| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920991000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 5903902000 | Doc | 55.0% | CN | US | 2025-05-12 |

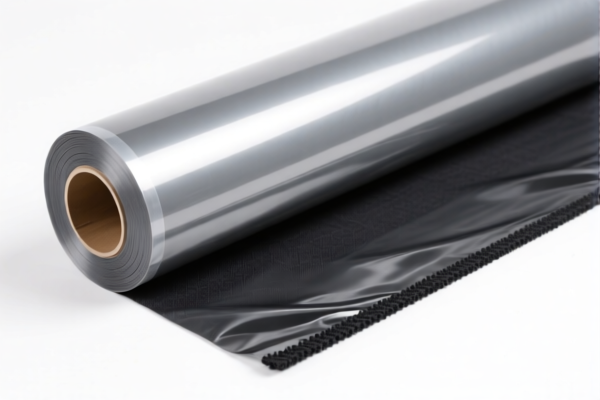

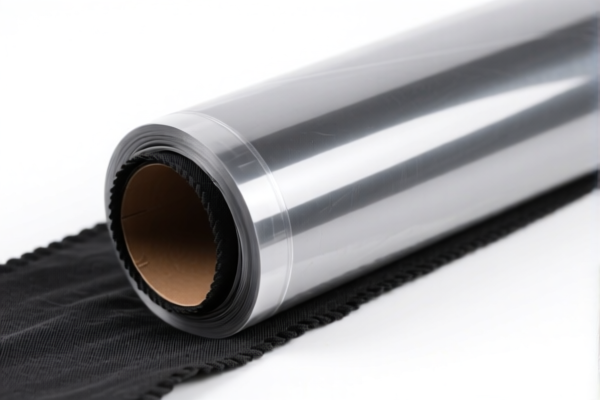

Here is the structured analysis and classification for the Industrial Textile Plastic Film product based on the provided HS codes and tariff details:

✅ HS CODE: 3921902900

Product Description: Plastic film combined with textile materials

Total Tax Rate: 59.4%

Tariff Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to films that are a combination of plastic and textile materials.

- The high total tax rate is due to both the base and additional tariffs.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 3921904090

Product Description: Industrial-grade plastic film

Total Tax Rate: 34.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for industrial-grade plastic films, likely used in manufacturing or packaging.

- No additional tariffs currently apply, but the 30.0% special tariff will be added after April 11, 2025.

✅ HS CODE: 3921905050

Product Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

Tariff Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code covers a wide range of plastic products, including films.

- No additional tariffs currently apply, but the 30.0% special tariff will be added after April 11, 2025.

✅ HS CODE: 3920991000

Product Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 61.0%

Tariff Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for other types of plastic films and sheets not covered by more specific codes.

- The total tax rate is the highest among the listed options.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 5903902000

Product Description: Plastic-coated textile products

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to textile products coated with plastic.

- No base tariff, but high additional tariffs apply.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

📌 Proactive Advice for Users:

- Verify Material Composition: Ensure the product is correctly classified based on its material (e.g., whether it is a combination of textile and plastic or purely plastic).

- Check Unit Price and Certification: Some products may require specific certifications (e.g., RoHS, REACH) for import compliance.

- Monitor Tariff Changes: The 30.0% special tariff after April 11, 2025, will significantly increase costs. Consider adjusting procurement or logistics timelines accordingly.

- Consult Customs Broker: For complex classifications, it is advisable to consult a customs broker or a compliance expert to avoid delays or penalties.

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured analysis and classification for the Industrial Textile Plastic Film product based on the provided HS codes and tariff details:

✅ HS CODE: 3921902900

Product Description: Plastic film combined with textile materials

Total Tax Rate: 59.4%

Tariff Breakdown:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to films that are a combination of plastic and textile materials.

- The high total tax rate is due to both the base and additional tariffs.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 3921904090

Product Description: Industrial-grade plastic film

Total Tax Rate: 34.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for industrial-grade plastic films, likely used in manufacturing or packaging.

- No additional tariffs currently apply, but the 30.0% special tariff will be added after April 11, 2025.

✅ HS CODE: 3921905050

Product Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 34.8%

Tariff Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code covers a wide range of plastic products, including films.

- No additional tariffs currently apply, but the 30.0% special tariff will be added after April 11, 2025.

✅ HS CODE: 3920991000

Product Description: Other plastic sheets, plates, films, foils, and strips

Total Tax Rate: 61.0%

Tariff Breakdown:

- Base Tariff: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for other types of plastic films and sheets not covered by more specific codes.

- The total tax rate is the highest among the listed options.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

✅ HS CODE: 5903902000

Product Description: Plastic-coated textile products

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to textile products coated with plastic.

- No base tariff, but high additional tariffs apply.

- Alert: The 30.0% special tariff will apply after April 11, 2025.

📌 Proactive Advice for Users:

- Verify Material Composition: Ensure the product is correctly classified based on its material (e.g., whether it is a combination of textile and plastic or purely plastic).

- Check Unit Price and Certification: Some products may require specific certifications (e.g., RoHS, REACH) for import compliance.

- Monitor Tariff Changes: The 30.0% special tariff after April 11, 2025, will significantly increase costs. Consider adjusting procurement or logistics timelines accordingly.

- Consult Customs Broker: For complex classifications, it is advisable to consult a customs broker or a compliance expert to avoid delays or penalties.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.