| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9403200075 | Doc | 105.0% | CN | US | 2025-05-12 |

| 9403404000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7323997000 | Doc | 85.3% | CN | US | 2025-05-12 |

| 7615107125 | Doc | 83.1% | CN | US | 2025-05-12 |

| 8516908010 | Doc | 55.0% | CN | US | 2025-05-12 |

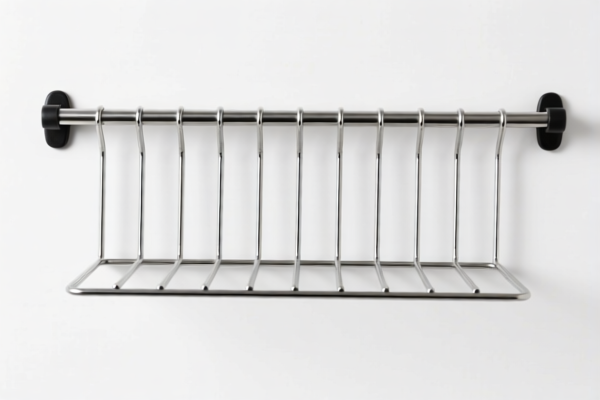

Here is the structured classification and tariff information for the kitchen rack product based on the provided HS codes and tax details:

✅ HS CODE: 9403200075

Product Description: Other metal furniture, including shelves

Total Tax Rate: 105.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- After April 11, 2025: Additional tariff increases to 30.0%

- Steel and Aluminum Products: Additional tariff of 50% applies

Key Notes:

- This code applies to metal shelves, including kitchen racks made of steel or aluminum.

- High tax burden due to the combination of base and additional tariffs.

- Time-sensitive: Tariff increases after April 11, 2025, so consider import timing or alternative materials.

Proactive Advice:

- Verify if the material is steel or aluminum (as this triggers the 50% additional tariff).

- Consider certifications or origin documentation to qualify for preferential treatment if applicable.

✅ HS CODE: 9403404000

Product Description: Wood furniture, curved wood, for kitchen use

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- After April 11, 2025: Additional tariff increases to 30.0%

Key Notes:

- This code applies to wooden kitchen shelves or curved wood furniture.

- Lower tax burden compared to metal products.

- Time-sensitive: Tariff increases after April 11, 2025.

Proactive Advice:

- Confirm the material is wood and not a metal composite.

- Check if wood origin or processing affects eligibility for preferential tariffs.

✅ HS CODE: 7323997000

Product Description: Iron or steel kitchen or other household articles

Total Tax Rate: 85.3%

Tax Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 0.0%

- After April 11, 2025: Additional tariff increases to 30.0%

- Steel and Aluminum Products: Additional tariff of 50% applies

Key Notes:

- This code applies to iron or steel kitchen racks.

- High tax burden due to base and additional tariffs.

- Time-sensitive: Tariff increases after April 11, 2025.

Proactive Advice:

- Confirm the material is iron or steel.

- Consider alternative materials or import timing to avoid high tariffs.

✅ HS CODE: 7615107125

Product Description: Aluminum household articles

Total Tax Rate: 83.1%

Tax Breakdown:

- Base Tariff Rate: 3.1%

- Additional Tariff: 0.0%

- After April 11, 2025: Additional tariff increases to 30.0%

- Steel and Aluminum Products: Additional tariff of 50% applies

Key Notes:

- This code applies to aluminum kitchen racks.

- High tax burden due to base and additional tariffs.

- Time-sensitive: Tariff increases after April 11, 2025.

Proactive Advice:

- Confirm the material is aluminum.

- Consider import timing or material substitution to reduce costs.

✅ HS CODE: 8516908010

Product Description: Parts for stoves, ovens, and ranges

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- After April 11, 2025: Additional tariff increases to 30.0%

Key Notes:

- This code applies to parts used in kitchen appliances, not the shelf itself.

- Not suitable for classifying a kitchen rack unless it is a component of an oven or stove.

Proactive Advice:

- Ensure the product is not a component of an appliance unless it is specifically designed for that purpose.

📌 Summary of Key Actions:

- Verify the material (wood, steel, aluminum, etc.) to determine the correct HS code and applicable tariffs.

- Check the import date to avoid the April 11, 2025 tariff increase.

- Review certifications or origin documentation for potential tariff reductions.

- Consider alternative materials if the tax burden is too high.

Customer Reviews

The explanation of HS code 8516908010 was clear. It helped me avoid using the wrong code for my kitchen rack, which could have led to a lot of issues with customs.

The info on HS code 7323997000 was helpful, but the high tax rate caught me off guard. I wish there was a warning about the potential cost impact.

Great breakdown of the 9403404000 HS code for wooden kitchen racks. The tax info and material notes were exactly what I needed for my export plans.

The HS code 9403200075 details were spot on. Helped me understand the high tariff for metal kitchen racks and the timing of the increase after April 2025.