indeed polyamide fiber and not a finished product or composite material.

- Certifications: Check if any specific certifications (e.g., technical specifications, origin documentation) are required for customs clearance.

📌 Alternative HS CODEs for Reference:

HS CODE: 5402116000

Description: Industrial-grade polyamide fiber yarn (not for retail packaging)

Total Tax Rate: 63.0%

🔍 Tax Breakdown:

- Base Tariff Rate: 8.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

⚠️ Important Notes:

- This code applies if the product is in the form of yarn rather than raw fiber.

- Ensure the product is not packaged for retail and is intended for industrial use.

HS CODE: 5503199000

Description: Polyamide fiber for industrial fabric use

Total Tax Rate: 59.3%

🔍 Tax Breakdown:

- Base Tariff Rate: 4.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

⚠️ Important Notes:

- This code is for fibers used in industrial fabric production.

- Confirm the end-use of the material to ensure correct classification.

📌 Proactive Advice:

- Verify Material: Confirm the exact chemical composition and form (fiber, yarn, or fabric) of the product.

- Check Packaging: If the product is for industrial use and not retail, ensure it is not packaged in consumer-ready formats.

- Review Documentation: Prepare necessary documentation such as commercial invoice, packing list, and material specifications.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for additional tariffs and plan accordingly.

📌 Summary of Key Tax Rate Changes:

| HS CODE | Base Tariff | Additional Tariff | April 11 Special Tariff | Total Tax |

|---|---|---|---|---|

| 5402510000 | 8.8% | 25.0% | 30.0% | 63.8% |

| 5402116000 | 8.0% | 25.0% | 30.0% | 63.0% |

| 5503199000 | 4.3% | 25.0% | 30.0% | 59.3% |

| 5402499140 | 8.0% | 25.0% | 30.0% | 63.0% |

| 5402620000 | 7.5% | 25.0% | 30.0% | 62.5% |

If you have more details about the product (e.g., form, packaging, end-use), I can help refine the classification further.

Product Name: Industrial Grade Polyamide Raw Material

Classification: Based on the provided HS codes and summaries, the product is likely classified under HS CODE 5402510000 or 5402116000, depending on the exact form and packaging of the material.

✅ HS CODE: 5402510000

Description: Polyamide fiber raw material (nylon or other polyamides)

Total Tax Rate: 63.8%

🔍 Tax Breakdown:

- Base Tariff Rate: 8.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is polyamide, not metal)

⚠️ Important Notes:

- April 11 Special Tariff: Applies after April 11, 2025. Ensure compliance with updated regulations if importing after this date.

- Material Verification: Confirm that the product is indeed polyamide fiber and not a finished product or composite material.

- Certifications: Check if any specific certifications (e.g., technical specifications, origin documentation) are required for customs clearance.

📌 Alternative HS CODEs for Reference:

HS CODE: 5402116000

Description: Industrial-grade polyamide fiber yarn (not for retail packaging)

Total Tax Rate: 63.0%

🔍 Tax Breakdown:

- Base Tariff Rate: 8.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

⚠️ Important Notes:

- This code applies if the product is in the form of yarn rather than raw fiber.

- Ensure the product is not packaged for retail and is intended for industrial use.

HS CODE: 5503199000

Description: Polyamide fiber for industrial fabric use

Total Tax Rate: 59.3%

🔍 Tax Breakdown:

- Base Tariff Rate: 4.3%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

⚠️ Important Notes:

- This code is for fibers used in industrial fabric production.

- Confirm the end-use of the material to ensure correct classification.

📌 Proactive Advice:

- Verify Material: Confirm the exact chemical composition and form (fiber, yarn, or fabric) of the product.

- Check Packaging: If the product is for industrial use and not retail, ensure it is not packaged in consumer-ready formats.

- Review Documentation: Prepare necessary documentation such as commercial invoice, packing list, and material specifications.

- Monitor Tariff Changes: Be aware of the April 11, 2025 deadline for additional tariffs and plan accordingly.

📌 Summary of Key Tax Rate Changes:

| HS CODE | Base Tariff | Additional Tariff | April 11 Special Tariff | Total Tax |

|---|---|---|---|---|

| 5402510000 | 8.8% | 25.0% | 30.0% | 63.8% |

| 5402116000 | 8.0% | 25.0% | 30.0% | 63.0% |

| 5503199000 | 4.3% | 25.0% | 30.0% | 59.3% |

| 5402499140 | 8.0% | 25.0% | 30.0% | 63.0% |

| 5402620000 | 7.5% | 25.0% | 30.0% | 62.5% |

If you have more details about the product (e.g., form, packaging, end-use), I can help refine the classification further.

Customer Reviews

No reviews yet.