| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926905900 | Doc | 57.4% | CN | US | 2025-05-12 |

| 5910001020 | Doc | 59.0% | CN | US | 2025-05-12 |

| 4010369000 | Doc | 58.3% | CN | US | 2025-05-12 |

| 4010333000 | Doc | 58.4% | CN | US | 2025-05-12 |

| 4010326000 | Doc | 57.8% | CN | US | 2025-05-12 |

| 3926906090 | Doc | 59.2% | CN | US | 2025-05-12 |

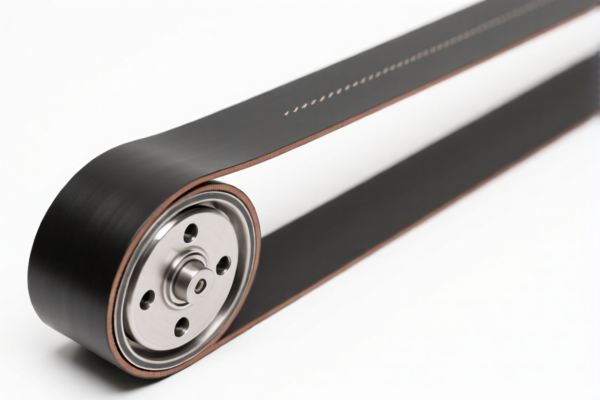

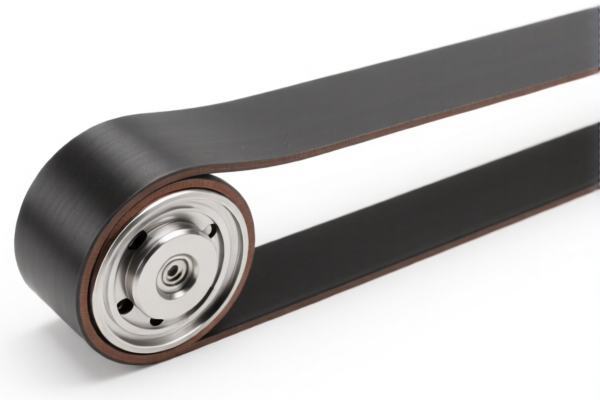

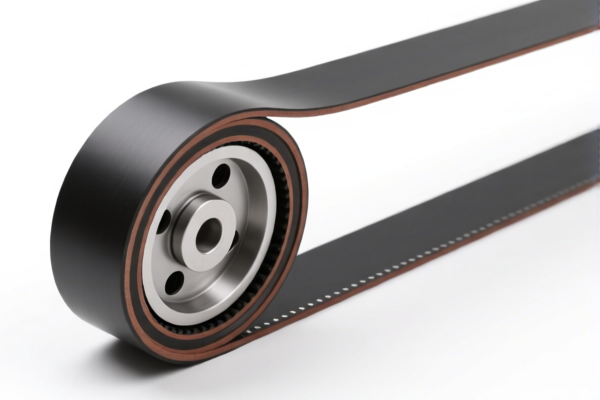

Product Classification: Industrial Machinery Belting

HS CODEs and Tax Information Overview:

- HS CODE: 3926905900

- Description: Conveyor belts and belts for machinery containing textile fibers

- Total Tax Rate: 57.4%

- Breakdown:

- Base Tariff: 2.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to belts with textile fibers, which may include rubber or synthetic materials combined with fabric.

-

HS CODE: 5910001020

- Description: Synchronous belts made of man-made fibers

- Total Tax Rate: 59.0%

- Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for specialized synchronous belts used in precision machinery.

-

HS CODE: 4010369000

- Description: Conveyor or transmission belts made of vulcanized rubber

- Total Tax Rate: 58.3%

- Breakdown:

- Base Tariff: 3.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Commonly used in industrial applications for heavy-duty use.

-

HS CODE: 4010333000

- Description: Conveyor or transmission belts made of vulcanized rubber

- Total Tax Rate: 58.4%

- Breakdown:

- Base Tariff: 3.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slight variation in description may reflect specific design or application.

