| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 5903902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5903903090 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

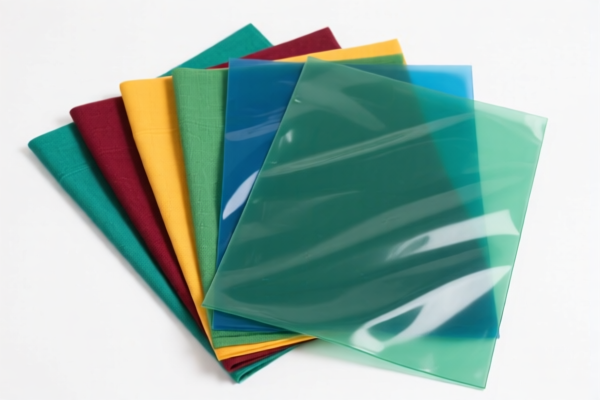

Here is the structured analysis and classification for Industrial Grade Textile Plastic Sheets, based on the provided HS codes and tariff details:

✅ Product Classification Overview: Industrial Grade Textile Plastic Sheets

These products are composite materials combining plastic with textile components, and are classified under various HS codes depending on the composition, weight, and type of textile fibers used.

📦 HS Code Breakdown and Tax Rates

1. HS CODE: 3921902550

- Description: Other plastic sheets, films, etc., combined with textile materials, with a weight exceeding 1.492 kg/m², where synthetic fibers make up the majority of the textile component, and plastic accounts for more than 70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: High tax rate due to the combination of textile and plastic with a high plastic content.

2. HS CODE: 3921902900

- Description: Other plastic sheets, films, etc., combined with other materials, with a weight exceeding 1.492 kg/m², and combined with textile materials.

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: Slightly lower base rate than 3921902550, but still subject to the same additional and special tariffs.

3. HS CODE: 5903902000

- Description: Other products, made of synthetic fibers, with rubber or plastic making up more than 70% of the weight.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: No base tariff, but still subject to the same additional and special tariffs.

4. HS CODE: 5903903090

- Description: Other products, not covered by the above.

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: Slightly higher base rate than 5903902000, but still subject to the same additional and special tariffs.

5. HS CODE: 3921904090

- Description: Other plastic sheets, films, etc.

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: Lower overall tax rate, but still subject to the special tariff after April 11, 2025.

⚠️ Important Policy Notes

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties Mentioned: Based on the provided data, anti-dumping duties on iron and aluminum are not applicable to these textile-plastic composite products.

- No Specific Tariff on Textile Content: The tariff is based on material composition and weight, not on the type of textile fiber (unless specified in the HS code).

🛠️ Proactive Advice for Importers

- Verify Material Composition: Ensure the plastic content and textile fiber type are clearly defined to determine the correct HS code.

- Check Unit Price and Weight: The weight per square meter is critical for classification (e.g., >1.492 kg/m²).

- Review Certification Requirements: Some products may require safety, environmental, or textile certifications depending on the end use.

- Plan for Tariff Increases: If importing after April 11, 2025, budget for the 30.0% additional tariff.

- Consult Customs Broker: For complex classifications, it's advisable to seek professional customs advice to avoid misclassification and penalties.

Let me know if you need help determining the correct HS code for your specific product or need assistance with customs documentation. Here is the structured analysis and classification for Industrial Grade Textile Plastic Sheets, based on the provided HS codes and tariff details:

✅ Product Classification Overview: Industrial Grade Textile Plastic Sheets

These products are composite materials combining plastic with textile components, and are classified under various HS codes depending on the composition, weight, and type of textile fibers used.

📦 HS Code Breakdown and Tax Rates

1. HS CODE: 3921902550

- Description: Other plastic sheets, films, etc., combined with textile materials, with a weight exceeding 1.492 kg/m², where synthetic fibers make up the majority of the textile component, and plastic accounts for more than 70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: High tax rate due to the combination of textile and plastic with a high plastic content.

2. HS CODE: 3921902900

- Description: Other plastic sheets, films, etc., combined with other materials, with a weight exceeding 1.492 kg/m², and combined with textile materials.

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: Slightly lower base rate than 3921902550, but still subject to the same additional and special tariffs.

3. HS CODE: 5903902000

- Description: Other products, made of synthetic fibers, with rubber or plastic making up more than 70% of the weight.

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: No base tariff, but still subject to the same additional and special tariffs.

4. HS CODE: 5903903090

- Description: Other products, not covered by the above.

- Total Tax Rate: 57.7%

- Base Tariff: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: Slightly higher base rate than 5903902000, but still subject to the same additional and special tariffs.

5. HS CODE: 3921904090

- Description: Other plastic sheets, films, etc.

- Total Tax Rate: 34.2%

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Note: Lower overall tax rate, but still subject to the special tariff after April 11, 2025.

⚠️ Important Policy Notes

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties Mentioned: Based on the provided data, anti-dumping duties on iron and aluminum are not applicable to these textile-plastic composite products.

- No Specific Tariff on Textile Content: The tariff is based on material composition and weight, not on the type of textile fiber (unless specified in the HS code).

🛠️ Proactive Advice for Importers

- Verify Material Composition: Ensure the plastic content and textile fiber type are clearly defined to determine the correct HS code.

- Check Unit Price and Weight: The weight per square meter is critical for classification (e.g., >1.492 kg/m²).

- Review Certification Requirements: Some products may require safety, environmental, or textile certifications depending on the end use.

- Plan for Tariff Increases: If importing after April 11, 2025, budget for the 30.0% additional tariff.

- Consult Customs Broker: For complex classifications, it's advisable to seek professional customs advice to avoid misclassification and penalties.

Let me know if you need help determining the correct HS code for your specific product or need assistance with customs documentation.

Customer Reviews

No reviews yet.