| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917290050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

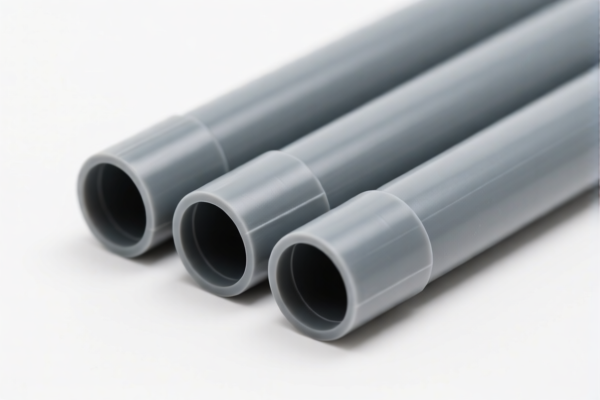

Product Classification: Industrial Short Plastic Tubes

HS CODE:

- 3917290050 – Other hard plastic tubes, length less than 200 mm

- 3917320050 – Other plastic tubes, not reinforced or combined with other materials, without fittings

🔍 Key Classification Notes:

- Material: Plastic (not reinforced or combined with other materials)

- Length: Less than 200 mm (for 3917290050)

- Structure: No fittings (for 3917320050)

📊 Tariff Overview (as of now):

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.1% (3.1% + 25.0% + 30.0%)

⚠️ Important: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline aligns with this policy change.

📌 Additional Considerations:

- Anti-dumping duties: Not applicable for plastic products unless specifically targeted by trade investigations.

- Certifications: May require compliance with environmental or safety standards (e.g., REACH, RoHS) depending on the destination country.

- Material Verification: Confirm the exact type of plastic (e.g., PVC, PE, PP) as this may affect classification and duty rates.

- Unit Price: Tariff calculations may depend on the declared value per unit, so ensure accurate pricing documentation.

✅ Proactive Advice:

- Verify the exact product description to ensure it matches the HS code (e.g., whether it is a "tube" or "tube fitting").

- Check for any recent trade agreements that may affect the tariff rate (e.g., RCEP, CPTPP).

- Consult a customs broker for real-time updates on tariff changes and documentation requirements.

- Keep records of material specifications, production processes, and certifications for customs audits.

Let me know if you need help with a specific import scenario or documentation!

Product Classification: Industrial Short Plastic Tubes

HS CODE:

- 3917290050 – Other hard plastic tubes, length less than 200 mm

- 3917320050 – Other plastic tubes, not reinforced or combined with other materials, without fittings

🔍 Key Classification Notes:

- Material: Plastic (not reinforced or combined with other materials)

- Length: Less than 200 mm (for 3917290050)

- Structure: No fittings (for 3917320050)

📊 Tariff Overview (as of now):

- Base Tariff Rate: 3.1%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 58.1% (3.1% + 25.0% + 30.0%)

⚠️ Important: The 30.0% additional tariff applies after April 11, 2025. Ensure your import timeline aligns with this policy change.

📌 Additional Considerations:

- Anti-dumping duties: Not applicable for plastic products unless specifically targeted by trade investigations.

- Certifications: May require compliance with environmental or safety standards (e.g., REACH, RoHS) depending on the destination country.

- Material Verification: Confirm the exact type of plastic (e.g., PVC, PE, PP) as this may affect classification and duty rates.

- Unit Price: Tariff calculations may depend on the declared value per unit, so ensure accurate pricing documentation.

✅ Proactive Advice:

- Verify the exact product description to ensure it matches the HS code (e.g., whether it is a "tube" or "tube fitting").

- Check for any recent trade agreements that may affect the tariff rate (e.g., RCEP, CPTPP).

- Consult a customs broker for real-time updates on tariff changes and documentation requirements.

- Keep records of material specifications, production processes, and certifications for customs audits.

Let me know if you need help with a specific import scenario or documentation!

Customer Reviews

No reviews yet.