| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4802613191 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4809202000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4816200000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4816900100 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4823908680 | Doc | 55.0% | CN | US | 2025-05-12 |

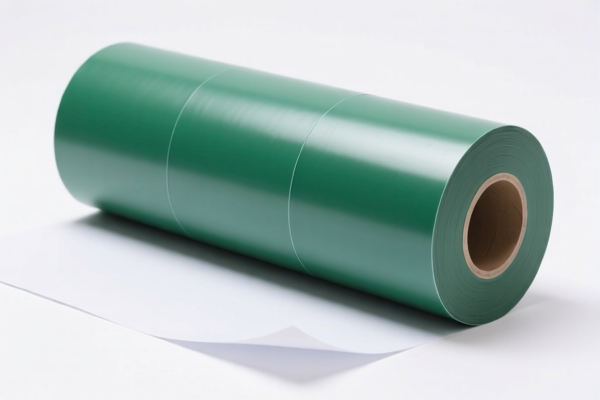

Product Classification: Inorganic Coated Paper Rolls for Writing and Printing

Based on the provided HS codes and tax details, the product "Inorganic Coated Paper Rolls for Writing and Printing" falls under several HS codes related to carbonless paper or non-carbon copy paper. Below is a structured breakdown of the classification and associated customs duties:

🔍 HS Code Classification Overview

- HS Code 4802613191 – Carbonless Copy Paper Rolls

- HS Code 4809202000 – Carbonless Writing Paper

- HS Code 4816200000 – Carbonless Copy Paper

- HS Code 4816900100 – Carbonless Paper Sheets

- HS Code 4823908680 – Carbonless Copy Paper

All of these HS codes are related to carbonless paper used for writing and printing, and they share the same total tax rate and tariff structure.

📊 Tariff Structure Summary

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0% (0.0% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. If your import is scheduled after this date, the total tax rate will be 55.0%.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is indeed carbonless paper and not a different type of coated or treated paper, as misclassification can lead to penalties.

- Unit Price and Quantity: Ensure accurate declaration of the unit price and quantity to avoid discrepancies during customs inspection.

- Certifications: Check if any certifications (e.g., environmental, safety, or origin) are required for import into the destination country.

- Origin of Goods: Be aware of origin rules and whether preferential tariffs apply (e.g., under free trade agreements).

- Documentation: Maintain proper commercial invoices, packing lists, and certificates of origin to support the declared classification.

📢 Proactive Advice

- Double-check the product description to ensure it aligns with the HS code used (e.g., "carbonless" or "non-carbon copy").

- Monitor the April 11, 2025 deadline for the special tariff and plan your import schedule accordingly.

- Consult a customs broker or trade compliance expert if the product is part of a larger shipment or involves multiple HS codes.

Let me know if you need help with certification requirements or customs documentation templates for these products.

Product Classification: Inorganic Coated Paper Rolls for Writing and Printing

Based on the provided HS codes and tax details, the product "Inorganic Coated Paper Rolls for Writing and Printing" falls under several HS codes related to carbonless paper or non-carbon copy paper. Below is a structured breakdown of the classification and associated customs duties:

🔍 HS Code Classification Overview

- HS Code 4802613191 – Carbonless Copy Paper Rolls

- HS Code 4809202000 – Carbonless Writing Paper

- HS Code 4816200000 – Carbonless Copy Paper

- HS Code 4816900100 – Carbonless Paper Sheets

- HS Code 4823908680 – Carbonless Copy Paper

All of these HS codes are related to carbonless paper used for writing and printing, and they share the same total tax rate and tariff structure.

📊 Tariff Structure Summary

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0% (0.0% + 25.0% + 30.0%)

⚠️ Important Note: The 30.0% additional tariff applies after April 11, 2025. If your import is scheduled after this date, the total tax rate will be 55.0%.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is indeed carbonless paper and not a different type of coated or treated paper, as misclassification can lead to penalties.

- Unit Price and Quantity: Ensure accurate declaration of the unit price and quantity to avoid discrepancies during customs inspection.

- Certifications: Check if any certifications (e.g., environmental, safety, or origin) are required for import into the destination country.

- Origin of Goods: Be aware of origin rules and whether preferential tariffs apply (e.g., under free trade agreements).

- Documentation: Maintain proper commercial invoices, packing lists, and certificates of origin to support the declared classification.

📢 Proactive Advice

- Double-check the product description to ensure it aligns with the HS code used (e.g., "carbonless" or "non-carbon copy").

- Monitor the April 11, 2025 deadline for the special tariff and plan your import schedule accordingly.

- Consult a customs broker or trade compliance expert if the product is part of a larger shipment or involves multiple HS codes.

Let me know if you need help with certification requirements or customs documentation templates for these products.

Customer Reviews

No reviews yet.