| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

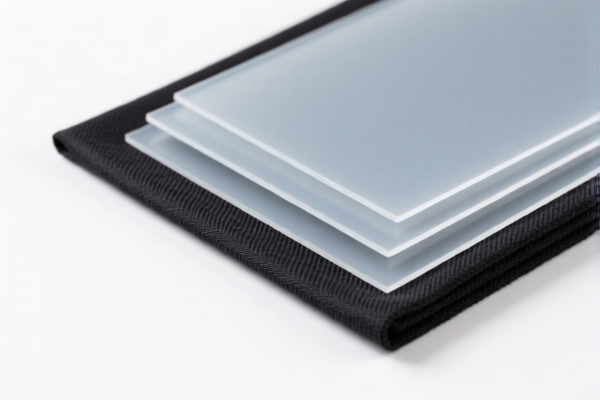

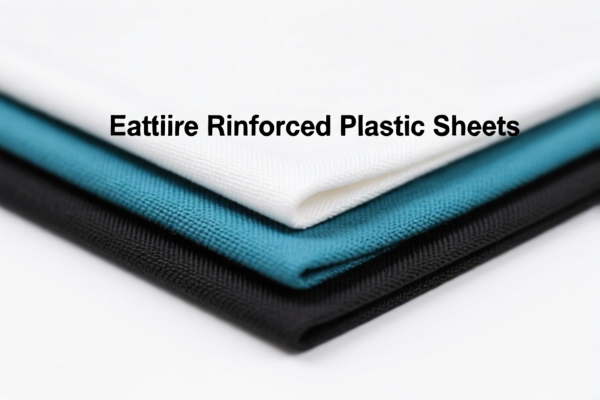

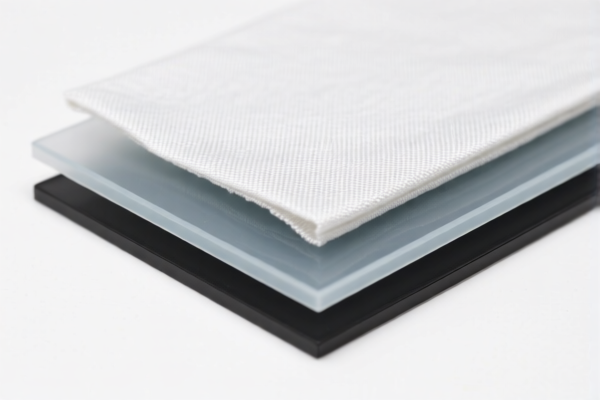

Product Classification: Industrial Textile Reinforced Plastic Sheets

HS CODEs Identified: 3921902510 and 3921902900

🔍 HS CODE Details and Tax Rates

1. HS CODE: 3921902510

- Description:

- Textile-reinforced plastic sheets where the textile component is the main weight component (by weight), and the weight of any single textile fiber is less than that of synthetic fibers.

- Plastic content must exceed 70% by weight.

-

Weight must be greater than 1.492 kg/m².

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

2. HS CODE: 3921902900

- Description:

- Plastic sheets, films, etc., combined with other materials (e.g., textile or glass fiber), with a weight greater than 1.492 kg/m².

-

This category includes glass fiber-reinforced or other composite materials.

-

Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

⚠️ Important Notes on Tariff Changes

- April 2, 2025 Special Tariff:

- An additional 30.0% tariff will be applied to both HS CODEs after April 2, 2025.

-

This is a time-sensitive policy and must be considered in cost planning and customs declarations.

-

Anti-dumping duties:

- Not explicitly mentioned in the data, but anti-dumping duties may apply if the product is subject to ongoing investigations or existing duties on similar products (e.g., iron or aluminum composites).

- Recommendation: Confirm with customs or a trade compliance expert if the product is under any anti-dumping investigations.

📌 Proactive Advice for Importers

- Verify Material Composition:

- Ensure the plastic content exceeds 70% (for HS CODE 3921902510) or that the total weight is over 1.492 kg/m² (for HS CODE 3921902900).

-

Confirm the type of textile or fiber used (e.g., glass fiber, synthetic fiber, etc.).

-

Check Unit Price and Certification:

- Some HS CODEs may require certifications (e.g., material composition certificates, origin certificates) to confirm compliance.

-

Ensure accurate product description in customs declarations to avoid misclassification and penalties.

-

Monitor Tariff Updates:

- Stay informed about tariff changes after April 2, 2025, and consider adjusting pricing or sourcing strategies accordingly.

✅ Summary of Tax Rates

| HS CODE | Base Tariff | Additional Tariff | Special Tariff (after April 2, 2025) | Total Tax Rate |

|---|---|---|---|---|

| 3921902510 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921902900 | 4.4% | 25.0% | 30.0% | 59.4% |

If you need further assistance with customs documentation, certification requirements, or tariff impact analysis, feel free to ask.

Product Classification: Industrial Textile Reinforced Plastic Sheets

HS CODEs Identified: 3921902510 and 3921902900

🔍 HS CODE Details and Tax Rates

1. HS CODE: 3921902510

- Description:

- Textile-reinforced plastic sheets where the textile component is the main weight component (by weight), and the weight of any single textile fiber is less than that of synthetic fibers.

- Plastic content must exceed 70% by weight.

-

Weight must be greater than 1.492 kg/m².

-

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

2. HS CODE: 3921902900

- Description:

- Plastic sheets, films, etc., combined with other materials (e.g., textile or glass fiber), with a weight greater than 1.492 kg/m².

-

This category includes glass fiber-reinforced or other composite materials.

-

Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

⚠️ Important Notes on Tariff Changes

- April 2, 2025 Special Tariff:

- An additional 30.0% tariff will be applied to both HS CODEs after April 2, 2025.

-

This is a time-sensitive policy and must be considered in cost planning and customs declarations.

-

Anti-dumping duties:

- Not explicitly mentioned in the data, but anti-dumping duties may apply if the product is subject to ongoing investigations or existing duties on similar products (e.g., iron or aluminum composites).

- Recommendation: Confirm with customs or a trade compliance expert if the product is under any anti-dumping investigations.

📌 Proactive Advice for Importers

- Verify Material Composition:

- Ensure the plastic content exceeds 70% (for HS CODE 3921902510) or that the total weight is over 1.492 kg/m² (for HS CODE 3921902900).

-

Confirm the type of textile or fiber used (e.g., glass fiber, synthetic fiber, etc.).

-

Check Unit Price and Certification:

- Some HS CODEs may require certifications (e.g., material composition certificates, origin certificates) to confirm compliance.

-

Ensure accurate product description in customs declarations to avoid misclassification and penalties.

-

Monitor Tariff Updates:

- Stay informed about tariff changes after April 2, 2025, and consider adjusting pricing or sourcing strategies accordingly.

✅ Summary of Tax Rates

| HS CODE | Base Tariff | Additional Tariff | Special Tariff (after April 2, 2025) | Total Tax Rate |

|---|---|---|---|---|

| 3921902510 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921902900 | 4.4% | 25.0% | 30.0% | 59.4% |

If you need further assistance with customs documentation, certification requirements, or tariff impact analysis, feel free to ask.

Customer Reviews

No reviews yet.