| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

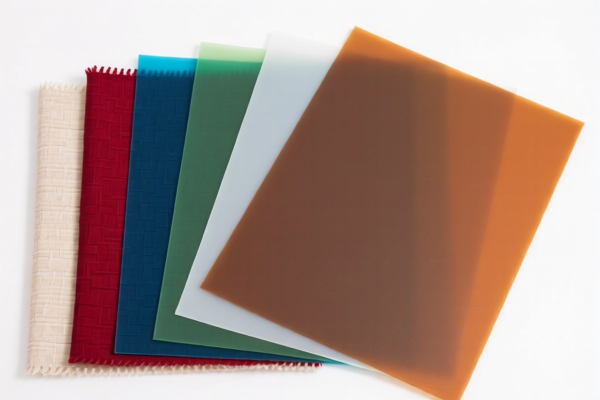

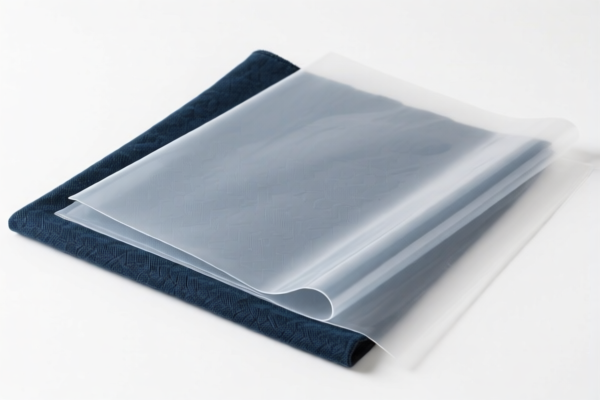

Product Classification: Interior Decorative Textile Reinforced Plastic Sheets

HS CODEs and Tax Information Summary:

✅ HS CODE: 3921902510

Description:

- Textile-reinforced plastic sheets where the textile component is the main weight component, and the weight of any single textile fiber is less than synthetic fiber.

- Plastic content exceeds 70% by weight.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921902550

Description:

- Decorative textile plastic sheets combined with other textile materials, with a weight exceeding 1.492 kg/m².

- Synthetic fiber weight exceeds that of any other single textile fiber.

- Plastic content exceeds 70% by weight.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921902900

Description:

- Fiber-reinforced textile plastic sheets combined with other materials, with a weight exceeding 1.492 kg/m².

- Not covered under the above two HS codes.

Tariff Breakdown:

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all three HS codes after April 11, 2025. Ensure your import timeline is planned accordingly. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, check for applicable anti-dumping duties based on the country of origin. -

Material Verification:

Confirm the composition and weight ratio of the textile and plastic components to ensure correct HS code classification. -

Certifications Required:

Verify if import permits, environmental certifications, or safety standards are required for the product in the destination country. -

Unit Price and Packaging:

Ensure the unit price and packaging method align with customs documentation requirements to avoid delays or penalties.

📌 Proactive Advice:

- Double-check the product's composition (e.g., textile fiber types, plastic content, weight per square meter) to ensure accurate HS code selection.

- Consult with customs brokers or classification experts if the product is close to the boundary between HS codes.

- Monitor policy updates after April 11, 2025, as the special tariff may affect cost structures and pricing strategies.

Product Classification: Interior Decorative Textile Reinforced Plastic Sheets

HS CODEs and Tax Information Summary:

✅ HS CODE: 3921902510

Description:

- Textile-reinforced plastic sheets where the textile component is the main weight component, and the weight of any single textile fiber is less than synthetic fiber.

- Plastic content exceeds 70% by weight.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921902550

Description:

- Decorative textile plastic sheets combined with other textile materials, with a weight exceeding 1.492 kg/m².

- Synthetic fiber weight exceeds that of any other single textile fiber.

- Plastic content exceeds 70% by weight.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3921902900

Description:

- Fiber-reinforced textile plastic sheets combined with other materials, with a weight exceeding 1.492 kg/m².

- Not covered under the above two HS codes.

Tariff Breakdown:

- Base Tariff Rate: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.4%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all three HS codes after April 11, 2025. Ensure your import timeline is planned accordingly. -

Anti-Dumping Duties:

If the product contains iron or aluminum components, check for applicable anti-dumping duties based on the country of origin. -

Material Verification:

Confirm the composition and weight ratio of the textile and plastic components to ensure correct HS code classification. -

Certifications Required:

Verify if import permits, environmental certifications, or safety standards are required for the product in the destination country. -

Unit Price and Packaging:

Ensure the unit price and packaging method align with customs documentation requirements to avoid delays or penalties.

📌 Proactive Advice:

- Double-check the product's composition (e.g., textile fiber types, plastic content, weight per square meter) to ensure accurate HS code selection.

- Consult with customs brokers or classification experts if the product is close to the boundary between HS codes.

- Monitor policy updates after April 11, 2025, as the special tariff may affect cost structures and pricing strategies.

Customer Reviews

No reviews yet.