| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4010326000 | Doc | 57.8% | CN | US | 2025-05-12 |

| 4010399000 | Doc | 58.3% | CN | US | 2025-05-12 |

| 5910001020 | Doc | 59.0% | CN | US | 2025-05-12 |

| 3926905900 | Doc | 57.4% | CN | US | 2025-05-12 |

| 4107917030 | Doc | 35.0% | CN | US | 2025-05-12 |

- HS CODE: 4010326000

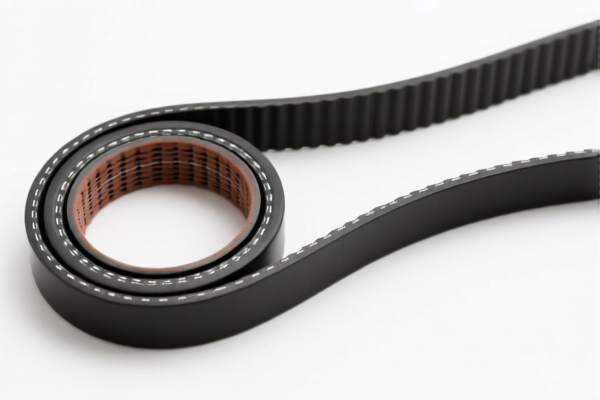

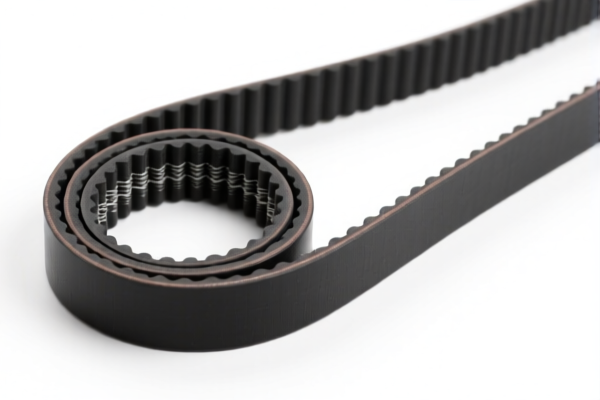

- Product Name: Industrial Power Belt

- Base Tariff Rate: 2.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.8%

-

Notes: This code applies to industrial power belts made of rubber or other materials. Ensure the product description matches the HS code to avoid misclassification.

-

HS CODE: 4010399000

- Product Name: Industrial Rubber Belt

- Base Tariff Rate: 3.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.3%

-

Notes: This code is for rubber belts used in industrial applications. Confirm the material composition to ensure correct classification.

-

HS CODE: 5910001020

- Product Name: Industrial Belt

- Base Tariff Rate: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.0%

-

Notes: This code is for industrial belts, possibly coated or treated. Verify if the product is coated or treated, as this may affect classification.

-

HS CODE: 3926905900

- Product Name: Industrial Mechanical Belt

- Base Tariff Rate: 2.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.4%

-

Notes: This code applies to industrial mechanical belts made of plastic or other materials. Ensure the product is not classified under a more specific code.

-

HS CODE: 4107917030

- Product Name: Cowhide Industrial Belt

- Base Tariff Rate: 5.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 35.0%

- Notes: This code is for belts made of cowhide. The additional tariff is not applicable here, but the special tariff after April 11, 2025, still applies.

Proactive Advice:

- Verify the material composition and specific use of the belt to ensure the correct HS code is applied.

- Check if certifications (e.g., CE, ISO) are required for import.

- Confirm the unit price and quantity for accurate tax calculation.

- Be aware of the April 11, 2025 deadline for the special tariff, which may significantly increase the total tax burden.

- HS CODE: 4010326000

- Product Name: Industrial Power Belt

- Base Tariff Rate: 2.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.8%

- Notes: This code applies to industrial power belts made of rubber or other materials. Ensure the product description matches the HS code to avoid misclassification.

- HS CODE: 4010399000

- Product Name: Industrial Rubber Belt

- Base Tariff Rate: 3.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.3%

-

Notes: This code is for rubber belts used in industrial applications. Confirm the material composition to ensure correct classification.

-

HS CODE: 5910001020

- Product Name: Industrial Belt

- Base Tariff Rate: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.0%

-

Notes: This code is for industrial belts, possibly coated or treated. Verify if the product is coated or treated, as this may affect classification.

-

HS CODE: 3926905900

- Product Name: Industrial Mechanical Belt

- Base Tariff Rate: 2.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.4%

-

Notes: This code applies to industrial mechanical belts made of plastic or other materials. Ensure the product is not classified under a more specific code.

-

HS CODE: 4107917030

- Product Name: Cowhide Industrial Belt

- Base Tariff Rate: 5.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 35.0%

- Notes: This code is for belts made of cowhide. The additional tariff is not applicable here, but the special tariff after April 11, 2025, still applies.

Proactive Advice: - Verify the material composition and specific use of the belt to ensure the correct HS code is applied. - Check if certifications (e.g., CE, ISO) are required for import. - Confirm the unit price and quantity for accurate tax calculation. - Be aware of the April 11, 2025 deadline for the special tariff, which may significantly increase the total tax burden.

Customer Reviews

No reviews yet.