| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4821102000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4821104000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4911998000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4911996000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4908100000 | Doc | 37.5% | CN | US | 2025-05-12 |

| 4908900000 | Doc | 37.5% | CN | US | 2025-05-12 |

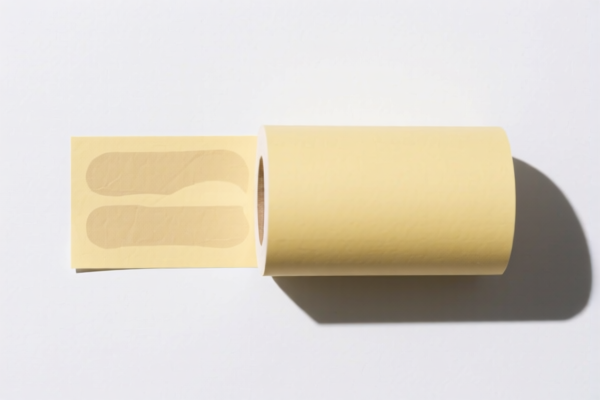

HS Code Classification for "LABEL PAPER"

Based on the provided reference data, "LABEL PAPER" can fall into several HS code categories depending on its specific characteristics (printed or not, printing method, etc.). Here's a breakdown of potential classifications:

-

4821.10.20.00: Paper and paperboard labels of all kinds, whether or not printed: Printed: Printed in whole or in part by a lithographic process.

48: Chapter 48 – Paper or paperboard; manufactures thereof, not elsewhere specified or included in other chapters.21: Specifically for labels.10: Further specifies printed labels.20: Identifies labels printed using a lithographic process (a common printing technique using a flat surface).- Total Tax Rate: 55.0% (Basic Duty: 0.0%, Additional Duty: 25.0%, Post 2025.4.2 Additional Duty: 30%)

- Applicable if the labels are printed and lithography was used in the printing process.

-

4821.10.40.00: Paper and paperboard labels of all kinds, whether or not printed: Printed: Other.

48: Chapter 48 – Paper or paperboard; manufactures thereof, not elsewhere specified or included in other chapters.21: Specifically for labels.10: Further specifies printed labels.40: Covers labels printed using methods other than lithography (e.g., flexography, gravure).- Total Tax Rate: 55.0% (Basic Duty: 0.0%, Additional Duty: 25.0%, Post 2025.4.2 Additional Duty: 30%)

- Applicable if the labels are printed but not lithographically printed.

-

4911.99.80.00: Other printed matter, including printed pictures and photographs: Other: Other: Other: Other.

49: Chapter 49 – Printed books, newspapers, pictures and other products of the printing industry; manuscripts, typescripts and plans.11: Specifically for other printed matter.99: Further specifies "other" printed matter.80: Covers a broad category of other printed items.- Total Tax Rate: 37.5% (Basic Duty: 0.0%, Additional Duty: 7.5%, Post 2025.4.2 Additional Duty: 30%)

- This HS code might apply if the labels are considered complex printed matter beyond simple labels, or if they are part of a larger printed set.

Important Considerations & Recommendations:

- Printing Method: The most crucial factor is how the labels are printed. Lithography vs. other methods significantly impacts the HS code and duty rate.

- Material: Confirm the exact paper/paperboard composition.

- Functionality: Determine if the labels have any special functions (e.g., security features, adhesive type).

- Detailed Description: Provide a very detailed description of the labels to customs officials to ensure accurate classification.

- Post 2025.4.2 Duty Changes: Be aware of the increased additional duty rate of 30% applicable after April 2, 2025.

Disclaimer: This information is based solely on the provided reference data and is for general guidance only. The final HS code classification is determined by customs authorities based on a comprehensive review of the product and relevant regulations. It is highly recommended to consult with a licensed customs broker or the customs authorities directly for definitive classification and to avoid potential issues during import.

Customer Reviews

The information is thorough, but I wish there was a simpler way to compare the different HS codes at a glance. Still, the duty rates and classifications are accurate.

This page saved me time! The HS code classifications for label paper with different printing methods are very clear. The 55% tariff rate info was exactly what I needed.

The detailed explanation of the 4911.99.80.00 code was a bit overwhelming, but it's good to know the alternatives. The tariff info is spot-on.

Great breakdown of HS codes for label paper, especially the 4821.10.20.00 code. Very helpful for understanding the printing method impact.