-

HS CODE: 4010326000

- Description: Conveyor or transmission belts made of vulcanized rubber

- Total Tax Rate: 57.8%

- Breakdown:

- Base Tariff: 2.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower base tariff compared to similar codes, possibly due to material or use classification.

-

HS CODE: 3926906090

- Description: Belts and straps for machinery

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Broad category, may include various types of industrial belts.

Key Observations:

- Common Additional Tariff: All listed HS codes are subject to an additional 25.0% tariff, likely due to general trade policies or import restrictions.

- Special Tariff after April 11, 2025: A 30.0% additional tariff will apply to all these products after April 11, 2025. This is a critical date to be aware of for cost planning and compliance.

- No Anti-Dumping Duties Listed: None of the listed HS codes show specific anti-dumping duties on iron or aluminum, but this may vary depending on the country of origin and specific product composition.

Proactive Advice:

- Verify Material Composition: Confirm the exact material (e.g., rubber, textile, synthetic fibers) to ensure correct HS code classification.

- Check Unit Price and Certification: Some countries may require specific certifications (e.g., CE, ISO) for industrial machinery parts.

- Monitor April 11, 2025 Deadline: If importing after this date, budget for the 30.0% additional tariff to avoid unexpected costs.

-

Consult Local Customs Authority: For the most up-to-date and region-specific tariff information, especially if importing to a specific country. Product Classification: Industrial Machinery Belting

HS CODEs and Tax Information Overview: -

HS CODE: 3926905900

- Description: Conveyor belts and belts for machinery containing textile fibers

- Total Tax Rate: 57.4%

- Breakdown:

- Base Tariff: 2.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to belts with textile fibers, which may include rubber or synthetic materials combined with fabric.

-

HS CODE: 5910001020

- Description: Synchronous belts made of man-made fibers

- Total Tax Rate: 59.0%

- Breakdown:

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for specialized synchronous belts used in precision machinery.

-

HS CODE: 4010369000

- Description: Conveyor or transmission belts made of vulcanized rubber

- Total Tax Rate: 58.3%

- Breakdown:

- Base Tariff: 3.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Commonly used in industrial applications for heavy-duty use.

-

HS CODE: 4010333000

- Description: Conveyor or transmission belts made of vulcanized rubber

- Total Tax Rate: 58.4%

- Breakdown:

- Base Tariff: 3.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Slight variation in description may reflect specific design or application.

-

HS CODE: 4010326000

- Description: Conveyor or transmission belts made of vulcanized rubber

- Total Tax Rate: 57.8%

- Breakdown:

- Base Tariff: 2.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Lower base tariff compared to similar codes, possibly due to material or use classification.

-

HS CODE: 3926906090

- Description: Belts and straps for machinery

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Broad category, may include various types of industrial belts.

Key Observations:

- Common Additional Tariff: All listed HS codes are subject to an additional 25.0% tariff, likely due to general trade policies or import restrictions.

- Special Tariff after April 11, 2025: A 30.0% additional tariff will apply to all these products after April 11, 2025. This is a critical date to be aware of for cost planning and compliance.

- No Anti-Dumping Duties Listed: None of the listed HS codes show specific anti-dumping duties on iron or aluminum, but this may vary depending on the country of origin and specific product composition.

Proactive Advice:

- Verify Material Composition: Confirm the exact material (e.g., rubber, textile, synthetic fibers) to ensure correct HS code classification.

- Check Unit Price and Certification: Some countries may require specific certifications (e.g., CE, ISO) for industrial machinery parts.

- Monitor April 11, 2025 Deadline: If importing after this date, budget for the 30.0% additional tariff to avoid unexpected costs.

- Consult Local Customs Authority: For the most up-to-date and region-specific tariff information, especially if importing to a specific country.

Customer Reviews

No reviews yet.