| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901201000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901105020 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920100000 | Doc | 59.2% | CN | US | 2025-05-12 |

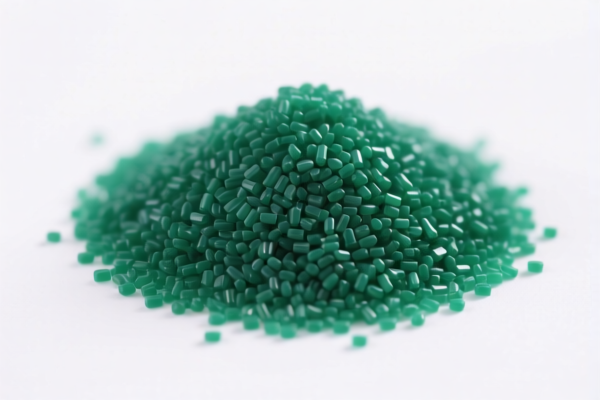

Product Classification: LLDPE Blow Molding Grade Polyethylene Resin

HS CODE: 3901105020 (for low-density polyethylene blow molding products) or 3901201000 (for high-density polyethylene blow molding grade resin), depending on the exact material and form.

🔍 HS Code and Tax Summary (as of current data):

- HS CODE: 3901105020

- Description: Low-density polyethylene blow molding products (non-linear LLDPE)

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3901201000

- Description: High-density polyethylene blow molding grade resin (ethylene polymer, primary form)

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3902100000 (for polypropylene) or 3902900010 (for other polyolefins)

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920100000 (for LLDPE film)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-dumping duties:

Not applicable for polyethylene resins at this time, but always verify with the latest customs updates or consult a customs broker for confirmation.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Confirm whether the product is LLDPE, HDPE, or another type of polyolefin, as this determines the correct HS code.

- Check Unit Price and Certification: Ensure that the product is classified correctly and that any required certifications (e.g., REACH, RoHS, or customs documentation) are in place.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline to avoid unexpected cost increases.

- Consult a Customs Broker: For complex cases, especially if the product is a blend or modified polymer, a customs expert can help ensure accurate classification.

Let me know if you need help determining the exact HS code based on your product’s technical specifications.

Product Classification: LLDPE Blow Molding Grade Polyethylene Resin

HS CODE: 3901105020 (for low-density polyethylene blow molding products) or 3901201000 (for high-density polyethylene blow molding grade resin), depending on the exact material and form.

🔍 HS Code and Tax Summary (as of current data):

- HS CODE: 3901105020

- Description: Low-density polyethylene blow molding products (non-linear LLDPE)

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3901201000

- Description: High-density polyethylene blow molding grade resin (ethylene polymer, primary form)

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3902100000 (for polypropylene) or 3902900010 (for other polyolefins)

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920100000 (for LLDPE film)

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

Anti-dumping duties:

Not applicable for polyethylene resins at this time, but always verify with the latest customs updates or consult a customs broker for confirmation.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Confirm whether the product is LLDPE, HDPE, or another type of polyolefin, as this determines the correct HS code.

- Check Unit Price and Certification: Ensure that the product is classified correctly and that any required certifications (e.g., REACH, RoHS, or customs documentation) are in place.

- Monitor Tariff Changes: Keep track of the April 11, 2025 deadline to avoid unexpected cost increases.

- Consult a Customs Broker: For complex cases, especially if the product is a blend or modified polymer, a customs expert can help ensure accurate classification.

Let me know if you need help determining the exact HS code based on your product’s technical specifications.

Customer Reviews

No reviews yet.