| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4106311000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 4106319000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 4106319000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 4106319000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 4106319000 | Doc | 59.2% | CN | US | 2025-05-12 |

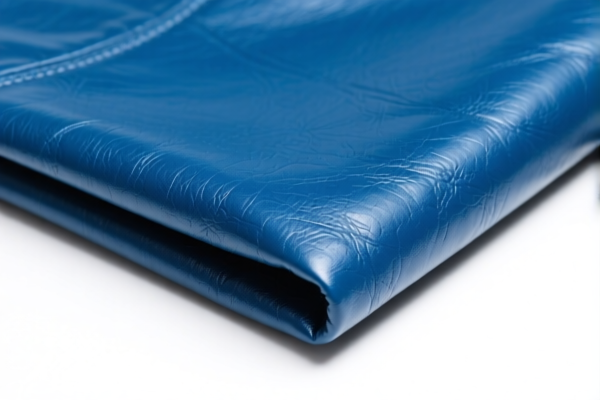

Product Classification: Industrial Grade Wet Blue Pigskin

HS CODE: 4106.31.10.00 and 4106.31.90.00 (various descriptions under the same HS code)

🔍 HS Code Overview

- HS CODE: 4106.31.10.00 / 4106.31.90.00

- Product Description: Wet blue pigskin (wet state) used for industrial purposes, including pigskin pieces and raw materials.

📊 Tariff Breakdown

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2% (4.2% + 25.0% + 30.0%)

⚠️ Important Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff is imposed after April 11, 2025. This is a time-sensitive policy and must be considered when planning import timelines. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties reported for this product category (iron and aluminum-related duties do not apply here).

📌 Proactive Advice for Importers

- Verify Material Specifications: Ensure the product is indeed "wet blue pigskin" and not misclassified (e.g., dry leather or other animal skins).

- Check Unit Price and Quantity: Tariff calculations may vary based on the declared value and quantity.

- Certifications Required: Confirm if any certifications (e.g., origin, environmental compliance) are needed for customs clearance.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially around the April 11, 2025 deadline.

🧾 Summary Table

| Tariff Component | Rate |

|---|---|

| Base Tariff | 4.2% |

| General Additional Tariff | 25.0% |

| Special Tariff (after 2025.4.11) | 30.0% |

| Total Tax Rate | 59.2% |

If you need further assistance with customs documentation or classification confirmation, feel free to provide more details about the product's origin, use, and packaging.

Product Classification: Industrial Grade Wet Blue Pigskin

HS CODE: 4106.31.10.00 and 4106.31.90.00 (various descriptions under the same HS code)

🔍 HS Code Overview

- HS CODE: 4106.31.10.00 / 4106.31.90.00

- Product Description: Wet blue pigskin (wet state) used for industrial purposes, including pigskin pieces and raw materials.

📊 Tariff Breakdown

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2% (4.2% + 25.0% + 30.0%)

⚠️ Important Notes on Tariff Changes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff is imposed after April 11, 2025. This is a time-sensitive policy and must be considered when planning import timelines. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties reported for this product category (iron and aluminum-related duties do not apply here).

📌 Proactive Advice for Importers

- Verify Material Specifications: Ensure the product is indeed "wet blue pigskin" and not misclassified (e.g., dry leather or other animal skins).

- Check Unit Price and Quantity: Tariff calculations may vary based on the declared value and quantity.

- Certifications Required: Confirm if any certifications (e.g., origin, environmental compliance) are needed for customs clearance.

- Monitor Tariff Updates: Stay informed about any changes in tariff policies, especially around the April 11, 2025 deadline.

🧾 Summary Table

| Tariff Component | Rate |

|---|---|

| Base Tariff | 4.2% |

| General Additional Tariff | 25.0% |

| Special Tariff (after 2025.4.11) | 30.0% |

| Total Tax Rate | 59.2% |

If you need further assistance with customs documentation or classification confirmation, feel free to provide more details about the product's origin, use, and packaging.

Customer Reviews

No reviews yet.