| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918903000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5903903090 | Doc | 57.7% | CN | US | 2025-05-12 |

| 3926903500 | Doc | 44.0% | CN | US | 2025-05-12 |

| 3924901010 | Doc | 33.3% | CN | US | 2025-05-12 |

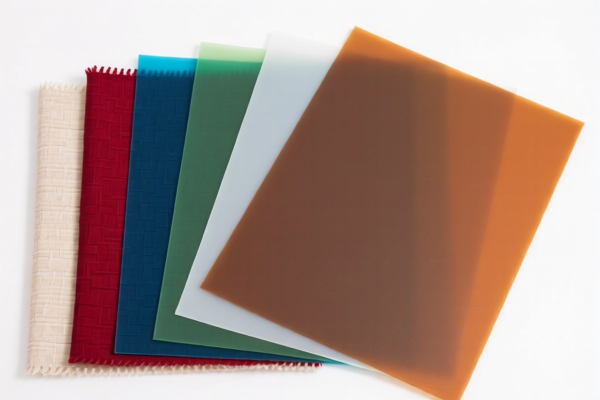

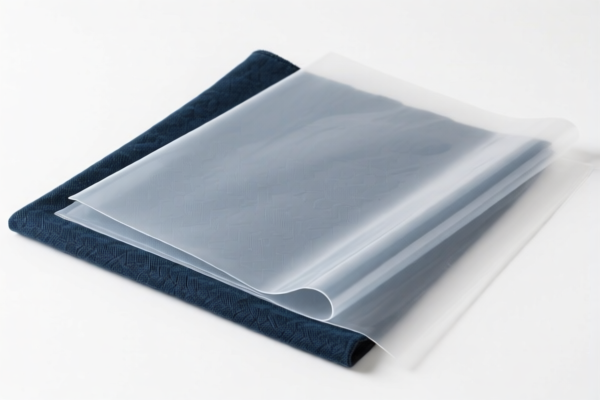

Here is the structured analysis and classification for Interior Decoration Textile Plastic Sheets, based on the provided HS codes and tariff details:

✅ HS CODE: 3921902550

Product Description:

Other plastic sheets, plates, films, foils and strips combined with other textile materials, with a weight exceeding 1.492 kg/m².

- Textile component contains synthetic fibers in greater weight than any other single textile fiber.

- Plastic content exceeds 70% by weight.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This classification is suitable if the product is a composite of plastic and textile, with plastic content over 70% and textile content dominated by synthetic fibers.

- Proactive Advice: Verify the exact composition (plastic vs. textile weight) and ensure compliance with textile labeling regulations.

✅ HS CODE: 3918903000

Product Description:

Other plastic wall or ceiling coverings with textile fiber backing.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This code applies to decorative plastic panels or coverings with a textile backing (e.g., for walls or ceilings).

- Proactive Advice: Confirm the product is used for interior decoration and has a textile backing.

✅ HS CODE: 5903903090

Product Description:

Textile fabrics impregnated, coated, covered or laminated with plastic, classified as "Other".

Tariff Summary:

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

Key Notes:

- This code is for textile fabrics that have been treated with plastic (e.g., coated or laminated).

- Proactive Advice: Ensure the product is not classified under a more specific category (e.g., 590310 or 590320).

✅ HS CODE: 3926903500

Product Description:

Other plastic articles, including decorative plastic sheets.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 44.0%

Key Notes:

- This is a general category for plastic products not covered by more specific codes.

- Proactive Advice: Use this code only if the product cannot be classified under a more specific HS code (e.g., 3921 or 3918).

✅ HS CODE: 3924901010

Product Description:

Curtains and drapes, including panels and pleated curtains.

Tariff Summary:

- Base Tariff Rate: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.3%

Key Notes:

- This code applies to decorative curtains or drapes made of plastic.

- Proactive Advice: Confirm the product is not a textile product (e.g., made of fabric) and is primarily made of plastic.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above codes will be subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for these HS codes (no mention of anti-dumping duties on iron or aluminum).

- Certifications: Ensure your product meets any required certifications (e.g., fire safety, environmental standards) for interior decoration materials.

- Documentation: Maintain clear documentation on the product composition, weight, and intended use to avoid misclassification.

Let me know if you need help with customs declarations or tariff calculations for a specific shipment. Here is the structured analysis and classification for Interior Decoration Textile Plastic Sheets, based on the provided HS codes and tariff details:

✅ HS CODE: 3921902550

Product Description:

Other plastic sheets, plates, films, foils and strips combined with other textile materials, with a weight exceeding 1.492 kg/m².

- Textile component contains synthetic fibers in greater weight than any other single textile fiber.

- Plastic content exceeds 70% by weight.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This classification is suitable if the product is a composite of plastic and textile, with plastic content over 70% and textile content dominated by synthetic fibers.

- Proactive Advice: Verify the exact composition (plastic vs. textile weight) and ensure compliance with textile labeling regulations.

✅ HS CODE: 3918903000

Product Description:

Other plastic wall or ceiling coverings with textile fiber backing.

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This code applies to decorative plastic panels or coverings with a textile backing (e.g., for walls or ceilings).

- Proactive Advice: Confirm the product is used for interior decoration and has a textile backing.

✅ HS CODE: 5903903090

Product Description:

Textile fabrics impregnated, coated, covered or laminated with plastic, classified as "Other".

Tariff Summary:

- Base Tariff Rate: 2.7%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 57.7%

Key Notes:

- This code is for textile fabrics that have been treated with plastic (e.g., coated or laminated).

- Proactive Advice: Ensure the product is not classified under a more specific category (e.g., 590310 or 590320).

✅ HS CODE: 3926903500

Product Description:

Other plastic articles, including decorative plastic sheets.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 44.0%

Key Notes:

- This is a general category for plastic products not covered by more specific codes.

- Proactive Advice: Use this code only if the product cannot be classified under a more specific HS code (e.g., 3921 or 3918).

✅ HS CODE: 3924901010

Product Description:

Curtains and drapes, including panels and pleated curtains.

Tariff Summary:

- Base Tariff Rate: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 33.3%

Key Notes:

- This code applies to decorative curtains or drapes made of plastic.

- Proactive Advice: Confirm the product is not a textile product (e.g., made of fabric) and is primarily made of plastic.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All the above codes will be subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not applicable for these HS codes (no mention of anti-dumping duties on iron or aluminum).

- Certifications: Ensure your product meets any required certifications (e.g., fire safety, environmental standards) for interior decoration materials.

- Documentation: Maintain clear documentation on the product composition, weight, and intended use to avoid misclassification.

Let me know if you need help with customs declarations or tariff calculations for a specific shipment.

Customer Reviews

No reviews yet.