Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3926909987 | Doc | 42.8% | CN | US | 2025-05-12 |

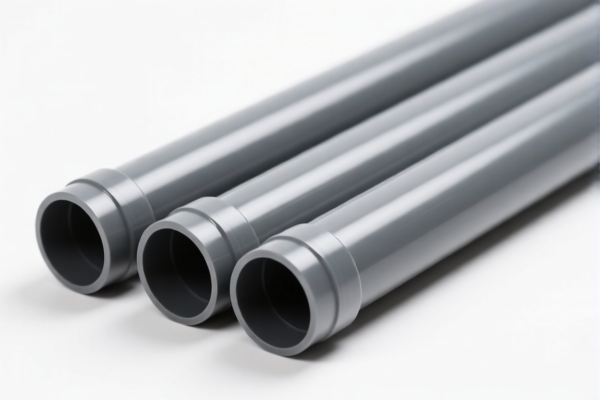

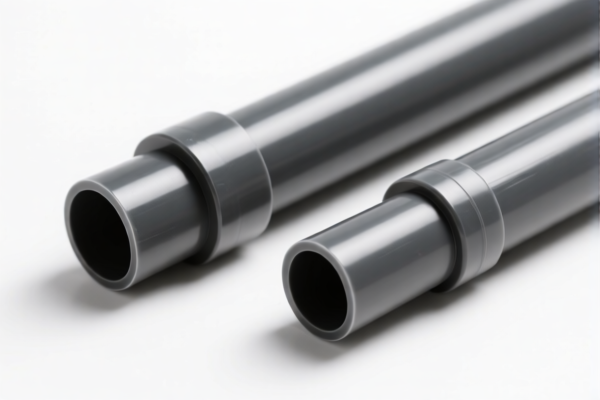

Here is the structured classification and tariff information for industrial-grade plastic tubes, based on the provided HS codes and tax details:

🔍 HS CODE: 3917400095 – Industrial-grade plastic fittings

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code applies to plastic fittings used in industrial applications.

- The high total tax rate is due to the combination of base, additional, and special tariffs.

- Proactive Advice: Confirm the exact product description and whether it includes fittings or just tubes.

🔍 HS CODE: 3917310000 – Industrial-grade plastic pressure tubes / Industrial-grade plastic soft tubes

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Notes:

- This code covers pressure tubes and soft tubes made of plastic.

- The base rate is lower than 3917400095, but the total tax is still high due to the additional and special tariffs.

- Proactive Advice: Clarify whether the product is a "pressure tube" or "soft tube" to ensure correct classification.

🔍 HS CODE: 3917320050 – Plastic industrial tubes

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Notes:

- This code is for general industrial plastic tubes.

- The tax structure is similar to 3917310000.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 3917310000 for pressure tubes).

🔍 HS CODE: 3926909987 – Industrial plastic conduits

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

- Notes:

- This code applies to plastic conduits used in industrial settings.

- The total tax rate is lower than the previous codes, but still includes the 30% special tariff after April 11, 2025.

- Proactive Advice: Confirm if the product is a conduit (e.g., for electrical wiring) or a general-purpose tube.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30% tariff after this date.

- Material and Certification: Verify the material composition (e.g., PVC, PE, etc.) and whether certifications (e.g., RoHS, REACH) are required for import.

- Unit Price and Classification: Ensure the product description and unit price align with the HS code to avoid misclassification and penalties.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured classification and tariff information for industrial-grade plastic tubes, based on the provided HS codes and tax details:

🔍 HS CODE: 3917400095 – Industrial-grade plastic fittings

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code applies to plastic fittings used in industrial applications.

- The high total tax rate is due to the combination of base, additional, and special tariffs.

- Proactive Advice: Confirm the exact product description and whether it includes fittings or just tubes.

🔍 HS CODE: 3917310000 – Industrial-grade plastic pressure tubes / Industrial-grade plastic soft tubes

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Notes:

- This code covers pressure tubes and soft tubes made of plastic.

- The base rate is lower than 3917400095, but the total tax is still high due to the additional and special tariffs.

- Proactive Advice: Clarify whether the product is a "pressure tube" or "soft tube" to ensure correct classification.

🔍 HS CODE: 3917320050 – Plastic industrial tubes

- Base Tariff Rate: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.1%

- Notes:

- This code is for general industrial plastic tubes.

- The tax structure is similar to 3917310000.

- Proactive Advice: Ensure the product is not classified under a more specific code (e.g., 3917310000 for pressure tubes).

🔍 HS CODE: 3926909987 – Industrial plastic conduits

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

- Notes:

- This code applies to plastic conduits used in industrial settings.

- The total tax rate is lower than the previous codes, but still includes the 30% special tariff after April 11, 2025.

- Proactive Advice: Confirm if the product is a conduit (e.g., for electrical wiring) or a general-purpose tube.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above codes are subject to an additional 30% tariff after this date.

- Material and Certification: Verify the material composition (e.g., PVC, PE, etc.) and whether certifications (e.g., RoHS, REACH) are required for import.

- Unit Price and Classification: Ensure the product description and unit price align with the HS code to avoid misclassification and penalties.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.