| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920690000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920632000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921135000 | Doc | 59.2% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Industrial Polyester Sheets and related products, based on the provided HS codes and tax details:

🔍 Product Classification Overview

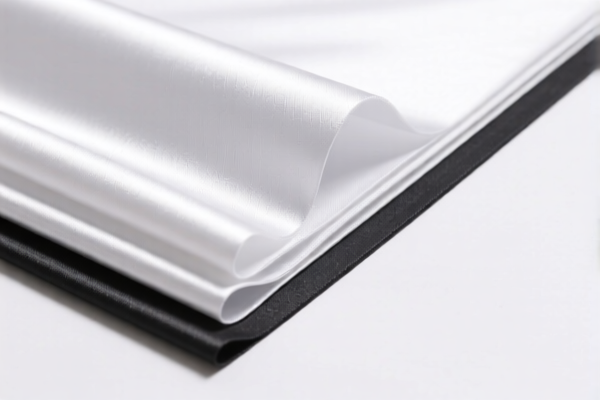

1. HS CODE: 3920690000

Product Name: 聚酯工业板 (Polyester Industrial Sheets)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes: This is the most common code for polyester industrial sheets. Ensure the product is not misclassified as another polymer type (e.g., polycarbonate).

2. HS CODE: 3920632000

Product Name: 聚碳酸酯工业板 (Polycarbonate Industrial Sheets)

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This code is specific to polycarbonate sheets. Confirm the material composition to avoid misclassification.

3. HS CODE: 3920610000

Product Name: 聚碳酸酯工业板 (Polycarbonate Industrial Sheets)

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This is another code for polycarbonate sheets. Verify if this is the correct code based on thickness, use, or other specifications.

4. HS CODE: 3921905050

Product Name: 工业用聚合物塑料板 (Industrial Polymer Plastic Sheets)

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes: This code applies to general polymer sheets. Ensure the product is not a specific type (e.g., polyester or polycarbonate) that would fall under a more specific code.

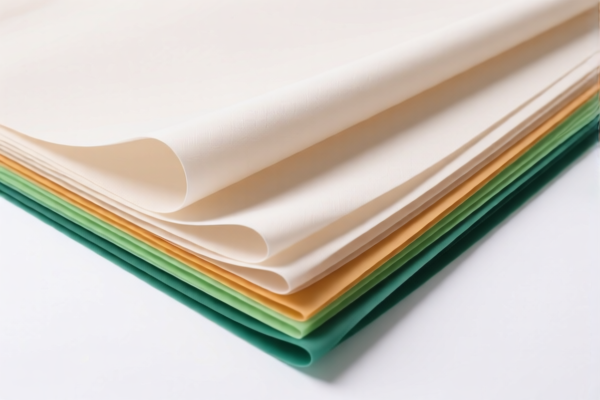

5. HS CODE: 3920100000

Product Name: 聚乙烯工业包装板 (Polyethylene Industrial Packaging Sheets)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes: This code is for polyethylene sheets used in packaging. Confirm the intended use to avoid misclassification.

⚠️ Important Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but be cautious if the product is subject to anti-dumping or countervailing duties. Check with customs or a compliance expert.

- Material Verification: Confirm the exact polymer type (e.g., polyester, polycarbonate, polyethylene) and technical specifications (e.g., thickness, use) to ensure correct HS code classification.

- Certifications: Some products may require specific certifications (e.g., RoHS, REACH) depending on the destination country and application.

✅ Proactive Advice

- Verify Material and Unit Price: Ensure the product description and material composition match the HS code.

- Check for Additional Tariffs: Be aware of the 30% special tariff after April 11, 2025, and factor this into your import cost calculations.

- Consult Customs or a Compliance Expert: For high-value or complex shipments, seek professional advice to avoid misclassification and penalties.

Let me know if you need help with a specific product or shipment! Here is the structured classification and tariff information for Industrial Polyester Sheets and related products, based on the provided HS codes and tax details:

🔍 Product Classification Overview

1. HS CODE: 3920690000

Product Name: 聚酯工业板 (Polyester Industrial Sheets)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes: This is the most common code for polyester industrial sheets. Ensure the product is not misclassified as another polymer type (e.g., polycarbonate).

2. HS CODE: 3920632000

Product Name: 聚碳酸酯工业板 (Polycarbonate Industrial Sheets)

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This code is specific to polycarbonate sheets. Confirm the material composition to avoid misclassification.

3. HS CODE: 3920610000

Product Name: 聚碳酸酯工业板 (Polycarbonate Industrial Sheets)

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This is another code for polycarbonate sheets. Verify if this is the correct code based on thickness, use, or other specifications.

4. HS CODE: 3921905050

Product Name: 工业用聚合物塑料板 (Industrial Polymer Plastic Sheets)

- Base Tariff Rate: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.8%

- Notes: This code applies to general polymer sheets. Ensure the product is not a specific type (e.g., polyester or polycarbonate) that would fall under a more specific code.

5. HS CODE: 3920100000

Product Name: 聚乙烯工业包装板 (Polyethylene Industrial Packaging Sheets)

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

- Notes: This code is for polyethylene sheets used in packaging. Confirm the intended use to avoid misclassification.

⚠️ Important Alerts

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but be cautious if the product is subject to anti-dumping or countervailing duties. Check with customs or a compliance expert.

- Material Verification: Confirm the exact polymer type (e.g., polyester, polycarbonate, polyethylene) and technical specifications (e.g., thickness, use) to ensure correct HS code classification.

- Certifications: Some products may require specific certifications (e.g., RoHS, REACH) depending on the destination country and application.

✅ Proactive Advice

- Verify Material and Unit Price: Ensure the product description and material composition match the HS code.

- Check for Additional Tariffs: Be aware of the 30% special tariff after April 11, 2025, and factor this into your import cost calculations.

- Consult Customs or a Compliance Expert: For high-value or complex shipments, seek professional advice to avoid misclassification and penalties.

Let me know if you need help with a specific product or shipment!

Customer Reviews

No reviews yet.